10 Potential Black Swans and Opportunities for the US Economy in 2017

Economics / US Economy Jan 11, 2017 - 04:46 PM GMTBy: John_Mauldin

We’ve reached that wonderful time of year when financial pundits pull out their forecaster hats and take a crack at the future. This time the exercise is particularly interesting because we’re at several turning points. Any one of them could remake the entire year overnight.

We’ve reached that wonderful time of year when financial pundits pull out their forecaster hats and take a crack at the future. This time the exercise is particularly interesting because we’re at several turning points. Any one of them could remake the entire year overnight.

I should probably say up front that I am actually somewhat optimistic about 2017—optimistic, meaning I think we will Muddle Through—but that’s a lot better outcome than I was expecting five months ago. However, midcourse corrections may be warranted.

Instead of trying to answer questions about the future, I’ll try to list those we should be asking as 2017 opens.

We can’t afford for any of the major components of the global economy to break down; so, it’s smart to ask, “Where are the weak points?” That’s what we’ll do today. We’ll poke at the economic mechanism as it grinds along.

Trumping DC

The biggest change will happen in Washington DC when Donald Trump takes office. Aside from the changes he can make on his own authority, he’ll be in position to approve the many Republican initiatives that President Obama blocked. Here are some items I’m watching.

Tax reform: Our monstrosity of a tax system needs major reconstruction: a reduction and simplification of corporate taxes, a significant reduction of the individual income tax, and replacement of the Social Security tax with a VAT-like consumption tax. What will come out of the House is still unknown.

My sources are telling me House members want to pass an initial tax cut quickly and defer the more complicated changes for later in the year. The easy initial tax cut is to remove the Obamacare tax when they repeal Obamacare (the Affordable Care Act), which it appears they will do early in the session.

Final thoughts on taxes: Some industries will suffer massive impacts if you slap tariffs on incoming goods. Further, putting a high tariff on products that are sold at Walmart and Costco and on Amazon is massively inflationary to those shoppers (and that’s most of us).

These policies can be tricky, and the consequences can have a big impact on consumer confidence.

Energy: The Obama administration’s heavy-handed environmental regulations are a major impediment to US energy independence. Trump can change many of them quickly because they came in the form of executive orders and rulemaking that doesn’t require congressional approval.

Trump can also approve some of the Arctic and offshore drilling projects that Obama would not consider. I am told that there are some $50 billion worth of oil-production projects that are ready to go, which would be a massive source of high-paying jobs.

If he wants to play hardball with OPEC, Trump could even impose a tariff on imported petroleum products that we can produce here (as opposed to the raw crude, especially heavy crudes, that we currently don’t produce). That would give domestic producers and refiners a further boost. It would also aggravate the rest of the world’s oil glut.

Economic stimulus: We have plenty of shovel-ready projects, or could create them in short order, that would create jobs and simplify trade and travel. Some will not be very profitable in the short run, so they may not happen under a tax-credit scheme.

Trade: Import-dependent businesses are on pins and needles right now, hoping the Trump administration doesn’t turn toward the kind of protectionism some of the new appointees have advocated in the past. We’ll see. The president has considerable latitude in this area, so almost anything is possible.

Banking: One reason the stock market has gone bananas since the election is the prospect of banking deregulation. Wall Street has been chafing under the Dodd-Frank Act’s requirements and restrictions. The Volcker Rule on proprietary trading has clearly worsened bond market liquidity and taken a major revenue center away from the banks.

The Dodd-Frank Act as presently constructed could actually aggravate matters if we find ourselves in another financial crisis. Dodd-Frank prevents the Federal Reserve from stepping in with liquidity and instead says that the FDIC should “resolve” any failing banks.

I see the point, but the main reason we have a central bank is to be a lender of last resort to the banking system. The FDIC simply can’t act fast enough, nor does it have the ability or the cash to act effectively in a crisis. Congress needs to fix this soon.

Finally, Dodd-Frank puts our regional and small community banks at a massive disadvantage. They get all of the costs and are restricted from their normal activities. Overhauling Dodd-Frank will be a big boon to entrepreneurs and small businesses and will create jobs.

Federal Reserve: We should also see at least two nominees to the Fed’s Board of Governors soon after Trump takes office. He may get a third one if Daniel Tarullo leaves, as some observers expect. He will get to nominate both the chair and vice chair next year, and it is likely that the remaining members will think about leaving as well when Yellen departs. But the early nominees will tell us a lot about Trump’s priorities and long-term plans—hopefully for the better.

Meanwhile, the Fed is in the middle of a long-overdue policy turn. There’s still a risk that they will find they started tightening just in time for a recession, which is also long overdue.

Surprises and Black Swans

Black swans aren’t a risk limited to the world of finance; they happen in politics too. Such an event could push aside all the best-laid plans and change everything.

Canadian bubble: Our neighbors to the north are at their own turning point. The Canadian economy was riding high in the commodity boom but has run into problems after two years of sharply lower oil prices. Since then Canada has avoided recession but has not enjoyed much growth.

Canada also has a housing bubble that looks increasingly ready to pop. House prices have little to do with oil and everything to do with Chinese buying property.

What happens in Canada will tell us something important about China and vice versa. Anything that keeps Chinese money from leaving China will raise the odds of Canada’s bubble popping.

US energy policy matters to Canada too. The country’s huge oil sands deposits would help its export balance, but in some cases the best access requires pipelines through the US, like the Keystone that Obama has held up. Trump can help Canada by letting that project go forward.

Crowded exits in Europe: I thought there was a good chance the Italian bank crisis would come to a head in 2016. The Italians seem to have yet again delayed the inevitable. Reality hasn’t fundamentally changed, though. Troubled institutions are not going to get better on their own, nor is the new government going to miraculously gain public confidence.

Saving Italian banks will take multiple hundreds of billions of euros, which Italy does not have, nor do they technically even have the legal right to unilaterally bail these banks out. They would have to utilize an ECB facility that does not now exist to get that much money, and such a measure would require German approval.

I keep telling you that Italy is the most dangerous economic issue on the world front. Attention must be paid.

That said, Europe is quite capable of staving off disaster. They are professionals at that. They can do it again this time if nothing else goes wrong. That’s a big if.

NATO: The defense alliance partially overlaps with the EU but also includes Turkey. Trump wants the other member states to increase their defense spending. He says, correctly, that they aren’t paying their fair share and has openly questioned whether the US would come to their aid in an attack.

The Baltic countries and Poland are very concerned, as they are the most exposed to potential Russian aggression.

Does Putin intend to attack and try to occupy one of those countries? I really rather doubt he will, but he can cause all kinds of problems without attacking. Fear alone is sufficiently troublesome.

As with Italy, though, fear has consequences. Leaders can juggle only so much. When too many things happen at once, the risk rises that someone will drop a ball.

Asian angst: Relationships within Asia are in flux, to say the least. Trump’s phone call with the Taiwanese president and subsequent comments show he’s willing to roll back prior commitments in order to get better ones. We could see some major changes in 2017.

China has other problems too. They are holding the domestic economy together with astonishing amounts of debt. New liquidity can’t leave the country due to capital controls, but it has to go somewhere. The result is rolling asset bubbles that make even Vancouver housing prices look flat.

The transition from an economy driven by exports to one led by domestic demand is probably going as well as it can, but that’s not saying much. The process may accelerate if Trump has his way.

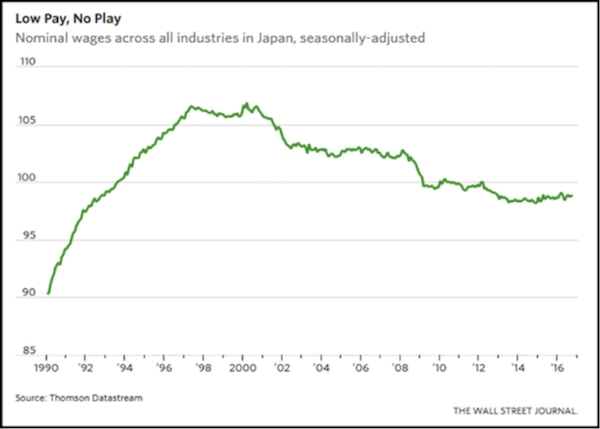

Over in Japan, something interesting is happening. The job market is unbelievably tight. I saw in a Wall Street Journal report last week that each available worker has two job offers on average. The unemployment rate is historically low.

In a normal market, you would expect employers to compete for workers by raising wages, right? But it isn’t happening. Wages are flat or even falling. Deflation has changed the psychology for two generations of workers and managers. Employees are afraid to demand more, and companies are afraid to pay more.

It’s also a potentially ominous sign for the US. The Fed and many others are watching labor markets closely for signs of wage inflation. Rising wages are one of the factors that would justify tighter interest-rate policies. Yet, Japan shows that unemployment can stay low for years without necessarily causing wage inflation.

Japan is another potential target of Trump’s trade policy. Unlike China, Japan really is devaluing its currency. The policy is working too, in terms of promoting exports. But those exports don’t all go to the United States. Japan sells China much of its industrial equipment and technology, demand for which will presumably drop if Trump succeeds in reducing Chinese exports.

Final Thoughts

We enter 2017 with more question marks than I can count. Even if all the policymakers are competent and have good intentions, stuff happens.

Now, more than ever, economic risk around the world emanates from our governments and central banks.

Trump has the traditional 100 days to deliver something to keep the optimism going. Hopefully, a Congress that is nominally Republican controlled can agree on important measures and move more quickly than we have seen it move in quite a while.

There have been only a few times when I was not optimistic about the coming year, but thankfully this is again one of the optimistic times. I’m actually as pumped as I have been in a long time.

2016 has been a year of major surprises. Frankly, I think 2017 has the potential to offer even more challenges than 2016 did.

Grab This Free Report to See What Lies Ahead in 2017

Now, for a limited time, you can download this free report from Mauldin Economics detailing the rocky roads that lie ahead for three globally important countries in 2017—and how the economic fallout from their coming crises could affect you. Top 3 Economic Surprises for 2017 is required reading for investors and concerned citizens alike. Get your free copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.