Fed Rate Hikes, Fiscal vs. Monetary Policy and Why Again the Case for Gold?

Interest-Rates / US Interest Rates Mar 15, 2017 - 07:49 AM GMTBy: Gary_Tanashian

I’ve been thinking about the current Fed Funds rate hike cycle, which is logically gaining forward momentum now that the Fed can stand down from its 8-year, ultra-lenient monetary policy cycle. That is because the Obama administration’s goals required a compliant Federal Reserve to continually re-liquefy the economy as its fiscal policies drained it.

I’ve been thinking about the current Fed Funds rate hike cycle, which is logically gaining forward momentum now that the Fed can stand down from its 8-year, ultra-lenient monetary policy cycle. That is because the Obama administration’s goals required a compliant Federal Reserve to continually re-liquefy the economy as its fiscal policies drained it.

With the coming of Trump mania and its very different fiscal policy goals, we will witness the end of much of what I considered to be the “evil genius” employed by the Federal Reserve, mostly under Ben Bernanke. When he oversaw the brilliant and completely maniacal painting of the macro known as Operation Twist in 2011, I knew we were not in Kansas anymore. We’d gone off the charts and off the balance sheet into a Wonderland of financial and monetary possibilities.

What else would you call a plan to sell the government’s short-term debt and buy its long-term debt in the stated effort to “sanitize” (the Fed’s word, not mine) inflationary signals on the macro? It was evil, it was genius, and it worked. So too did various other financial manipulations that took place before and after Op/Twist. And here we are.

The Republican view is one where businesses and consumers are stimulated, not money supplies. I think it is a better economically, but not by much in this case. That is because the Trumpian ‘reflation’ would simply be another form of man-made stimulation attempting to deny market and economic excesses from being cleared. A normal economy goes through normal cycles. We have not had a normal economy or a normal cycle since at least pre-2000.

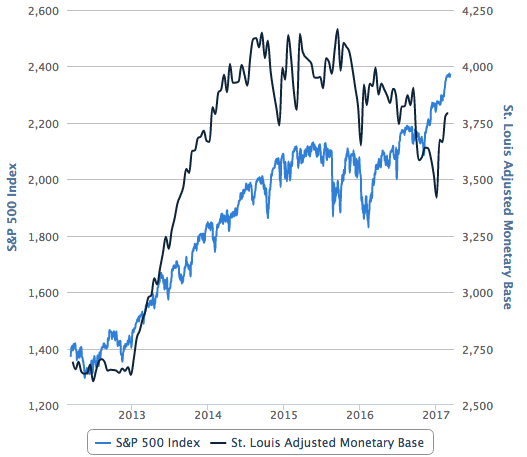

Since Alan Greenspan panicked and blew the credit bubble of last decade, we have been on a continuum further into uncharted waters. Trump’s policies are not going to stop it, either. Besides, he inherits this (chart source: SlopeCharts).

What we see above is a dangerous correlation between Monetary Base, which is the product of monetary policy, and the S&P 500. We see that the S&P 500, which followed the Base in lockstep for much of the bull market, is playing a little catch up to the Base, which itself is only bouncing within a topping structure. That is a dangerous looking chart if the assumption that monetary policy will be withdrawn as fiscal policy is anticipated/enacted is a good one.

To put it simply, the Fed is no longer mandated to prop the markets and the economy. The Trump administration is taking that task on. But what about the transition from monetary to fiscal? Ah, the transition. It is in that grey area that the Good Ship Lollypop could get cast about.

The Fed is apparently (finally!) in hawk mode. ‘Trump will free us from the chains of taxation, regulation and an out of control welfare state!’ think legions of happy people and corporations. But if the policy of the last 8 years is replaced and radically changed, there will be a transition period.

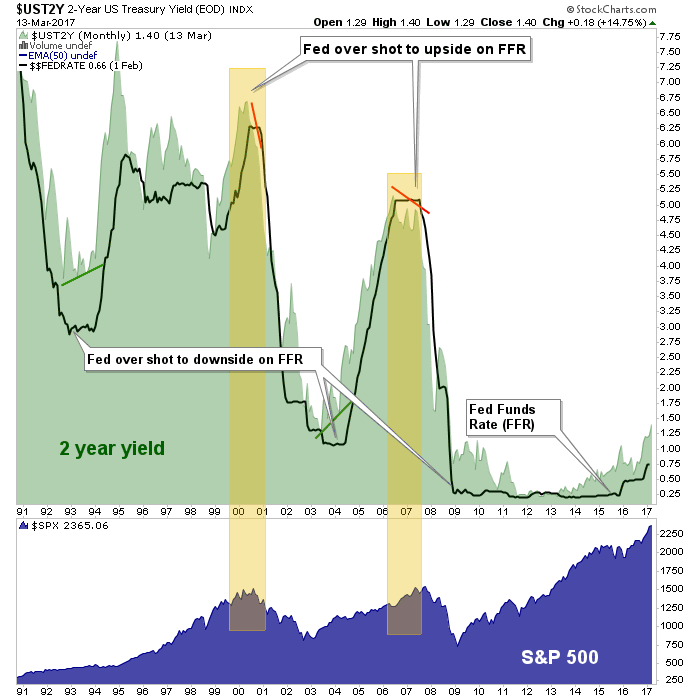

There are a lot of similarities to George W. Bush’s first term in office. A new Republican takes over from a 2-term Democrat under whom the markets roared. A rate hike cycle was in play at the end of Clinton’s term. When Bush took over into the jaws of a bear market, that was when Greenspan panicked and blew the millennium’s first bubble. On the next cycle, as G.W. benefited from the resulting inflationary bull market another rate hike cycle was kicked in. Greenspan rode off into the sunset and left a liquidation and crash in the lap of Bernanke and the Obama administration. They immediately went full frontal monetary policy and never looked back.

Now here we are. Another rate hike cycle is in the early stages. Normally the early stage of a rate hike cycle is a bullish thing and so far it has been just that. While my other work anticipates a perhaps routine market correction right around now, the favored view holds open new highs later in the year. The Fed Funds rate needs to climb significantly higher after all, in order to trigger the next market crash.

That is what the above chart says if taken at face value. The problem is that with 8 years of pure monetary policy distorting the system in ways that are impossible to quantify, who’s to say that this cycle will not abort at a significantly lower interest rate on the Fed Funds? After all, the entire asset price gambit has been built on ever-expanding debt, has it not?

What again is the case for gold? Real, heavy, in-your-hand gold? It is an anchor to the time before the Good Ship Lollypop set sail on these uncharted waters. Though its ‘on the surface’ fundamentals are not complete yet, there are rocks just beneath the macro’s surface. Those rocks are exponential monetary policy levels being withdrawn. That is enough reason to have monetary insurance, which is gold’s most basic utility.

Aside from the monetary metal, it is advisable to tune out overly conventional analysis that does not look below the surface (unless you day trade and are blissfully concentrating on the daily red and green lights). It is advisable to have balance with respect to your holdings (cash is a holding, folks, and if you own an equivalent like T Bills it is soon to be paying another .25%) and not to run with the herds. For example in the short-term, the pro-inflation/reflation and anti-Treasury bond herds are very crowded.

Given the monetary distortions noted above, the transition to coming fiscal distortions and a general backdrop that people should not pretend to be able to quantify, it is more important than ever to think for yourself and not lap up generic market advise. Have balance *, perspective and for crying out loud, do the work!

* For me this has taken the form of profit taking, loss limiting, rebalancing, cash raising and slowly increasing short positions in less favored areas.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.