USD May Stay Soft in Near Term

Currencies / US Dollar Mar 30, 2017 - 02:43 PM GMT Although the Fed is in the rate hike cycle, USD rally started to lose momentum early this year when market started to realize that monetary policy divergence started to narrow. ECB has started to talk about rate hikes, while China started to tighten monetary policy by raising money market rates early last month. The Fed also sounded less hawkish in their last rate hike as they forecasted only three rate hikes this year and no Fed members agreed to hike rate four times.

Although the Fed is in the rate hike cycle, USD rally started to lose momentum early this year when market started to realize that monetary policy divergence started to narrow. ECB has started to talk about rate hikes, while China started to tighten monetary policy by raising money market rates early last month. The Fed also sounded less hawkish in their last rate hike as they forecasted only three rate hikes this year and no Fed members agreed to hike rate four times.

US Dollar long bets continued to be paired down after the Republican withdrew the bill on the American Health Care Act (AHCA) last Friday when it became clear that they did not have the minimum 215 votes to make it pass. The AHCA was advocated by Trump and supposed to be the replacement for Obama’s Affordable Care Act (Obamacare). Trump’s opposition from his own party has cast doubt to his ability to deliver on other priorities and also his plan to reduce $350 billion in the coming 10 years.

In the past year, Trump’s campaign promise including tax reforms, infrastructure spending, and border-adjusted tax system has generated inflation and growth bets, dubbed as “Trump trade”, and these are supportive factors for the U.S Dollar. AHCA is the first litmus test on Trump’s ability to fulfill his promise and the failure of to pass this proposal could presage the next item on the agenda.

With the original supportive factors for US Dollar not realized in the short term and the Fed not hawkish enough, US Dollar may stay soft in the short term. These are the cited reasons for the recent U.S. Dollar weakness, but does technical trading, specifically Elliott Wave, help to anticipate it?

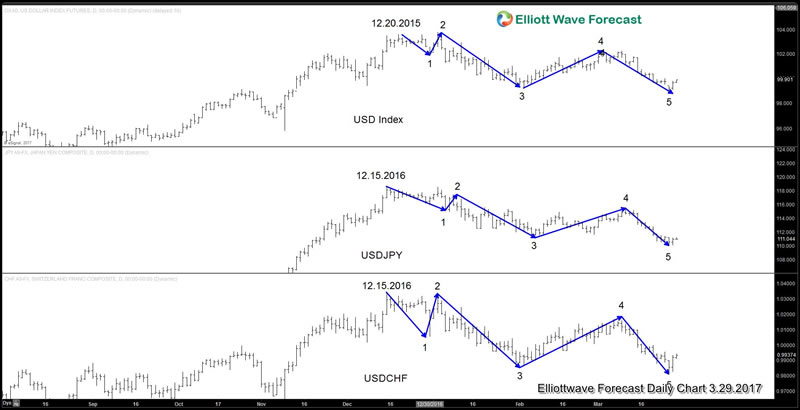

Daily Chart Overlay of USD (DXY), USDJPY, and USDCHF 3.29.2017

A technical look at US Dollar Index (DXY) and two major USD Pairs (USDJPY and USDCHF) above suggest they show a 5 swing sequence from 12.15.2015 peak, favoring more downside. Please note that this is not the same with 5 waves impulse or diagonal, but this is a swing count (sequence) that we use at Elliottwave Forecast. Any bounce in USD pair now ideally stays below March 9 peak for another leg lower. Thus technical outlook suggests that US Dollar may stay soft in the near term.

The fifth swing in the chart above however is formed after the Fed’s meeting and also after the Republican decision to withdraw the healthcare bill. How about before the events? Through Elliott Wave, intermarket analysis, sequence and distribution analysis, we’ve been able to identify US Dollar weakness prior to the Fed’s rate decision and communicated to our members. Below is 1 hour chart prior to the Fed’s meeting

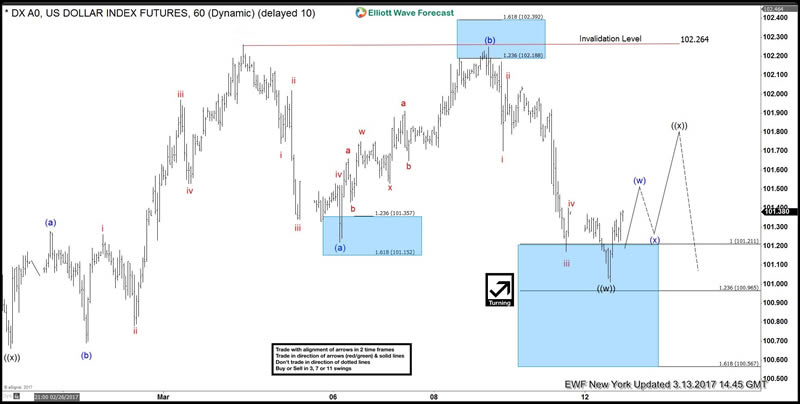

1 Hour DXY New York Chart 3.13.2017

This suggests that a good reading of technical charts can anticipate a move without depending on the outcome of important news events. In addition, technical trading also provides a risk management mechanism that could not be done otherwise.

If you enjoyed this article, feel free to try our –> Free 14 day trial . We provide Elliott Wave charts in 4 different time frames, up to 4 times a day update in 1 hour chart, live trading room, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! Try us out for Free 14 day trial & starts making profits with us.

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2017 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.