Who’s Liking the US Interest Rate Hike Most?

Interest-Rates / US Interest Rates Apr 11, 2017 - 01:54 AM GMTBy: Nicholas_Kitonyi

As investors prepare for what looks like a potentially second rate hike within the first half of 2017, there are those who are still questioning the overall impact of increased interest rates on the economy.

As investors prepare for what looks like a potentially second rate hike within the first half of 2017, there are those who are still questioning the overall impact of increased interest rates on the economy.

By trade, stock market investors gain more when interest rates are higher. This is simply because capital risk assets will reflect the interest rate hike. However, as per the most recent rate hike, things seem to be a little different.

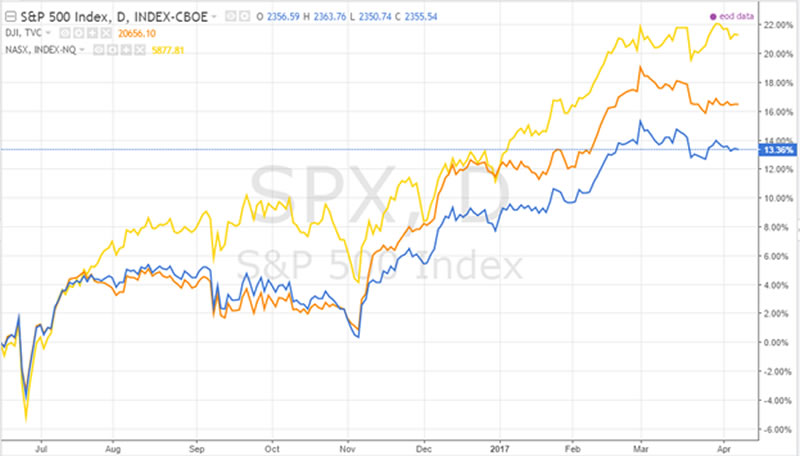

The stock market rallied from late January when a rate hike during the first quarter of the calendar year became more feasible with every Federal Reserve minutes pointing towards an increment.

As such, investors invested bullishly in anticipation of this hike thereby rendering the actual announcement ineffective. In fact, after the rate hike on March 15, major indices appear to have since slowed down significantly, with both the S&P 500 Index and the Dow 300 Index shelling points.

From this point of view, it is correct to say that stock market investors aren’t liking the interest rate hike. They seem to ride more on the promise of a rate hike rather than the actual hike. On the other hand, gold prices have recovered significantly after plunging weeks just before the rate hike announcement.

This is a rather unfamiliar picture for most investors in the sense that gold prices tend to go south when interest rates are higher. This is mainly because high US interest rates strengthen the USD, thereby putting pressure on gold prices.

As demonstrated on the chart above, the price of the yellow metal has recovered to trade at the levels reached a few weeks before the rate hike.

So, what’s the meaning of this?

The most obvious explanation is that investors are getting a little worried about the strength of the US economy. Perhaps, the question on their minds is, can the economy sustain the current interest rate levels?

One thing for sure is that with every interest rate increment, lending rates will continue to go up. This might be good for banks and other lending institutions, but for individuals and companies that depend on credit to keep their businesses running, things could be getting murkier especially if most of their credit facilities are on floating rates.

However, according to insights from various credit repair companies and reviews, things are not as bad as they might look. With the US Average Monthly Prime Lending Rate at just about 3.88%, the lending market is still considered attractive for consumers compared to the historical highs.

During the housing market boom of 2006-2007, the prime monthly lending rate breached the 8% level while in 1981, it reached an all-time high of 20.5%. As such, there is still room for more rate hikes in the coming months and this shouldn’t necessarily frighten investors.

Now, there have been a few theories that have tried to explain the stock market rally experienced early this year. Some have tied it to the change in regime at White House with Donald Trump’s victory in last year’s elections. And now, there are those who believe that the rally was nothing more than a victory bubble, which is slowly being depressurized as reality begins to sink in.

Meanwhile, investors continue to anticipate more rate hikes with at least two expected before the end of the year. Banks do certainly seem to be the likely winners because every increase in interest rate means an increase in lending rates, and thus more interest income.

Conclusion

While an increase in interest rates is supposed to signal government confidence in economic growth, the best measure of the strength of an economy usually comes from numbers tied to the consumer market.

Jobs numbers, unemployment rate and the CPI are some of the assured barometers for determining the potential direction of an economy. Therefore, it would be interesting to see how these economic indicators shape out in the coming quarters as the Federal Reserve continues to weigh the environment for more rate hikes.

By Nicholas Kitonyi

Copyright © 2017 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.