Trump Deficits Will Be Huge

Interest-Rates / US Debt Jan 19, 2017 - 11:26 AM GMTBy: Peter_Schiff

There is much we don't know about how the Trump presidency will play out. Will the Wall get built? Who will pay for it? Will it have at least some fencing? Will repeal and replace happen at exactly the same time? Will Trump throw a ceremonial switch? Will there be a Trump National Golf Course in Sochi? It's anyone's guess. But of one thing we can be fairly certain. President Trump is very likely to preside over the largest expansion of Federal budget deficits in our history. Trump has built his companies with debt and I'm sure he thinks he can do the same with the country. His annual budget deficits are likely going to be huge. This development will make a greater impact on the investment landscape than most on Wall Street can imagine.

There is much we don't know about how the Trump presidency will play out. Will the Wall get built? Who will pay for it? Will it have at least some fencing? Will repeal and replace happen at exactly the same time? Will Trump throw a ceremonial switch? Will there be a Trump National Golf Course in Sochi? It's anyone's guess. But of one thing we can be fairly certain. President Trump is very likely to preside over the largest expansion of Federal budget deficits in our history. Trump has built his companies with debt and I'm sure he thinks he can do the same with the country. His annual budget deficits are likely going to be huge. This development will make a greater impact on the investment landscape than most on Wall Street can imagine.

In the past half-century, Republican presidents have been the going away winners at the deficit derby, a fact that should make any true conservative blush. The sad truth is that annual deficits exploded under Ronald Reagan and George W. Bush, and generally contracted under Bill Clinton and Barack Obama. Some of the explanation is just luck of the draw, some walked into office in the midst of recessions they didn't create. But the better part of the explanation is baked into the political dynamics.

Democrats want to raise spending and taxes. Republicans want to cut spending and taxes. But whereas Democrats have generally succeeded on both of their missions, Republicans have just succeeded in one. (Actual spending cuts require politically difficult choices that are much harder to vote for than perennially popular tax cuts). This puts a giant thumb on the Republicans' budgetary scale.

Like prior Republicans, Trump has promised to cut taxes, on both corporations and individual taxpayers...even the wealthy. But unlike prior Republicans, he has not paid a word of lip service to spending cuts. He has promised to spend now, and spend big. Trump just doesn't do the austerity thing. It's for losers.

In addition to fronting the cost of building the 2,000 mile Wall (accounts receivable has a reliable address in Mexico), Trump plans big increases in military spending, both on active military and on our veterans. His reboot of Obamacare has yet to be presented, but as he has promised that no one will lose coverage, not even those with pre-existing conditions, we can be sure that Trumpcare won't be cheap. But his big project will likely be his promised $1 trillion plus infrastructure spending plan. Most importantly, he diverges from most Republicans by promising no structural changes in Social Security and Medicare, the entitlement leviathans that are the sources of the vast majority of Federal red ink.

To aid him in these budget-busting efforts, Trump will have the benefit of a compliant Congress in which his own party controls both Houses. Most Republican senators and representatives now seem eager to jump aboard the Trump train and will likely pass anything he sends to the Hill. Those who resist should prepare for the kind of political hardball that we have rarely seen in this country (I'm talking to you Lindsay Graham). If Republicans couldn't hold the line on Obama, how will they do so with Trump and, politically, why would they even want to? Grandstanding against Obama's big deficits, even to the point of forcing a government shutdown, did not play well politically. Standing up against Trump will involve considerably more risk with Republican primary voters.

Even if none of Trump's taxing and spending plans come to fruition, the United States would still be on the threshold of a sobering era of debt expansion. The age of trillion dollar plus annual deficits began in 2009 when the financial crisis tripled a very large $458 billion deficit in 2008 into a record smashing $1.4 trillion in 2009. Three more trillion-dollar deficits followed. But since 2009, excluding a small increase from 2010 to 2011, the deficits have declined steadily. By 2015, they had decreased to $438 billion, slightly below where they were before the crisis began. (Of course these smaller deficits exclude hundreds of billions of additional debt that is borrowed off budget.) These developments have caused many to conclude that budgetary issues are no longer at the top of the agenda.

But, as a result of the failure of Republicans and Democrats to achieve any kind of agreement on long-term budgetary reform, the six-year run of declining deficits has come to an end. The 2016 deficit was more than $100 billion wider than 2015. This marks the first year since 2009 that the deficit increased from the prior year (except for a minimal .001% expansion in 2011 over 2010). This is just a down payment on things to come.

The Congressional Budget Office (CBO) - the closest Washington comes to actual objectivity - issues long-term budget assumptions. Except for a relatively small dip from 2017 to 2018, the CBO sees continuous deficit expansions every year through the end of the next decade, culminating in continual $1 trillion deficits every year starting in 2024. (8/23/16 CBO report) That's the good news. The bad news is that in making these projections, the CBO has to make some very rosy assumptions. The most egregious of these is that the U.S. economy will avoid recession for the entirety of the next decade.

Over the past century we have seen a recession, on average, every 60 months (based on data from National Bureau of Economic Research and Bureau of Labor Statistics). According to current figures, the economy has been in expansion for 92 consecutive months. This means that the current expansion is already 50% longer than average. Expecting it to last for nearly 18 years is completely without precedent. I believe it will be sooner rather than later that we will have another recession, which will greatly enlarge the deficits. History is clear on that point. The Great Recession caused the deficit to triple. Even the mild recession of 2001 turned a $236 billion surplus into a $157 billion deficit in just two years. The next recession I expect to work similar magic. But, in addition to being blind to recessions, the CBO was also blind to Donald Trump.

In making its projections, the CBO simply assumed that the taxing and spending laws currently on the books would remain unchanged. The projections do not account for any tax cuts or spending increases. As mentioned previously, Trump has virtually promised to do both in the first year of his presidency. If he is successful, we could return to trillion dollar deficits much sooner than the CBO thinks. A recession could push the red ink well into record territory.

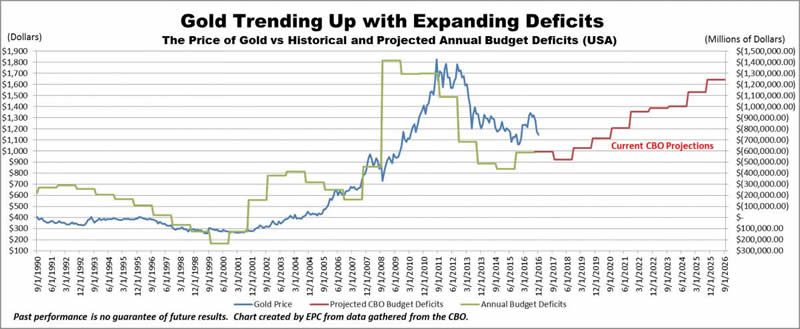

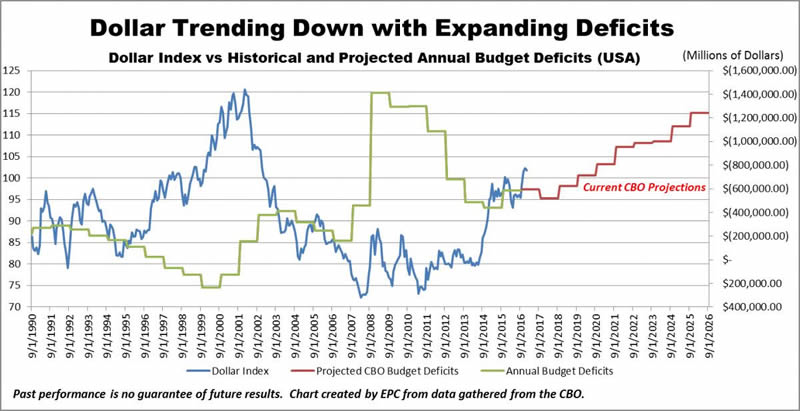

The graphs below chart the prices of gold and the dollar versus annual budget deficits since 1990. The data shows clearly that after a few months of lag time, the price of gold has followed the long-term expansion and contraction of deficits, while the dollar has moved in the opposite direction.

Of course, who on Wall Street has picked up on these macro trends. In fact, one of the biggest issues currently being discussed is how the U.S. economy will deal with a perennially strengthening dollar. They are assuming that the Federal Reserve will be raising rates and that the economy will be expanding under the Trump stimulus thereby strengthening the dollar and attracting flows from abroad. This type of "trees grow to the sky" thinking is similar to Clinton-era assumptions that the national debt would be repaid by perpetual budget surpluses, or the feeling earlier in this century that real estate prices could never decline.

To make these assumptions, Wall Street must ignore the obvious ramifications of big deficits, in particular the need for the Federal Reserve to step up and buy all the new debt that the Trump administration will have to issue. The last time the government had to find buyers for more than a trillion dollars per year of debt, it relied on foreign central banks. Eight years ago, the vast majority of Treasury debt was purchased by China and Japan (and, to a lesser extent, Saudi Arabia, Russia and other emerging nations in Asia and Latin America). But as the debt surge persisted, the real heavy hitter became the Federal Reserve itself which, through its Quantitative Easing (QE) Program, bought more than half a trillion dollars of Treasury debt per year from 2009 to 2014.

But there can be little expectation that the foreign buyers will be returning for a repeat performance. Currently, both China and Japan are looking to draw down foreign exchange and are engaged in active selling of U.S. Treasuries in order to keep their currencies from declining against the dollar (Scott Lanman, 10/18/16, Bloomberg). What's more, Donald Trump is likely to engage in aggressive trade wars that may certainly discourage other foreign central banks from supporting our debt issuance.

Also, bond analysts are now convinced that the 35-year plus bond bull market, which began in 1980, finally topped out in July of 2016, when European and Japanese yields sank deeply into negative territory and yields on the 10-year Treasury hit 1.36% (Peter Boockvar, 9/19/16, CNBC). Since then bond prices are down significantly across the board. If this trend continues, it will discourage private buyers from making the jump into Treasuries. In other words, the Fed may be the only game in town when it comes to financing future deficits in a new bond bear market.

This would mean that the QE programs that many had assumed to be a thing of the past can return with a vengeance, becoming the signature program of the Trump era. When this reality sinks in, you may witness the dollar begin a long and steady decline from its current decades-high strength. At the same time, gold, gold stocks, commodities and foreign stocks could finally enter a turnaround.

Ultimately, I expect years of dollar decline to culminate in a crisis, with the dollar plunging in value, as the world abandons it as its primary reserve currency. The last time the dollar was on the brink of collapse it was saved by the financial crisis of 2008. Next time we will not be so lucky!

Catch Peter's latest thoughts on the U.S. and International markets in the Euro Pacific Capital Summer 2015 Global Investor Newsletter!

Regards,

Peter Schiff

Euro Pacific Capital

http://www.europac.net/

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.