Gold Price In GBP Rises 4% On Brexit and UK Economy Risks

Commodities / Gold and Silver 2017 Jan 10, 2017 - 12:40 PM GMTBy: GoldCore

– Pound fell 2% against gold yesterday after Theresa May created Brexit concerns

– May’s ‘Hard Brexit’ denial does not calm markets growing fears

– Investors concerned about lack of government strategy and uncertainty

– UK Prime Minister bizarrely blames media and “those who print things” for sterling depreciation

– GBP gold builds on 31% gain in 2016 with 4% gain so far in 2017

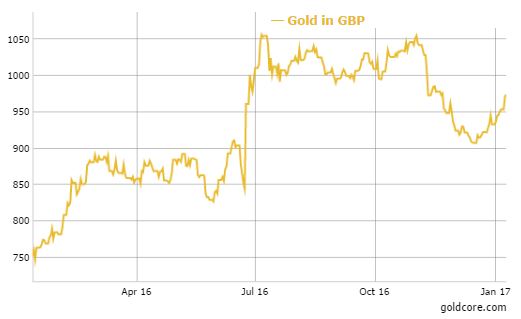

Gold in GBP – 1 Year and Timeline (GoldCore)

1. June 24: Brexit: Gold surged 20% in sterling to £1,015/oz in two days after UK votes to leave EU

2. August 4: Bank of England expands QE – launches latest massive money printing experiment

3. October 6: “Flash crash” — pound collapses 5% against gold in just over a minute

4. January 9: Pound falls another 2% against gold as UK PM fails to reassure markets

Gold rose to its highest in over one a month today as fears that the UK will have a ‘Hard Brexit’ with the EU led to safe-haven buying.

The pound fell sharply yesterday and gold in sterling terms rose from £954/oz to £973/oz after weekend comments from British Prime Minister Theresa May sparked concerns that Britain would drastically change trade, immigration and other relations with the EU after Brexit.

Gold has consoidated on those gains today and is over 4% higher in sterling terms so far in 2017 – building on the 31% gains seen in 2016.

The gains being seen are not simply related to Brexit. There are also substantial risks facing the UK economy in terms of the London property bubble (which shows signs of bursting), the very large UK current account deficit and the massive UK national debt.

Spot gold in dollar terms rose another 0.5% today to $1,187.60 an ounce, its highest since Dec. 5 at $1,187.61

There is also strong physical gold buying in China ahead of the Lunar New Year later in January.

Gold looks set to test $1,200 in the short term. In the coming days, attention will turn to U.S. President-elect Donald Trump’s inauguration and the geo-political and economic uncertainty regarding the next four years of his Presidency. This will likely further boost safe haven demand.

10 Important Points To Consider Before You Buy Gold

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold Prices (LBMA AM)

10 Jan: USD 1,183.20, GBP 974.60 & EUR 1,118.12 per ounce

09 Jan: USD 1,176.10, GBP 968.75 & EUR 1,118.59 per ounce

06 Jan: USD 1,178.00, GBP 951.35 & EUR 1,112.27 per ounce

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

03 Jan: USD 1,148.65, GBP 935.12 & EUR 1,103.28 per ounce

30 Dec: USD 1,159.10, GBP 942.58 & EUR 1,098.36 per ounce

29 Dec: USD 1,146.80, GBP 935.56 & EUR 1,094.85 per ounce

Silver Prices (LBMA)

10 Jan: USD 16.66, GBP 13.73 & EUR 15.76 per ounce

09 Jan: USD 16.52, GBP 13.57 & EUR 15.69 per ounce

06 Jan: USD 16.45, GBP 13.30 & EUR 15.54 per ounce

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

03 Jan: USD 15.95, GBP 12.97 & EUR 15.34 per ounce

30 Dec: USD 16.24, GBP 13.20 & EUR 15.38 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.