Preserving Order Amid Change in NAFTA, U.S. Sovereignty v. WTO

Economics / Global Economy Mar 17, 2017 - 10:34 AM GMTBy: STRATFOR

By Reva Goujon and Matthew Bey : It took more than a decade and three presidencies, from Ronald Reagan to Bill Clinton, to conceive and craft the North American Free Trade Agreement. Will a single presidency manage to undo the process of North American integration? While the risk is real, the reality may be less dramatic.

By Reva Goujon and Matthew Bey : It took more than a decade and three presidencies, from Ronald Reagan to Bill Clinton, to conceive and craft the North American Free Trade Agreement. Will a single presidency manage to undo the process of North American integration? While the risk is real, the reality may be less dramatic.

The Invisible Hand of Geopolitics

Just as in economics, there is an invisible hand in geopolitics that shapes the behavior of our politicians and business leaders. Individuals bend to the world, not the other way around. And North America has long been bending toward tighter integration.

The continent's combined population of 484 million is spread out across a landmass more than twice the size of Europe. At its heart is the world’s largest naturally integrated river system overlaid by arable lands, a foundation for an empire and a prize claimed by the United States. Massive oceans buffer a continent and extensive coastlines with deep ports serve as a launch pad for trade eastward and westward. Arguably, no other continent in the world is as blessed by geography.

An agreement that aims to reap the full benefits of the North American landmass and tighten economic integration was therefore a perfectly natural evolution. While NAFTA has its fair share of imperfections, as any aging trade deal would, it has also been a very sober and prudent exercise in transnational integration.

The development of the European Union and eurozone monetary union, by contrast, reeked of exuberant optimism. Understandably given the scarring of two horrific wars, the creators of the European Union deluded themselves into thinking that critical matters of national sovereignty in a densely packed and historically competitive continent could be swept aside so long as the bloc could keep an unrealistic promise of lasting economic prosperity.

Unlike Europe, North America is not riven by great power rivalries, and NAFTA is not attempting the dangerous task of trying to force together a political union. Instead, NAFTA is designed to play off the natural synergies of its members without drowning in greater ambitions.

23 Years of Big Change

Much has changed in the 23 years since NAFTA came into force. China entered the World Trade Organization in 2001, flooding North America with cheap goods and walloping U.S. manufacturing jobs in the process. Technological advances have increased worker productivity over the past two decades, also cutting into low-skilled jobs. While migrant flows from Mexico into the United States were peaking in the 1990s, the net flow of Mexicans migrating to the United States turned negative after the global financial crisis hit in 2008. In 2006, the Mexican government launched a massive drug war that would not have been possible without a heavy injection of U.S. aid, leading to the balkanization of drug cartels across Mexico.

And a shale revolution took off in the United States and Canada in the early 2000s, making the continent largely energy self-sufficient. Simultaneously declining oil production in Mexico spurred a big push for energy reform to attract foreign investment into the sector just as a closer energy union developed organically with its northern neighbor: U.S. refineries better suited for processing heavy crude took in oil from Mexico while cleaner natural gas could be piped southward to fuel Mexico’s growing industrial base. With U.S. refined product exports to Mexico now at around 1 million barrels per day (roughly double the amount of crude oil Mexico sends to the United States), the United States has become a net exporter of oil to its southern neighbor.

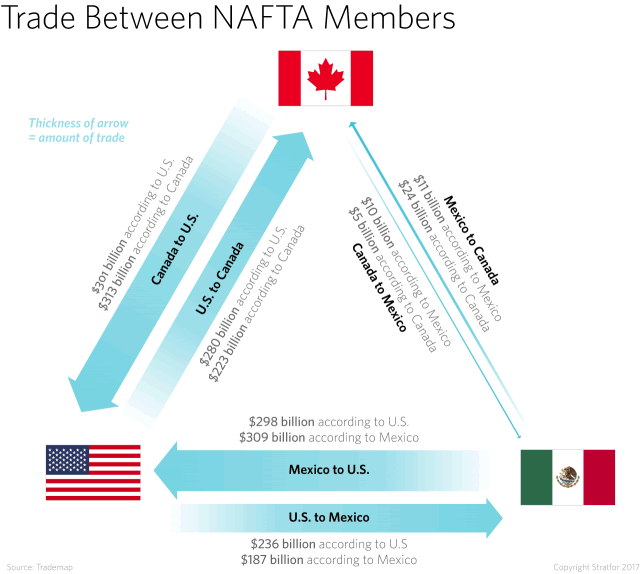

Trade quadrupled over these 23 years among the United States, Canada and Mexico, rising from around $290 billion in 1993 to more than $1.1 trillion in 2016. In a tariff-free zone, a robust supply chain platform and global export base developed on the continent, allowing each nation, state and province to follow the theory of the great classical economist David Ricardo and specialize in what they do best and import the rest. Parts and components now cross borders multiple times before they become part of a finished good, allowing for cost savings for the manufacturer that are then passed on to the consumer.

Strategically situated next to the world’s largest consumer market and still operating with depressed labor wages, Mexico sought out free trade agreements with as many partners as it could over the past couple decades, making itself the manufacturing gateway for countries selling into the United States. Since the 1990s, Mexico has created a network of FTAs with 45 different countries, and it was poised to expand that list with the signing of the Trans-Pacific Partnership, now thrown in limbo by the U.S. administration.

But there is a darker side to this story as well. NAFTA is prey to a broader anti-globalization narrative that argues free trade does more harm than good in killing tens of thousands of jobs. Of course, blaming NAFTA alone for job losses is highly misleading, particularly given the dramatic trade shifts that took place when China joined the WTO, the role of technological innovation in manufacturing, and the growth of a less-labor absorbent service economy over time.

Nonpartisan assessments of the impact of free trade agreements generally point to more jobs gained than lost. The U.S. Chamber of Commerce estimates that 6 million jobs depend on U.S. trade with Mexico while the Washington-based Wilson Institute calculated that 4.9 million jobs depend on U.S.-Mexico trade. Nonetheless, there is little debate that low-skilled workers competing with low-wage labor abroad have been the biggest victims of globalization. In building an unlikely coalition that includes Middle America and Wall Street, U.S. President Donald Trump has successfully tapped into that long-simmering frustration to bring a protectionist trade agenda to the White House.

Postulating Post-NAFTA

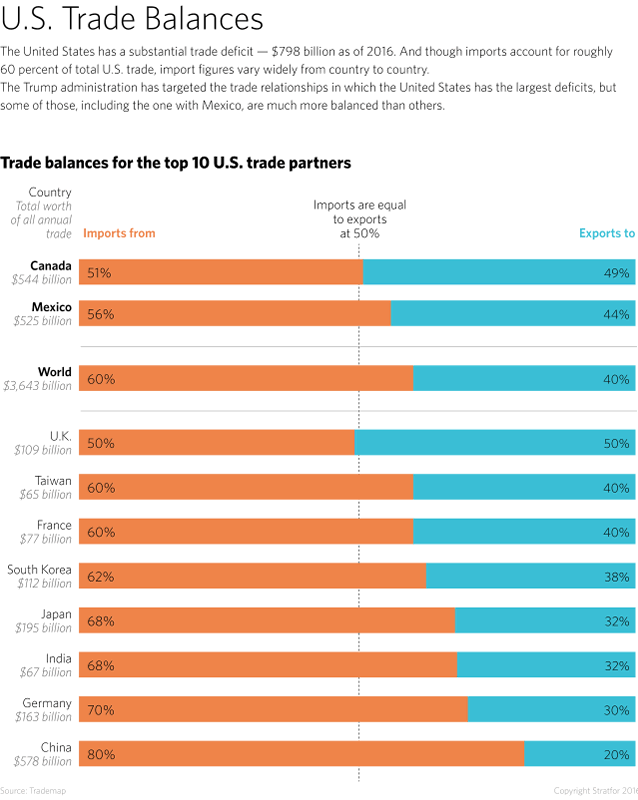

The Trump administration has homed in on trade deficits as the root of America’s economic challenges. The U.S. trade deficit with Mexico, however, is actually one of the United States’ more balanced trade relationships. The United States and Mexico traded $525 billion in goods at a $63 billion deficit with the United States in 2016. Compare that to China and the United States, which traded $579 billion in goods in 2016, leaving the United States with a $347 billion deficit.

The U.S.-Mexico trade picture gets even more nuanced when you factor in the deep level of supply chain integration. Some 80 percent of Mexico's exports go to the United States and, according to the Mexico Institute at the Wilson Center, 40 percent of the value of Mexican exports to the United States was created in the United States first, then exported to Mexico to be used in a good destined for the U.S. market. Put another way, 40 cents out of every dollar of goods exported by Mexico to the United States is "Made in the USA." For Canadian exports to the United States, 25 percent of goods' added value originated in the United States. By comparison, only 4.2 percent of Chinese exports to the United States are U.S.-made.

This is obviously an argument that Mexico will be bringing to the negotiating table as early as June, when the NAFTA renegotiation is tentatively set to begin. As Mexican Undersecretary for North America Carlos M. Sada said March 9 during a Casa Mexico-sponsored event during the South by Southwest media conference in Austin, Texas, all parties of NAFTA need to sit at the table with the same information. Different interpretations of the consequences of U.S. trade figures will only impede a renegotiation when there is still much work to be done on issues like streamlining regulations, incorporating energy into the agreement, raising labor and environmental standards, raising regional content criteria, and potentially broadening the negotiation to issues beyond trade to include ways to enhance security cooperation and develop a rational immigration policy.

But like any rational actor, Mexico, Canada and the state governments and businesses in the United States that would be most impacted by a disruption to NAFTA will also have to game out worst-case scenarios in preparation for this negotiation. The U.S. president technically has the authority to trigger the withdrawal of the United States from NAFTA by giving each party six months' notice, although it is less clear if the legislation implementing NAFTA can be unilaterally repealed by that executive action. Canada trades a marginal amount with Mexico and would thus prioritize its trade relationship with the United States in any renegotiation. Since Canada already has a free trade agreement with the United States that predated NAFTA to fall back on should NAFTA end, we will focus on the U.S.-Mexico relationship.

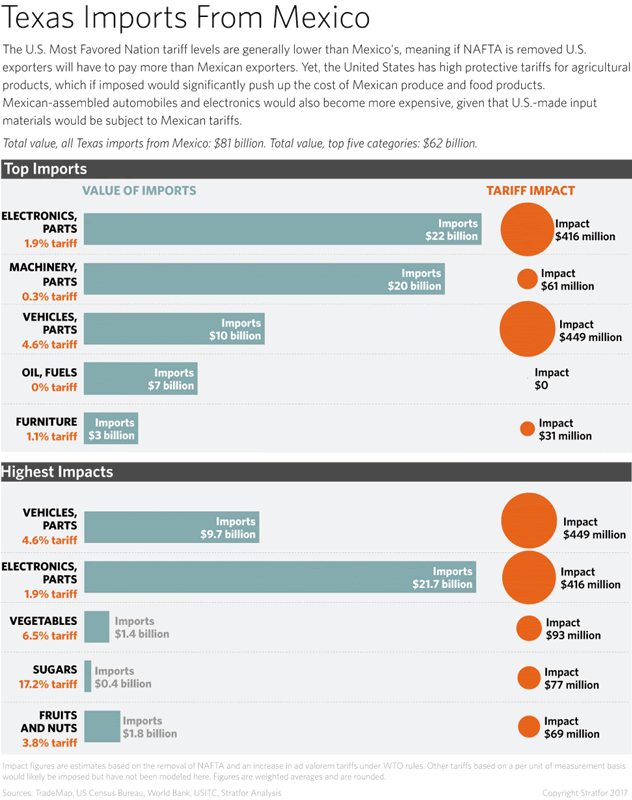

In a world without NAFTA, the United States and Mexico would revert to trading with each other based on the WTO's Most Favored Nation (MFN) tariff levels for both countries. For each category of goods, we took a weighted average of tariffs of each good within a category and then estimated the impact of shifting from zero to MFN-level tariffs by multiplying the weighted tariff average by trade volume. This allowed us to identify which sectors would see minimal change without NAFTA and which would see a disproportionate impact due to a significant tariff increase and large trade volumes. The sectors experiencing the highest impact would logically put the most energy into lobbying for the preservation of NAFTA.

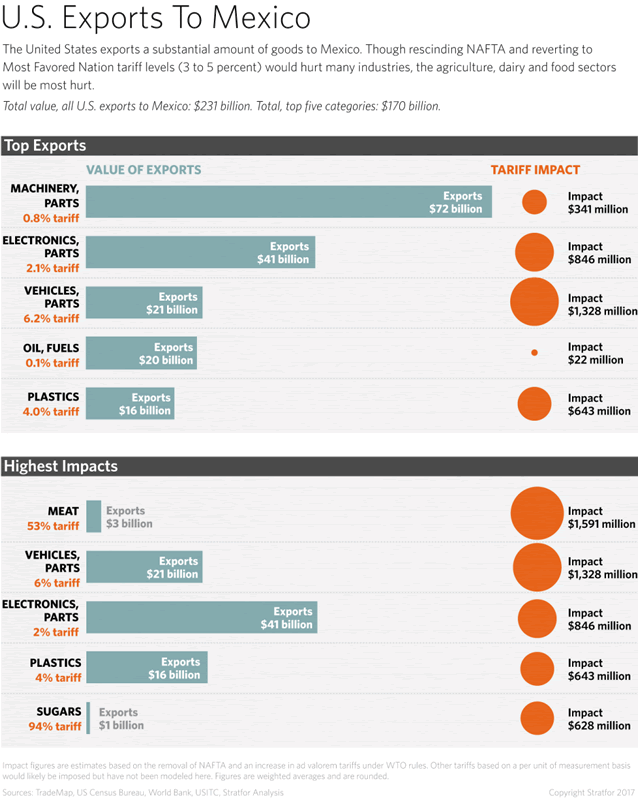

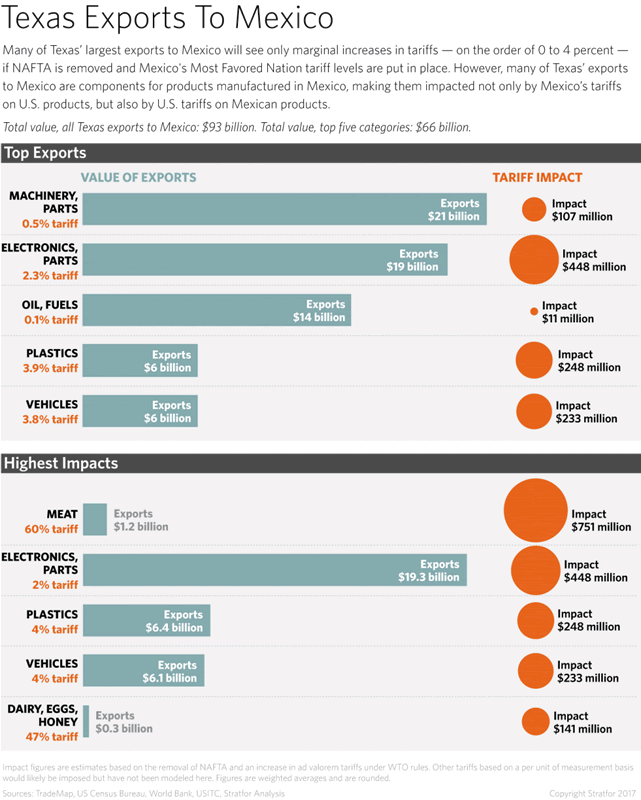

The United States exported $292 billion in goods to Mexico in 2016. The biggest industries that export to Mexico (heavy machinery, electronics, energy and plastics) would only see slight increases in tariffs and would thus be marginally affected. Agriculture, on the other hand, would clearly be the hardest hit. The meat and poultry sector is particularly vulnerable, where some exports could see tariffs jump to as high as 150 percent. Since Texas represents 42 percent of all meat and poultry exports that the United States sends to Mexico, it would bear the brunt of the pain in this sector from tariff hikes. Dairy and sugar would also face a disproportionate impact, facing an average 42 percent tariff and 94 percent tariff, respectively.

The automotive and electronics sectors would also feel a deep impact, but in varied ways. Finished vehicles face an average of 23-24 percent tariffs while most vehicle parts would face a negligible tariff of less than 1 percent. That said, for a state like Texas, where 80 percent of its auto exports to Mexico are parts, the impact would be more deeply felt from supply chain disruptions from tariffs applied on components that now move across the border duty free in cross-border production. Electronics and plastics would see minor tariff increases on average, except for a few narrower categories like plastic containers and TV receivers and monitors.

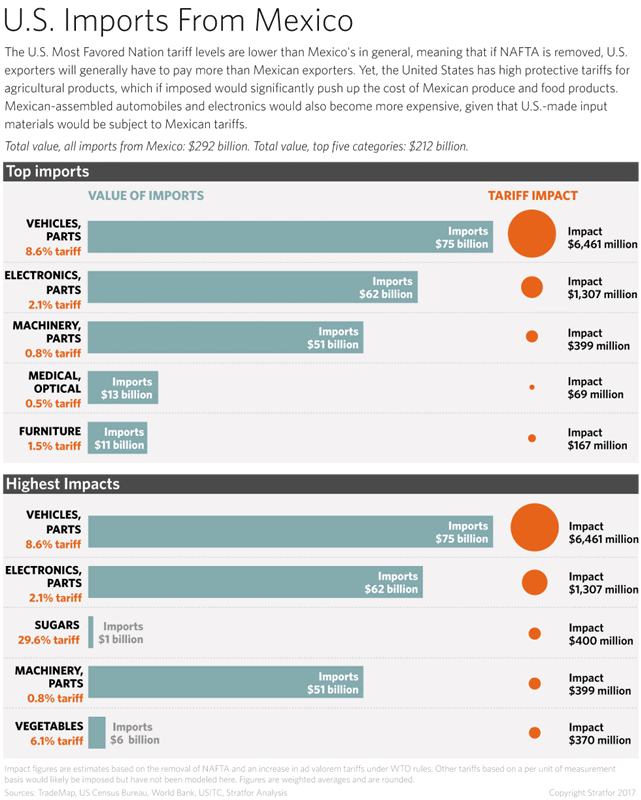

When looking at trade from the opposite direction, from Mexico to the United States, most sectors would see lower tariffs on average. But the same big pressure points apply when looking at more heavily protected industries like agriculture (sugars, dairy, vegetables and tobacco are the most heavily protected). The automotive sector — due to its sheer size and intertwined supply chains with Mexico — would also see a large impact in certain categories. While passenger vehicles and parts would only see a 2.5 percent tariff increase on average, vehicles for transporting goods would face a 23.3 percent tariff on average. Vehicles for transporting goods represented $22 billion in U.S. imports from Mexico in 2016 (or 7.5 percent of total imports from Mexico), so this particular subsector would bear 45.6 percent of the tariff impact on Mexican exporters.

U.S. Sovereignty v. WTO

But Mexico has an even bigger problem to factor in as it prepares for this renegotiation. On the more extreme end of threats, Trump has floated the idea of a 20 percent "border tax" on goods entering the United States and a 35 percent tax on goods imported from Mexico, arguing that this would bring jobs back to the United States. Congress would likely argue against such a move, but under the 1974 Trade Act, the president can impose tariffs and quotas by arguing that trading partners are violating trade agreements or engaging in unfair trade practices. Such a move, however, would require the Office of the United States Trade Representative to file a WTO dispute case before the White House takes action, and Washington is unlikely to win such a case against Mexico. The president can also impose import surcharges of up to 15 percent for 150-day periods on specific goods. A flat "border tax" would essentially be a tariff, and any one of these executive actions could still be challenged in the WTO.

Then there is the issue of the Border Adjustment Tax (BAT). This is a far less contentious issue for Republican congressmen who want to lower the corporate income tax rate from 35 to 20 percent and argue that U.S. tax policy should shift taxation away from domestic corporate production to domestic consumption. To this end, companies would be able to deduct all export sales in calculating their income tax but would no longer be able to deduct import costs. This would heavily benefit exporters and hurt importers who would be paying higher income taxes — to say nothing of consumers, who would see the prices of imports rise.

Proponents counter that the BAT would be "trade-neutral" because the dollar would appreciate enough to offset the rise in income tax paid by importers. Under this theory, the dollar would strengthen if U.S. companies with tax relief export more and foreign consumers of U.S. goods need U.S. dollars to buy those goods, creating enough demand to bolster the dollar’s exchange rate. U.S. consumers would also theoretically buy fewer foreign goods and the dollar would thus strengthen relative to less-in-demand foreign currencies. Of course, the value of the global reserve currency is subject to a range of variables beyond just trade flows, including asset holdings, U.S. Federal Reserve policy, fiscal policy, energy markets and geopolitical risk, making it difficult to predict its value. The trade-neutral argument could therefore be subject to debate and challenge in the WTO.

For U.S. trading partners, the BAT under the current House plan could be interpreted as a 20 percent import tax, as well as a 20 percent export subsidy. In the event that some form of a border adjustment tax is legislated, the United States could open the door for its trading partners to argue that the U.S. tax shift is not compliant with WTO rules. These cases would take years to reach a resolution and could trigger a series of tit-for-tat duties and other forms of trade retaliation. But for a country like Mexico, the cost of disputing the BAT at the WTO would have to be laid against the progress or setbacks it faces in NAFTA renegotiations. If Mexico sees a future where it is facing a 20 percent import tax from BAT regardless of what happens with NAFTA, then it will be much more cautious in trying to preserve the NAFTA framework. Mexico's competitive advantage in trade would be seriously eroded if MFN tariffs have to be applied on top of a BAT to export goods into the United States and the dollar does not strengthen enough to counter the BAT.

Mexico would also try to leverage rules of origin in a renegotiation of NAFTA. Rules of origin requirements identify where products are sourced from to determine how much of a good can be produced in non-NAFTA territory and still remain eligible for tariff-free benefits of the pact. Rules of origin vary by product under NAFTA rules, but there is considerable room for NAFTA partners to raise the rules of origin for North American content as a whole to strengthen the bloc and prevent non-NAFTA countries from taking as much advantage of their tariff-free zone. Critically, should NAFTA be abrogated and the United States and Mexico return to MFN tariff levels for trade, rules of origin would no longer apply. That would mean that Mexico, no longer bound by regional content requirements from the United States, could source cheaper parts from non-NAFTA countries. For U.S. businesses that supply a significant amount of automobile parts to Mexico, this could be an especially painful adjustment.

The White House also has yet to clarify its position on the BAT. While Trump has promised to lower the corporate income tax, it is not clear he would want to make up for that lost revenue with a tax restructuring designed to bolster the strength of the dollar and potentially exacerbate the trade deficits he is working to whittle down. Even if U.S. exporters are able to send more goods abroad, most U.S. industrial production is at or near capacity, while a larger appetite for U.S. goods abroad is far from guaranteed.

Whether the White House is really willing to take on a WTO battle that could result in an estimated $100 billion to $400 billion in retaliatory measures annually is also an open question. The Trump administration has demonstrated a profound distrust of multilateral institutions that it sees as constraining U.S. interests. In a recent trade policy paper, the White House made clear that U.S. sovereignty will override the WTO as the administration sees fit. This does not necessarily imply that the Trump administration will be willing to openly flout the WTO and upend a 70-year-old global trading regime and risk billions of dollars in damages. But it does raise the question of whether the United States under the Trump administration is feeling confident enough to gamble that its trading partners will avoid WTO challenges and accommodate themselves to U.S. policy shifts to avoid even bringing the fate of the WTO into question.

North American Integration Will Endure

As the English mathematician and philosopher Alfred Whitehead once said, "the art of progress is to preserve order amid change and to preserve change amid order." Great change has occurred over the past quarter century and there is much to be done to preserve order and prosperity in North America. Even as the continent’s most pivotal player is whistling a protectionist tune, this is largely a political manifestation of deeper forces currently in play.

The aging demographics of Canada and the United States are intensifying financial strains and sapping labor productivity. That economic stress helps drive technological innovations in manufacturing and services to maintain competitiveness, but those innovations come at the large political and social cost of leaving low-skilled labor on the sidelines. Even as politicians try to temper the subsequent social ire with nationalism and protectionism, technology is proceeding apace. Advances in automation, robotics and software-driven technologies are shaping a future where more production can migrate closer to home and still remain globally competitive.

For a regional bloc like North America, innovation and capital from the United States and Canada can meld neatly with comparatively cheap wages and a large and growing labor pool in Mexico. The more technology advances and brings down costs, the greater North America’s potential to become virtually self-sufficient when the rest of the world is going to be coping with deeper, more existential crises. An invisible hand is pushing North America toward greater connectivity in the long run. North American integration can be slowed down in a political spasm like the one we are in now, but it will not be reversed.

"Preserving Order Amid Change in NAFTA is republished with permission of Stratfor."

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2017 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.