Financial Markets Award Trump Nobel Prize in Economics

Stock-Markets / Financial Markets 2016 Dec 17, 2016 - 06:33 AM GMTBy: David_Galland

Dear Parader,

Dear Parader,

As today we are headed north to spend Christmas with the family, Jake Weber, the invaluable senior researcher of our premium Compelling Investments Quantified (CIQ) service has kindly offered to fill in for this edition.

In his article, he delves into the economic and political challenges President Trump is facing and scans for any red flags flapping in the breeze.

On the topic of CIQ, we maintain a laser-like focus on finding great companies that sell below their intrinsic value—the only proven path to successful long-term investment.

In fact, of the six stocks we recommended since launching in June of 2016, only one is in the red, down 8%. However, as we are long-term investors and our reasons for owning the high-yielding stock have not changed, its short-term pullback doesn’t concern us.

The other stocks in our CIQ portfolio have returned 1%, 16%, 22%, and 31%. Our most recent recommendation, made at the end of November, is already up 15%.

If you’re looking for a more predictable approach to investing, one that takes emotion out of the equation and ensures you’ll sleep well at night, you owe it to yourself to take a risk-free trial subscription to Compelling Investments Quantified—click here for details.

And with that biased but fully guaranteed recommendation, I’ll now turn the page over to Jake.

David Galland

Markets Award Trump Nobel Prize in Economics

By Jake Weber

It took only nine days in office for President Obama to be nominated for the Nobel Peace Prize.

Less than nine months later, the Norwegian Nobel Committee followed through and awarded Obama the Nobel Prize for “his extraordinary efforts to strengthen international diplomacy.” That, despite the fact Obama had no significant diplomatic accomplishments.

Likewise, the markets seem to have prematurely greeted Trumponomics as an outstanding success. US stock indices continue to make all-time highs, the dollar is charging ahead, and bond markets are being trashed.

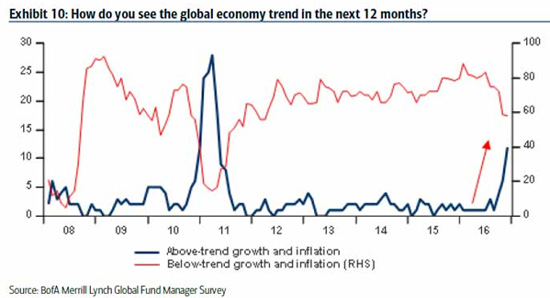

Furthermore, the latest Fund Manager Survey by Bank of America shows growth and inflation expectations at the second-highest level since 2004.

In short, US equity markets are already factoring in Trump’s draining of the swamp, his implementation of regulatory reforms, and the rollback of poor policies that trip up the American economy, while bond markets are pricing in higher inflation.

There’s just one thing: Trump hasn’t done anything yet. We’re still weeks away from his inauguration, and details of his economic plans remain scarce.

No matter, any potential positives for economic growth (lower taxes, deregulation, and fiscal stimulus) are being accepted at face value, while the potential negatives (soaring deficits, tariffs, and trade wars) are being ignored.

After eight years and 100,000 pages of new regulations during the Obama administration, it’s understandable why the markets are cheering for change. There are reasons to be optimistic. But as an investor, I’m not ready to give Trump the Nobel Prize for Economics just yet.

The Art of the Deal

There’s little doubt Trump will shake up the status quo of DC politics. For evidence, look no further than the @realDonaldTrump Twitter feed. But he’s going to have to use all of his skills in the art of the deal to get things done.

For example, earlier this year the Republican-majority House passed a budget blueprint calling for deficit reductions of $7 trillion over the next 10 years, primarily through spending cuts.

Against that blueprint, we have Trump’s proposed policy changes. The Committee for a Responsible Federal Budget, a nonpartisan think tank, estimates those changes, in particular tax cuts, could increase the deficit by $5.3 trillion over the next decade.

Speaker of the House Paul Ryan and Senate Majority Leader Mitch McConnell have both indicated that tax reform should be “deficit neutral.” Moving forward with the tax cuts will therefore require the assumption that they will trigger enough economic growth to offset the projected budgetary hit.

Trump’s team will have to successfully argue that point.

Deregulation is perhaps the most encouraging, pro-growth policy priority Trump and most Republicans can agree on. But it’s far harder to repeal a law than it is to write a new one. The process of repealing Obamacare could take years and, according to the Congressional Budget Office (CBO), could add $353 billion to the deficit over the next decade.

It’s also going to be hard to get deficit hawks on board with a trillion-dollar infrastructure plan, even if it is for the most part privately financed and includes significant tax incentives.

Then there’s Trump’s steady threats of imposing tariffs. History has shown that tariffs are inflationary as they raise prices of imported goods, allowing domestic industries to follow suit. Of course, should the new president follow through with tariffs, it will almost certainly lead to a tit-for-tat trade war with trading partners.

Trump the businessman was a huge fan of using debt to build his empire, and President-elect Trump appears to disregard the deficit entirely. Every economic policy proposal put forth by Trump seems to have inflationary implications.

In that light, the bond market’s sell-off makes perfect sense. After all, inflation is the number-one enemy of bonds.

However, it looks like the markets assume that Trump will be able to force his policies through Congress, and do so without consequences.

Trump’s Mountain

The consensus view is that the era of boosting growth with loose monetary policy is giving way to a new era of expansive fiscal policy. Most of the proposed changes should boost inflation and maybe growth too, which should send interest rates higher. But higher interest rates pose a major problem to the mountain of debt overhanging the US economy.

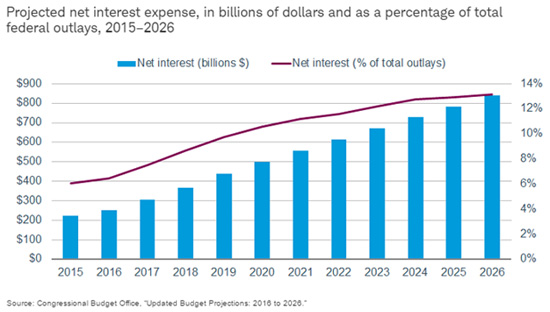

Federal debt is already $20 trillion—excluding the massive unfunded entitlement obligations that will balloon over the next decade as more Baby Boomers reach retirement age. 6% of the 2015 federal budget was used to pay interest on federal debt. That’s with historically low interest rates and the Federal Reserve owning 20% of the outstanding debt (interest paid to the Fed is remitted back to the Treasury).

If the interest rate on the 3-month Treasury bill rose from 0.5% today to 3.2% over the next 10 years, and the 10-Year Treasury bond from 2.6% to 4.1% over the same period, the CBO projects the interest expense could more than double—to 13.1% of federal spending.

That projection was made before taking into consideration any of Trump’s plans to boost federal spending while cutting taxes.

Then there are the state and local governments, which collectively are $3 trillion in debt—excluding trillions more in unfunded pension obligations.

Household debt sits at $14.6 trillion and business debt at $13.4 trillion, a 25% increase from 2008. Private debt alone accounts for 150% of GDP, a dangerous level.

American households have not deleveraged since the financial crisis, and corporate America has taken advantage of low interest rates to add significantly more leverage. In many cases, companies tacked on more debt for share buybacks to juice earnings rather than make productive capital investment.

An early-2016 report by Standard & Poor’s estimated that US companies have $4.1 trillion of debt coming due in the four short years between 2016 and the end of 2020. If the recent trend for higher interest rates continues, rolling over that corporate debt will be a challenge.

Stock market bulls are placing firm bets that tax cuts and stimulus spending will boost earnings more than higher interest rates will lower them. And interest rates are on the rise in anticipation of economic growth and inflation.

Yet there is still a lot of ground to be covered before tax cuts and stimulus spending are passed into law and begin to have their (hopefully) positive impact on the economy.

Too Far, Too Fast

Inflation expectations have been the main driver behind the spike in rates—not actual inflation.

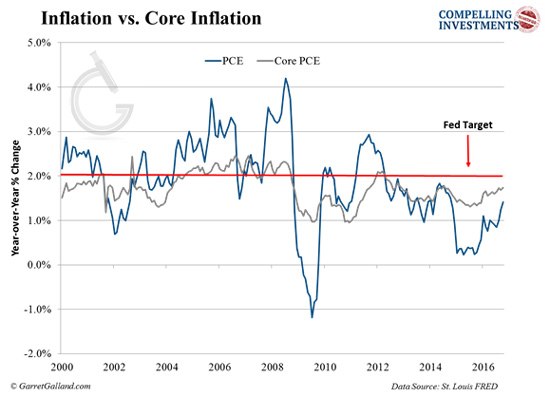

The Fed’s preferred inflation gauge is the annual change in the price index for personal consumption expenditures (PCE), which is still running below the 2% inflation target.

As you can see in the chart, PCE has been on the rise, but that is mostly a result of year-over-year increases in still historically cheap oil prices. Core PCE, which excludes the more volatile food and energy prices, has had a much smaller increase this year and is also running below the Fed’s target.

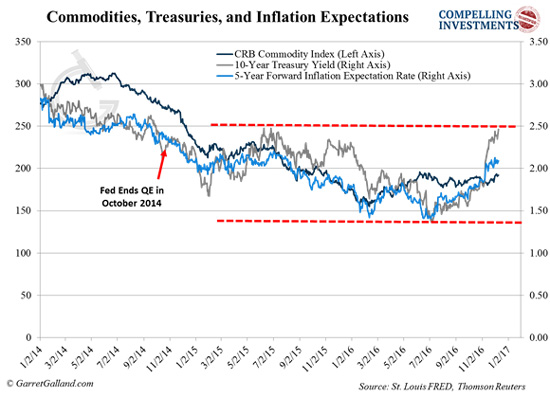

On the other hand, inflation expectations (the light-blue line in the chart below) have spiked above 2%. Following suit, the 10-Year Treasury bond yield has jumped as well.

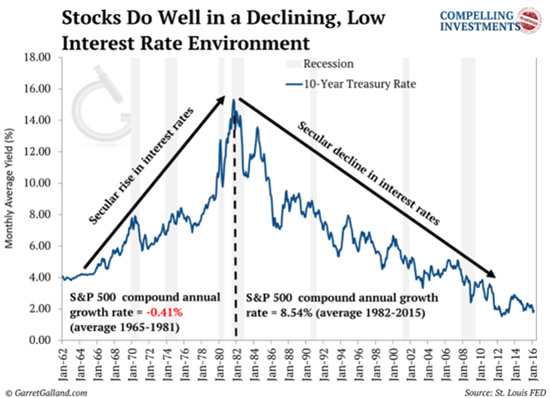

Inflation expectations may be justified as Trump appears intent on jumpstarting inflation. However, interest rates may have gone too far, too fast. If rates stay elevated before the tax cuts and stimulus spending kicks in, the US could slip back into a recession. In which case the 35-year secular bull market in bonds may not be over.

Either way, Trump is going to face many challenging decisions in his quest to stimulate growth. Given the massive overhang of debt and his plans to add more, the headwinds from higher interest rates pose a significant threat.

Catch-22 Monetary Policy

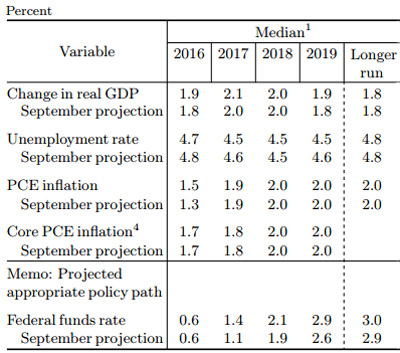

The Federal Reserve hiked rates by a quarter point this week, and the projected path was raised from two rate hikes to three by the end of 2017. That projection needs to be taken with a grain of salt. At the beginning of both 2015 and 2016, the Fed projected four hikes, but ultimately only hiked once during each year, in December.

Significantly, by projecting three rather than four hikes in its latest meeting, the Fed is actually entering 2017 more dovish than it has been at the start of the last two years.

Interestingly, the Fed only modestly adjusted real GDP growth up by 0.1% in 2017 and 2019. And its projections for inflation and core inflation were unchanged from 2017 onward.

For years, the Fed has begged for fiscal stimulus to complement its loose monetary policy. With the economy finally poised to receive a dose of Keynesian government spending, the Fed is itching to normalize rates.

The Fed wants higher rates so that when the next recession threatens, it’ll have enough ammo in its war chest to fend it off. However, even a modest rise in interest rates could be the thing that triggers a recession. It’s a catch-22.

Of course, the Fed can only control shorter-term interest rates with its normal operations. There are many determinants of longer-term interest rates, but growth and inflation expectations are probably the most important.

Right now, the euphoric markets think both will be instantaneous with Trump’s inauguration. Until we see something more tangible, cautious optimism is probably the more appropriate stance for investors to take on Trumponomics.

A Few Concluding Portfolio Thoughts

If you’re holding long bonds, your portfolio has already experienced a lot of pain since the election. Now that the December Fed hike is out of the way, I wouldn’t be surprised to see interest rates pull back from here. It’s probably a good idea to use any pullback to reduce your exposure to long rates as we wait to see what Trump can actually do.

If Trump can quickly push through his economic agenda and cooler heads prevail on the trade front, then the path of least resistance will be higher for interest rates.

In this optimistic view, strong economic growth could overcome the headwinds from the debt overhang. The Fed would still probably err on the side of caution. Allowing inflation to run ahead of 2% would help relinquish some of the national debt burden.

However, it’s more likely that Trump’s agenda faces pushback from both sides of the aisle. If the last eight years have taught us anything, it’s that there are many creative ways to hold up action in DC. That’s not always a bad thing as government meddling is usually counterproductive. But I have a sneaking suspicion that we haven’t heard the word “filibuster” for the last time.

In that case, the stock market rally and the bond market rout have both probably overshot.

Of course, no one can predict how this will play out. The best we can do is wait and see. Having ample cash on the sidelines may be the best strategy.

Trends in interest rates tend to stay in motion for years if not decades, so there will be enough time to switch if a new secular bear market in interest rates emerges in earnest.

(No investment strategy is bulletproof, but you can tilt the odds in your favor by focusing your attention on buying great companies when they fall to a level of deep undervaluation. How to do just that is explained in some detail in our free report, Dimes for Dollars—The 3 Most Powerful Strategies to Buy Low and Sell High. Click here to get your free copy now.)

Here Come the Clowns

Next Time, Try Handing the Terrorist a Participation Medal. The modern-day separationist movements continue trying to outdo themselves in the Olympics of inanity… or maybe even insanity. In the latest attempt at the gold, the Ohio State University Coalition for Black Separation Liberation held a rally at which they read out a list of non-white men killed by the police.

Among the victims on the list was poor Abdul Razak Ali Artan, the jihadist who just a couple of weeks ago plowed his car into a group of students, then embarked on a stabbing spree, wounding 11 people.

Fortunately, or I guess “unfortunately” if you belong to the aforementioned coalition, a fast-thinking university police officer committed the politically incorrect act of sending Abdul off to meet his 72 virgins.

All I can do when reading this sort of thing is shake my head and thank my lucky stars that my life path led me to a quaint pueblo in the Argentine outback where both terrorism and political correctness are nowhere to be found.

And with that, I will sign off until next week and resume preparing for the trip back to the frigid North for the holidays. Thank you for reading.

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.