China’s “One Belt, One Road” Is a Nice Thought, but Nothing More

Politics / China Feb 01, 2017 - 03:49 PM GMTBy: John_Mauldin

BY JACOB SHAPIRO : In late 2013, Chinese President Xi Jinping showed off the One Belt, One Road (OBOR) plan in Kazakhstan and Indonesia.

BY JACOB SHAPIRO : In late 2013, Chinese President Xi Jinping showed off the One Belt, One Road (OBOR) plan in Kazakhstan and Indonesia.

Xi’s OBOR could be a bold economic development program that will vault Chinese political power ahead in the modern day. However, the OBOR plan is at an early stage.

More than three years after Xi unveiled OBOR, the plan is still vague, lacks funds, and faces a hard fight against constraints of things discussed previously in This Week in Geopolitics (subscribe here for free) like geography, Eurasian instability, and current trade patterns.

Plus, OBOR is first and foremost about China’s domestic economic inequalities and not China spreading its power around the globe.

This is a Herculean task

OBOR is meant to make many economic paths to cover two-thirds of the world’s people and a third of global GDP.

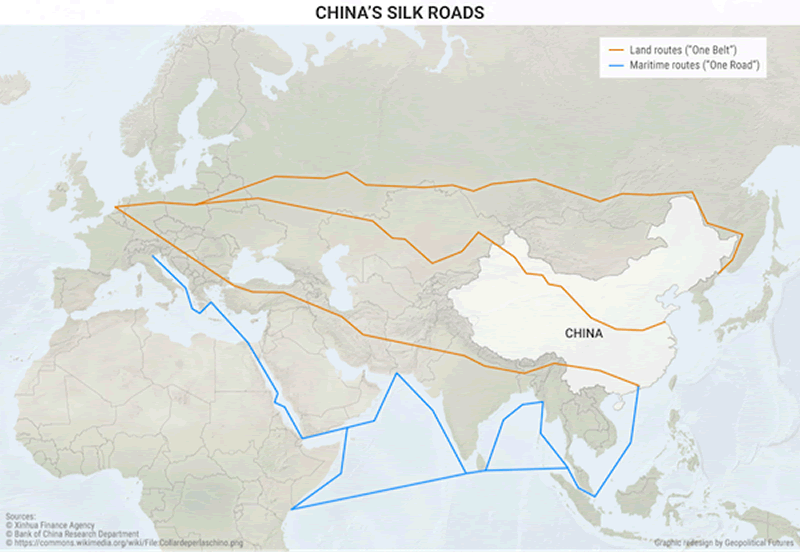

The One Belt part means overland paths; One Road means sea routes (see the map below).

To link Eurasia, China must build roads, railways, ports, and such across vast distances in harsh lands and in some of the least populated areas of the world. (Also, some of the most lawless and insecure parts.)

This is a herculean task and $240 billion that was already funded barely makes a dent in the total amount of needed funds. HSBC thinks that OBOR needs at least $4–6 trillion over the next 15 years, but that is likely too small. Even if true, from where and whom this money will come is not known.

There are two deeper problems

There is no central organizing body or goal that OBOR is meant to do beyond enriching Eurasia. OBOR boils down to a vague list of projects and it does not have a clear and steady funding mechanism or a head to see how these small projects fit into a bigger scheme.

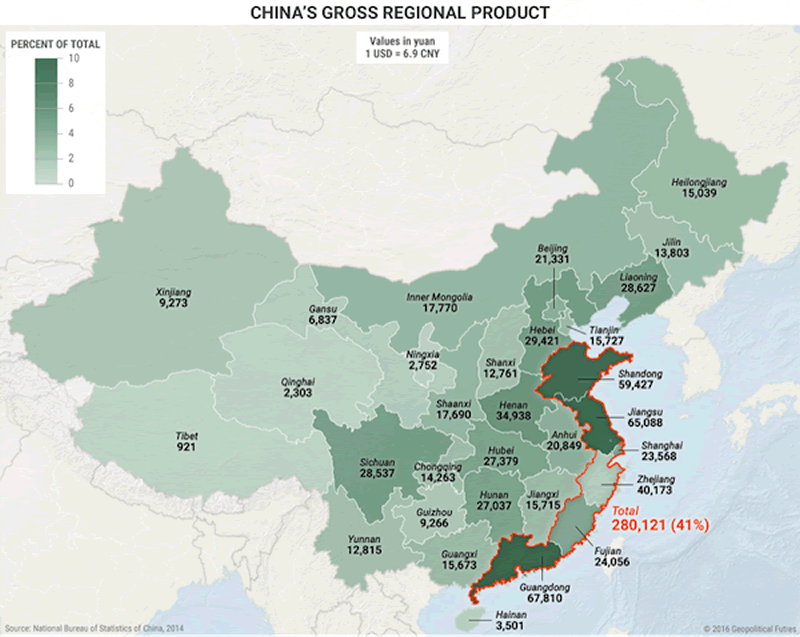

Also, China wants OBOR not to get more foreign power, but to lessen its own domestic economic pressures. OBOR is one part of Xi’s attempt to try and do what many Chinese leaders have not done: move the wealth of the coast to the poor parts of China’s interior without social instability.

The two parts will greatly benefit China

The One Belt part of the plan aims to do this through easy access to overland markets to help take in China’s large excess capacity of steel, coal, and other key items. China wants to cut production of these items, but cannot do so without lower economic growth rates.

China is still quite poor and a large gulf comes between the economic strength of the Chinese on the coast and those inland. China hopes One Belt will help it find a place to dump the surplus items it has made and justify more infrastructure spending in less-developed regions.

One Road, the maritime part of the plan, is more notable because the global shipping routes that form the basis of the world economy are the true 21st century Silk Road.

The United Nations Conference on Trade and Development says about 80 percent of global trade by volume and over 70 percent of global trade by value is shipped via maritime routes. Even China’s interior provinces trade mostly by shipping goods overland to and from the coast—not via overland routes to the west.

The issue for China is that its economy needs these routes, and their security is guaranteed by the US Navy because while many Asian countries will happily take Chinese money and put it to good use, there is also not much trust in Chinese intentions.

OBOR will give China global prestige

Eurasia is not the pivot of the world as it was when the ancient Silk Road was a vibrant and strong trade route. Today, most global trade is at sea, which is the US’ domain and OBOR will not change that.

OBOR as funded and directed by China is a nice thought, but when you look at the facts, it is clear that OBOR is still just a hope. But OBOR has done well at giving China global prestige and domestic credibility for Xi, which is the basis of most Chinese moves on the global stage.

Prepare Yourself for Tomorrow with George Friedman’s This Week in Geopolitics

This riveting weekly newsletter by global-intelligence guru George Friedman gives you an in-depth view of the hidden forces that drive world events and markets. You’ll learn that economic trends, social upheaval, stock market cycles, and more… are all connected to powerful geopolitical currents that most of us aren’t even aware of. Get This Week in Geopolitics free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.