Dow 20K, US Debt $20 Trillion, Trump and Gold

Commodities / Gold and Silver 2017 Jan 27, 2017 - 11:32 AM GMTBy: GoldCore

by Jan Skoyles, Editor Mark O’Byrne

by Jan Skoyles, Editor Mark O’Byrne

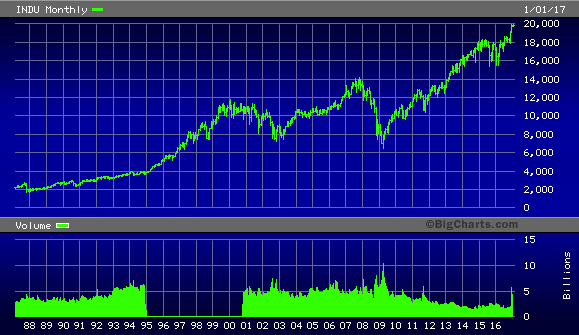

In case you’ve been hiding under a rock, the Dow Jones Industrial Average reached 20,000 earlier this week for the first time in its 132 year history to much media fanfare.

Bigcharts via Financial Sense

Since Trump’s election US market indicators, including the Dow have been ticking up – it has been labelled the Trump rally. This latest milestone is something that the new President is happy to take credit for. In fact, he tweeted ‘Great! #Dow20K’ in response.

He told ABC News that

“We just hit a record, and a number that’s never been hit before. So I was very honored by that … Now we have to go up, up, up …”

Trump’s senior advisor (and fellow advocate for a weaker dollar) Anthony Scaramucci took to Twitter to thank President Trump for bringing about the best stock-market performance after a presidential election win since 1900. UKIP Leader Nigel Farage agreed that this was thanks to the Donald and saw it has a ‘huge vote of confidence in @POTUS.’

Few commentators pointed out that this latest ‘bubblelicious’ Dow milestone of 20K comes at a time when the U.S. is drowning in a sea of red debt as debt levels continue to surge and will reach the even more important milestone of $20,000,000,000,000 (trillion) in the coming weeks. The digit two is in both and both have a lot of zeros but the latter is actually much more important than the former.

In value terms, the 20,000 milestone means very little. In fact, in real value terms (when priced in gold) the Dow isn’t much higher than when it first hit just 1,000 back in 1972.

Make America Great Again has to mean Make America have Value Again

The Dow has had an impressive performance since November 8th, it has climbed around 9.5%. The actions of Trump since both his election and inauguration (from tweets to signing Executive Orders) have driven positive market reactions … so far.

There is little doubt that since his inauguration the new President has worked hard to show that he will make good on his election promises. All of which come under the umbrella to ‘Make America Great Again.’ In turn, market activity does show signs of what Keynes would have called ‘animal spirits’ – the self-feeding frenzy in markets when confidence is high.

As a result, it appears US markets are doing well and so the DJIA reaches a new all-time high in nominal dollar terms. But, as we have learnt from both Obama’s administration and all the others before that, there is a serious falsehood in claiming new records in markets really mean something, particularly when you are basing your information on an already flawed monetary system involving the increasingly debased currency that is the dollar, not too mention currencies internationally which are all being debased.

The Dow has been on a winning streak since 2009, in the period of Obama’s two term presidency the index climbed 144%, the S&P 500 172% and the Nasdaq Composite 275%. No-one can claim that this was all thanks to the Obama administration and some argue that it is not a reflection of what the 44th President really did for the economy given the actions of central banks both at home and abroad – involving QE on an unprecedented scale and an unprecedented monetary experiment in zero percent and negative interest rates.

It is worth noting that Venezuela and previously Zimbabwe had the best performing stocks markets in recent years.

In fact, whilst Trump will be keen to beat Obama’s stock market performance figures, he was a vocal critic of the ‘falsehoods’ upon which his predecessor based his economic KPIs on. We wonder if Trump will remember this when he continues to publish self-congratulatory tweets about the DJIA’s success.

DJIA – the wrong way to value investment performance and an economy

For a start, the Dow Jones Industrial Average is an odd measure for a economy’s success. There are hundreds of publicly traded companies in the United States, but the DJIA only considers 30 of them. There is no clear reason why it includes those particular 30 and their performance is calculated using the Dow Divisor (which is currently 0.14602128057775).

Trump is celebrating something that has come about in the face of what he called ‘a false economy.’ An economy, that he inherited from Obama and continues to benefit from – the economy that has been pumped up by the Federal Reserve including a massive increase in public and national debt.

When you look at the DJIA against something that has held its value, as opposed to the debased dollar and the artificially stimulated US economy, then you will see a different story.

Dow Jones Versus Gold

‘Sir Charles’ over at pricedingold.com, draws our attention to the fact that the Dow priced in gold is nowhere near its high of 1110 grams of gold (49 oz) seen in 1999 when the DJIA rose to a record of 11,700 and gold was at a record low of $240 per ounce (see chart). Last Friday, when Trump was inaugurated the Dow was at 530g (18.1 oz).

Breaking through 20,000 is clearly an important psychological level for traders and markets, as it was in 1972 when it reached 1,000, then 5,000 in 1995 and 10,000 in 1999 and 15,000 in 2013. The difference though from the first big milestone in 1972 and today is that much of that was driven by a real economy, real company profits and real economic growth.

Sir Charles explains:

“Breaking the 1,000 barrier in November of 1972 was an emotional moment for traders on the floor and investors around the world. It seemed to mark a new era of prosperity, even as, behind the scenes, inflation and recession were preparing to set in. At that time, Dow 1,000 USD meant Dow 482 grams of gold, and through the rest of 1972, the Dow traded between 480 and 500 grams.’

It wasn’t until 1973 that the strings began to unravel and both the dollar and stock market began to fall, the Dow reached its all time low of 37g (1.3oz) in 1980. Were that to happen today with the DJIA at 20,000, we would need to see gold prices surge to $15,384 per ounce.

As you can see from the important chart above, the largest bull-market in the Dow Jones began in 1980, Sir Charles states that we need to ask if we are

“now following the trajectory of the early 1980s (on our way to the moon again) or if we are instead channeling the spirit of 1974 to 1977 (a major bear market rally, on our way to a retest of all-time lows).”

Trump, the Fed and gold

The answer to this question lies with Donald Trump. As we have explained already, whilst the recent highs in the DJIA might not mean much in real-terms, it is an important indicator of the high expectations traders have for Trump and his radical policies – at least in the short term anyway.

This is a President who has won an election on promises to grow a real economy and to bring it back to its former glory days, this surely means a currency that is worth something.

For all of Trump’s comments on the Fed during the election campaign and complaints about the strong dollar in the run-up to the inauguration, he actually hasn’t done much to reassure us that he is aware of how to fix the financial system. Instead, he talks about the strong dollar in relation to its exchange rate with another currency, not in terms of its real value.

For Trump the solution appears to lie in protectionism, which just seems to be a way of papering over very odgy vulnerable and cracked foundations. Economics and the Triffin Dilemma tells us that Trump can’t have his cake and eat it – there is an incompatibility between the domestic policy of a country (which operates a global reserve currency) and the international monetary order.

Instead, the solution may lie in real monetary reform. Something his recent pronouncements and cabinet appointees strongly suggest will not take place.

During the Republican nomination rounds, there was plenty of talk about the value of the dollar and how it could be reformed to some of its past glory through the gold-standard. Since Trump’s nomination, this has not been mentioned again.

From a Libertarian perspective, he is proving himself very disappointing indeed. Both in terms of economic and monetary policies and indeed in terms of his expansionist, some would say quasi-imperialist foreign policies.

If Trump really wants a reason to fist pump on social media, and show that he is bringing real value to the US economy, he would have to begin to focus on honest money and basing his monetary policies on something of real value – gold. So far there is little sign of this – quite the opposite as his fiscal policies are wildly expansionary and this needs to be paid for by the already massively indebted U.S. sovereign.

The New York Sun editorial summed it up well this week:

“This is a moment to press the importance of true monetary reform — a point that was marked on the Journal op-ed page January 24 in a piece by John Mueller. He argues precisely that Mr. Trump’s trade real trade problem is not a lack of protectionism but a lack of the right monetary system. “When America had a gold or silver standard, the federal budget ran an annual surplus averaging 0.4% of gross domestic product,” he writes. “When it hasn’t, the average deficit has been 2.7%.”

Who is going to carry this reform for Mr. Trump? He has an early chance to nominate two governors of the Federal Reserve and, before long, to replace the chairman and vice chairman. These choices will be important. Mr. Trump’s nominee as Treasury Secretary, Steve Mnuchin, seems lukewarm or even indifferent to the cause of honest money. Vice President Pence, however, gets it down to the ground. We’ve already suggested Senator Cruz as the next Fed chairman.

A long-shot, no doubt, though the senator of Texas was the first candidate to thrust monetary policy to the center of the campaign. This week, the editor of the Interest Rate Observer, James Grant, asks a craftier suggestion: “Is it so farfetched,” he quips, “to imagine Stephen Bannon as chairman of a Trumpian Federal Reserve?” We’ve met Mr. Bannon only glancingly, but he strikes us as having the kind of crust that will be needed if Mr. Trump is to get a monetary reform to undergird his radical presidency.”

A return to the gold standard may seem a way off, but if Trump’s presidency continues to be as radical as it initially appears it is not impossible to imagine monetary reform happening.

However, it may be that necessity rather than prudence forces the President’s hand. Given the scale of U.S. debt, a dollar crisis seems increasingly likely. The new President may then be forced to look to gold as a way to restore confidence in a battered greenback.

Conclusion – Dollar ‘great’ or dollar crisis?

To conclude, ‘Sir Charles’ sums it up nicely. He writes that gold is not perfect, but that

“it has stood the test of time, both as cash money and as a measure of value, for thousands of years – while hundreds of other currency systems have come and gone.”

Trump so far appears to be exacerbating and accelerating financial, monetary and geo-political trends that were already taking place. What was happening slowly and almost imperceptibly under Bush II and Obama is now becoming more apparent and intensifying under Trump. Wars are very expensive things to wage and have to be financed. Today they are being financed by stealth currency devaluation.

Will Trump accelerate the decline and devaluation of the US dollar during his Presidency? Or will he make the dollar “great again” and restore the greenback to its former glory?

The signs in the first few days of his Presidency are not good, underlining once again the importance of owning physical gold to protect against geo-political risks, stock and bond market bubbles and the continuing devaluation of all fiat currencies.

KNOWLEDGE IS POWER

10 Important Points To Consider Before You Buy Gold

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold Prices (LBMA AM)

26 Jan: USD 1,184.20, GBP 943.81 & EUR 1,108.77 per ounce

26 Jan: USD 1,191.55, GBP 945.14 & EUR 1,111.95 per ounce

25 Jan: USD 1,203.50, GBP 956.90 & EUR 1,119.62 per ounce

24 Jan: USD 1,213.30, GBP 972.22 & EUR 1,130.07 per ounce

23 Jan: USD 1,213.75, GBP 974.03 & EUR 1,130.12 per ounce

20 Jan: USD 1,199.10, GBP 974.87 & EUR 1,127.03 per ounce

19 Jan: USD 1,203.35, GBP 976.76 & EUR 1,129.34 per ounce

18 Jan: USD 1,212.50, GBP 984.91 & EUR 1,134.78 per ounce

17 Jan: USD 1,217.50, GBP 1,003.59 & EUR 1,141.65 per ounce

Silver Prices (LBMA)

27 Jan: USD 16.70, GBP 13.32 & EUR 15.61 per ounce

26 Jan: USD 16.86, GBP 13.39 & EUR 15.71 per ounce

25 Jan: USD 16.93, GBP 13.46 & EUR 15.74 per ounce

24 Jan: USD 17.10, GBP 13.73 & EUR 15.92 per ounce

23 Jan: USD 17.14, GBP 13.78 & EUR 15.97 per ounce

20 Jan: USD 16.89, GBP 13.73 & EUR 15.87 per ounce

19 Jan: USD 16.95, GBP 13.75 & EUR 15.89 per ounce

18 Jan: USD 17.12, GBP 13.93 & EUR 16.01 per ounce

17 Jan: USD 17.00, GBP 13.91 & EUR 15.87 per ounce

16 Jan: USD 16.82, GBP 13.94 & EUR 15.87 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.