US Housing Market - IndyMac - We are Not a Subprime Lender!

Housing-Market / US Housing Mar 21, 2007 - 04:09 PM GMTBy: Michael_K_Dawson

On March 15, IndyMac released a rather lengthy press release claiming that it had been inappropriately categorized by many media sources as a subprime lender. IndyMac stated that it is primarily a prime/Alt-A mortgage lender with minimal exposure to subprime. With the subprime lenders in melt-down mode, it is quite understandable why IndyMac would want to differentiate itself.

However, in doing so it brought more attention to itself and was featured in an article by CNN Money called “Liar loans: Mortgage Woes Beyond Subprime.” Sometimes it pays just to be quiet.

What is Alt-A?

Lenders use the term Alt-A (Alternative-documentation) to categorize or differentiate between borrowers. Applicants for this type of loan often lack proof of income from traditional employment. Investors and self-employed borrowers are good candidates. Commissioned employees with inconsistent income also fall into this group. IndyMac is the king-pin of Alt-A loans. Trade publication Inside Mortgage Finance estimates it did $70.2 billion Alt-A loans in 2006, up 48 percent from a year earlier. This was nearly 80% of the company's mortgage originations last year.

Alt-A loans are also known as “Stated Income” or “Liar Loans” since income is taken as fact. No further documentation is required. As long the automated property appraisal software is functioning, approval is only a few keystrokes away. These loans are tremendously profitable, since the underwriting costs are much lower and the rates are higher than a standard 30 year fixed mortgage.

IndyMac pointed-out in its press release that subprime mortgages generally include loans where the borrower's FICO score is 620 or below and that their customer's average score was 701 in 2006. This is an interesting data point, but a person's FICO score is hardly the root cause of the escalating subprime defaults. The problem lies in the type of loans that have been originated.

Creative loans using teaser rates, negative amortization and interest-only are causing the chaos. Here is an example. An option ARM allows a borrower to pay full principle and interest, interest only or less than full interest based on a teaser rate. If a person elects to pay less than full interest the remainder of the interest is put back into the principle. This is called negative amortization. A person would choose this option, because it could cut their monthly payment in half versus a fully amortized product. However, like all good things - it must end at some point. Most of these loans typically reset interest rates in 1 or 2 years. What's worse is when the negative amortization reaches its limit, usually 110% of the original loan, not only does the interest rate reset, but both principal and interest must be paid going forward. This could double or triple the monthly payment.

Resetting of such loans is causing the subprime sector to explode. Guess what? Alt-A is dominated by these loans as well. Regardless of a person's FICO score, a doubling or tripling of their mortgage is going to cause a problem. The higher FICO person may be able to buy a little more time, but the end result will be the same.

Trader's Paradise

Traders have had a field day literally shorting the subprime lenders into the ground. New Century, the second largest subprime lender in the U.S., was delisted from the NYSE and is down -93% year to date as of March 16. Others such as Accredited Home Lenders (LEND), Novastar Financials (NFI) and Freemont General (FMT) have been thoroughly beaten to the tune of -60%, -78%, and -45% respectively. Some traders will short these to oblivion, but the smarter ones are looking for their next prey with more downside. Hmm, I wonder which company fits that description?

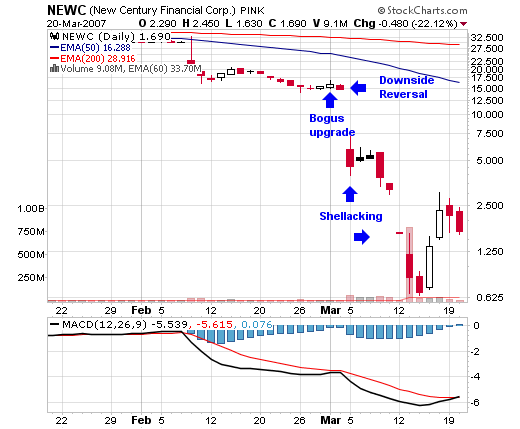

The best time to short a wounded duck is after a bogus announcement is conjured up to pump up its stock price. New Century is a perfect example. On March 1, Bear Sterns upgraded New Century to a buy. Apparently the analyst was asleep at the switch when three weeks prior, New Century announced that it was restating their earnings for the first three quarters in 2006 and postponing to an undetermined future date their Q4 and full year earnings. The infamous upgrade provided a nice 3% bounce. The following day's downside reversal completed the short set-up and the rest is history. Read more about this trade in my earlier article .

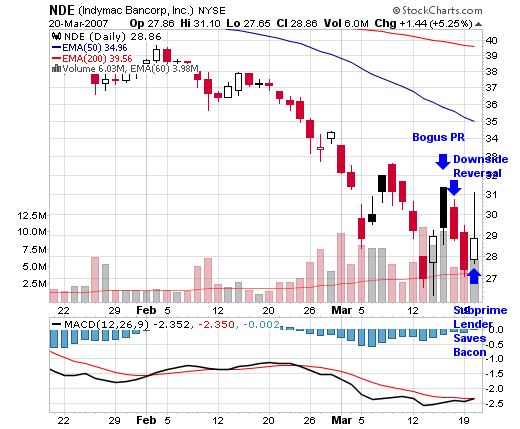

Low and behold, IndyMac has provided the exact same setup. Their bogus press release provided 1.5% bounce. The downside reversal on the next day completes the set-up. Then the shellacking begins.

Not so fast with the shellacking. How ironic is it that a subprime lender saves IndyMac's bacon? Today, Accredited Home Lenders received a $200 million loan commitment to stay its execution. This gave a boost to all mortgage related stocks. A little patient is necessary, but IndyMac's 15 minutes of fame is coming soon.

By Michael K Dawson

http://www.thetimeandmoneygroup.com/

Michael K Dawson founded the Time and Money Group with the aim of educating and sharing 20 years of experience on how to reach financial freedom. "Financial Freedom is freedom to focus on what is truly important to you and your family without having to trade time for a wage. It is enabled by a portfolio of income producing assets, managed by you, which generates sufficient income to cover your yearly expenses on an ongoing basis. It provides both time and money". The intent of his website is to become a repository of information to put you on the fast track to becoming financially free. For further infromation visit http://www.thetimeandmoneygroup.com/

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.