The Whole US Economy Hangs In The Balance

Economics / US Economy Feb 24, 2017 - 04:30 PM GMTBy: John_Mauldin

I have talked with many of the actors in the tax reform process—both in Congress and in think tanks. These discussions have served as the basis for my recent writing in Thoughts From the Frontline (subscribe here for free).

I have talked with many of the actors in the tax reform process—both in Congress and in think tanks. These discussions have served as the basis for my recent writing in Thoughts From the Frontline (subscribe here for free).

I’ve seen one point of agreement—the tax system must be massively reformed. That point, sadly, is where agreement ends.

Tax reform ideas usually fail because the status quo gives everybody some kind of perceived benefit. In reality, the benefit may be worth less than people think. But it’s preferable to the uncertainty of a new system.

We must remember that the "Better Way" is simply a set of proposals at this time. President Trump announced on Feb. 9th that his economic team is drawing up its own “phenomenal” business tax reform proposal.

I’m not enthusiastic about the border adjusted tax (BAT) idea either, to say the least. I fear it would come with serious macroeconomic side effects, and not just for the US.

The BAT Aims to Increase Exports

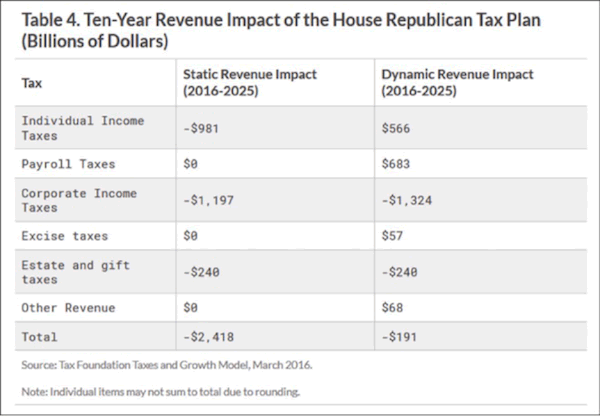

Here is how the Tax Foundation calculates the plan’s impact, under both static conditions and a dynamic model that tries to assess economic changes.

Under static conditions, the plan would reduce tax revenue by some $2.4 trillion over 10 years. A dynamic scoring reduces that amount to $191 billion. The reality is likely somewhere in between, but no one really knows.

Here is how it works: Businesses that import goods from outside the US would not be able to deduct the cost of those goods from their corporate tax returns. But companies that export products to other countries would not count the revenue received from the exports as income.

The hopeful effect of this measure is to encourage exports and discourage imports. This is in keeping with President Trump’s objectives.

Our Whole Economy Depends on Imports

Most Americans may not realize how different our tax system is from those of every other country in the world. Almost every other nation has some variation of a value-added tax (VAT), a form of sales tax added at every level of production.

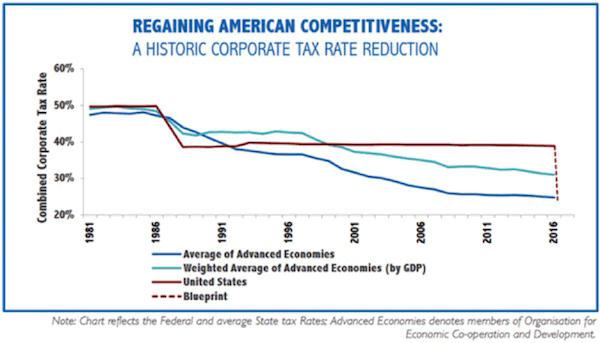

The House GOP plan (the red, dotted “Blueprint” line at the far right in the chart above) brings our corporate tax rates much closer to the average. Other countries make up the revenue gap with a VAT. The Better Way plan does this with border adjustment, which is sort of a halfway VAT.

The problem is that the US runs an enormous trade deficit because our whole economy depends on imports. We do not presently have the capacity to replace those imports with domestic goods.

What Are the Republicans Thinking?

This is obviously not good for job creation if you are an importer. So what are the Republicans thinking? Why propose something that seems so daft?

Well, in theory the BAT will bring in a lot of revenue, something like $1 trillion over 10 years if their assumptions are correct. This revenue is necessary to keep the Better Way plan’s other tax cuts from adding to the debt. And it will also theoretically increase jobs tied to exports.

The Republicans also pitch the BAT as simple fairness. Other countries apply their VAT taxes to goods shipped to the US, so the US should do likewise. The problem here is that the US doesn’t have a VAT, so we’re adjusting for something that doesn’t exist. That makes this idea look less like an adjustment and more like an outright import tariff.

In discussing this whole border adjustment concept with other economists, I find general agreement that my description of the BAT as a “half-assed VAT” is generally correct.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.