Is This The Top Commodity Play For 2017?

Commodities / Lithium Feb 13, 2017 - 12:04 PM GMTBy: OilPrice_Com

The sweetest spot in the Lithium rush is now definitively Chile: It’s the world’s biggest venue, and it’s about to explode as Tesla flips the switch on its battery gigafactory, Chinese-Korean investors prepare to drop $2 billion on a new Chilean gigafactory, and the government has a change of heart that has lithium at its core.

The sweetest spot in the Lithium rush is now definitively Chile: It’s the world’s biggest venue, and it’s about to explode as Tesla flips the switch on its battery gigafactory, Chinese-Korean investors prepare to drop $2 billion on a new Chilean gigafactory, and the government has a change of heart that has lithium at its core.

Against this backdrop, we’re not just looking at the new ‘Who’s Who’ of lithium. We’re beyond that. Now we’re looking at who’s going to advance to new production first, with the highest grades of low-cost lithium.

Bearing Resources Ltd. (TSX.V:BRZ), acquired a world-class resource in Chile that gives it the second-most advanced lithium project in the world, is a front-line contender.

While 2017 was ushered in with the euphoric fanfare of Tesla’s new gigafactory, which is now operational, the coming years will be all about lithium; and all about finding and developing new supply.

Tesla already has some 330,000 orders for its Model 3 electric vehicle—100,000 of which it has promised to deliver by the end of the year—and securing lithium supplies has never been more critical.

According to Macquarie Bank (ASX:MQG), the share of lithium demand from electric and hybrid vehicles is due to surge from 10 percent in 2015 to 33 percent by 2021.

Lithium expert Joe Lowry says demand should double between now and 2020, driven by the massive battery market, producers are in no position to keep up with this in the medium or long term.

Today’s global lithium-ion cell production is only enough to supply around 900,000 to 1 million electric vehicles—or, in other words, a meagre 1 percent of the demand considering 100 million light EV sales, according to Evercore ISI analyst George Galliers.

PriceWaterhouseCooper (PwC) also agrees that “supply will continue to trail until new projects come online in the next five years.”

Lithium prices tripled even before the battery gigafactories got off the ground. Tesla’s has already opened in Nevada, and 11 more are in play. The battery supply chain is exploding, and the math is brilliant.

As Lowry puts it: “No matter what certain “experts” say – supply and demand are NOT in balance. If the market is adequately supplied, why are we having the current price run-up?”

Everyone is preparing for a bull market that will be one of the longest bull runs of the century. But this time around, there’s a new ‘cartel’ in town, and it’s full of small-caps like Bearing Resources. Though 90 percent of global lithium production is now controlled by four players—Albermarle Corporation (22 percent), FMC Corp (10 percent), Chile’s SQM (21 percent) and Chinese Sichuan Tianqui Lithium Industries (21 percent)—it’s time to move over for new players.

Now it’s time to take a closer look at who’s going to make it to the finish line first.

Here are 5 reasons to keep a close eye on Bearing Resources (TSX.V:BRZ):

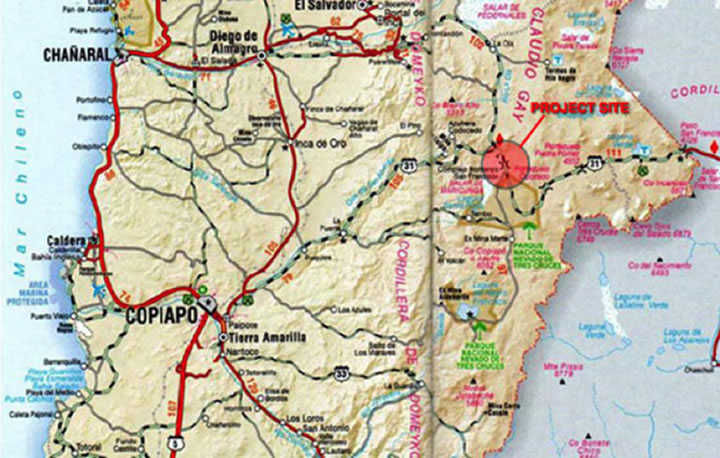

#1 Prime Time Play in World’s #1 Lithium Venue

The biggest share of the world’s lithium comes from Chile, whose Atacama area produces 40 percent of our global supply right now.

And while it hasn’t always been easy to get around the government to mine lithium in Chile, that’s suddenly changing. Chile has enough lithium to supply the world for decades, according to the Financial Times, but the country has been painfully slow in exploiting its lithium.

Now, there is a new urgency. The lithium boom has forced the Chilean government into a major turnaround. The precious metal is now the new Chilean gold.

As a testament to this, Chilean President Michelle Bachelet has even ordered state-run Codelco to move ahead with lithium projects in Maricunga and Pedermales to promote new production. She also just signed a bill into law to inject US$975 million into the company to help it along.

The Chinese are all over Chile’s lithium as well. Chinese and Korean investors are in advanced talks with the Chilean government to open up a $2-billion lithium battery mega-plant that would feed on the country’s lithium riches—and may start Chinese hoarding of supplies as EVs hit the mainstream and everyone scrambles for the precious metal behind the batteries.

U.S. mining giant Albermarle Corporation (NYSE:ABL)—the company with the only existing lithium mine in the U.S.—is also banking big on Chile, striking a deal to increase its lithium production from an existing facility there. On 4 January, the government approved its expansion plans.

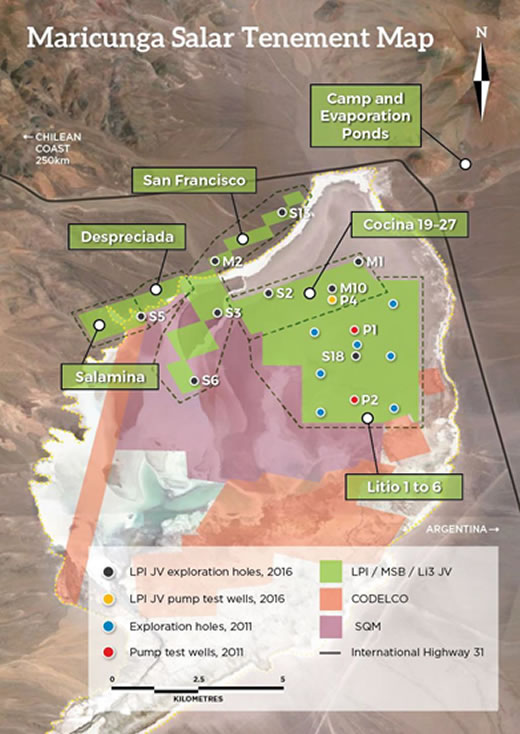

But the small-cap that leads the day here is Bearing Resources, which has just moved to acquire a 17.67 percent interest in Li3 Energy Inc.’s Maricunga Lithium Project—the 4th top lithium brine project in the world.

Not only does it have world-class resources, with higher grades of lithium than almost anything else out there, but it also has significant potential for resource growth.

Maricunga is located in the 2nd largest lithium brine project in Chile with exceptional grades. This play is second only to the Salar de Atacama, which accounts for 100 percent of Chile’s lithium production, and about 40 percent of global production.

The project covers 4,463 hectares—some of which fall under an earlier mining code that allows for immediate exploitation. Li3 has already put over $30 million into the project, and a major exploration and development project is already underway to de-risk. Another $22 million will be spent ahead of the Definitive Feasibility Study next year.

The near-term catalysts are more exciting than anything else on the new lithium scene right now. They include exploration results from 16 wells, pump tests from two production wells and an updated resource estimate, as well as construction and operation of evaporation ponds and a pilot plant.

That’s why Chilean lithium giant SQM is here, and it’s why Bearing Resources is right next to them. In Chile, if you want to get in on lithium before anyone else, look for the small-cap that’s positioned itself right next to the biggest player on the scene.

#2 World-Class Resource, Highest Grade of Lithium Yet

For high-grade lithium, the ‘Lithium Triangle’ of Argentina, Bolivia and Chile is the place to be—it’s also where all the best ‘brine’ projects are, which have significantly lower operational costs than hard rock.

And while Argentina is another sweet spot, Chile’s lithium is of a significantly higher grade, 2 to 4 times that of Argentina’s. So far, Bearing Resources has seen some of its results come back at over 2000 PPM, with other holes average up to 1500 PPM.

#3 Second-Most Advanced New Lithium Project in the World

Bearing Resources (TSX.V:BRZ) is sitting on prime lithium territory that got started in 2009 during the original lithium run. With US$30 million already into it, it is poised to be one of the first across the new supply finish line.

Aside from LAC, there is nothing more advanced out there that is not in production yet, and the US$400-million-market-cap company just closed some deals that ensure funding for construction. It’s even more attractive when you consider that giant SQM is right next to Bearing in the Salar—and it’s fully committed to developing this lithium.

The first phase of Bearing’s project will cost US$8 million and see the drilling of 18 wells. It’s already funded and paid for and is expected to double or triple the resource. This would put the project on the same timeline as Lithium Americas Corp. (TSE:LAC).

The next three months will see flow results and pumping tests. While Bearing isn’t pinging the investor radar right now, getting in on the ground floor of this will be more expensive around April or May, when the company announces an update on its resources, which they expect to double or triple. As one of the few projects that’s already got tens of millions of dollars of investment into it and work done, the resource update will be a very big deal.

The resource is already proved-up, so once the results come in in April/May, it’s just about de-risking and moving into phase two in the third quarter of this year.

#4 The Deal of the Century: No Shareholder Dilution

The deal Bearing made with Li3 for this lithium gem in the heart of Chile has a free carry all, which means their shareholders do not have to be diluted. Even better, they have enough capital in the bank to complete the transaction and to fund so they won’t have to go back to the markets. This is what investors want to hear.

When the results come out in April/May, Bearing will be looking for ways to expand its stake in the project.

#5 World Class Lithium Team, World Class Partners

From a management standpoint, this is a world class lithium team—and that’s what the new lithium game is all about right now: The right people who can bring new plays into production.

But beyond that, look to the big investors. Posco, one of the world’s largest steel companies, just invested US$18 million in the project, and it’s bringing proprietary lithium technology with it. This is a US$70-billion/year company with a brilliant balance sheet for building up this lithium project. Posco’s lithium tech has already successfully tested at an 88 percent recovery rate in under 8 hours. Bearing says the current resource on the project is 600,000 tonnes, measured and indicated.

There’s also a clear pathway to other major partners, including Codelco, which recently announced with the government that it’s going to develop the Maracunga project. In terms of production partners, it doesn’t get any better than this.

The lithium rush is in full force now that Tesla has turned on its gigafactory, and that’s only the beginning. At least five gigafactories are planned for Europe, with Tesla eyeing one of them to make batteries and build cars.

German BMZ has launched the first phase of its German battery factory, and LG Chem is planning one in Poland, which is slated to open next year. Samsung also hopes to start making batteries in Hungary beginning in 2018.

This is set to be a bull run based on one of the most voracious commodity appetites we’ve seen in decades, and the new barons will be the first lithium deal-makers—in other words, the first to bring new supply into production.

By. Charles Kennedy of Oilprice.com

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Oilprice.com only and are subject to change without notice. Oilprice.com assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.