Fed Raised Rates 0.25% – Rising Interest Rates Positive For Gold

Commodities / Gold and Silver 2016 Dec 15, 2016 - 12:47 PM GMTBy: GoldCore

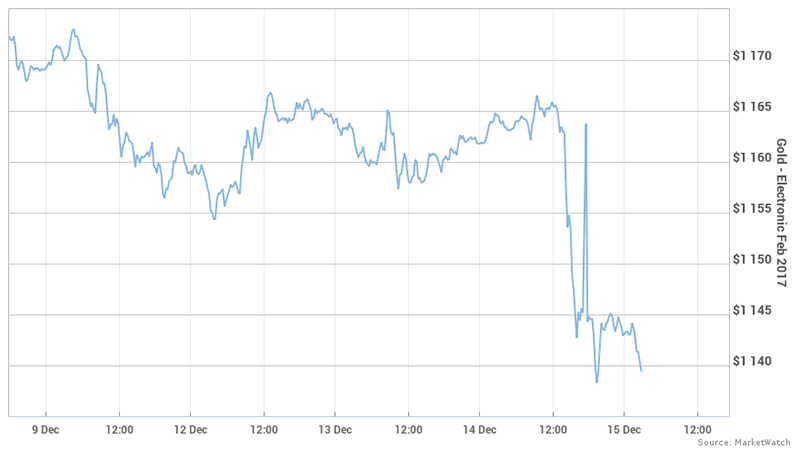

The Federal Reserve increased interest rates by 0.25% as expected yesterday leading to gold falling to lows last seen in February 2016 and the dollar rising to its highest level against the euro in 14 years.

The Federal Reserve increased interest rates by 0.25% as expected yesterday leading to gold falling to lows last seen in February 2016 and the dollar rising to its highest level against the euro in 14 years.

Gold actually settled higher at $1,163.70 for the day yesterday. However gold futures slid to $1,156.70 an ounce in electronic trading on the rate decision at 1400 EST and soon gold was pushed down 1.3% to 10 month lows after the decision in less liquid after hour markets.

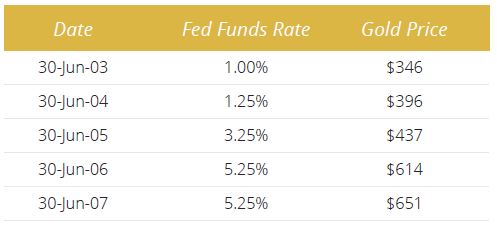

Source: New York Federal Reserve for Fed Funds Rate, LBMA.org.uk for Gold (PM fix)

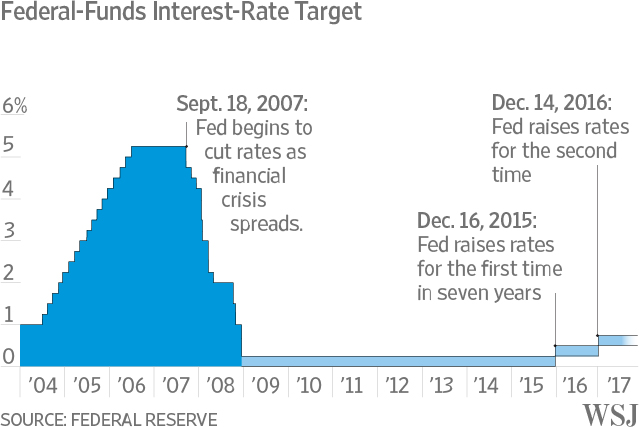

Yellen announced a 0.25% increase in the benchmark rate to 0.50-0.75% as the Fed raised interest rates for the first time in a year.

The Fed signalled more rate hikes in 2017 as expected and once again attempted to appear hawkish and suggested they would increase interest rates three times in 2017.

It is important to remember that they promised three rate hikes for 2016 this time last year. Only one rate hike materialised – yesterday’s rate hike. It is prudent to focus on what the Fed does rather than what it says.

The Fed has been promising higher interest rates most years since 2008 and yet there have only been two interest rate rises since 2008. Yesterday’s rate rise was only the second rate rise since the 2008 financial crisis. The Fed frequently adopts a hawkish tone which consistently fools many market participants who buy into it.

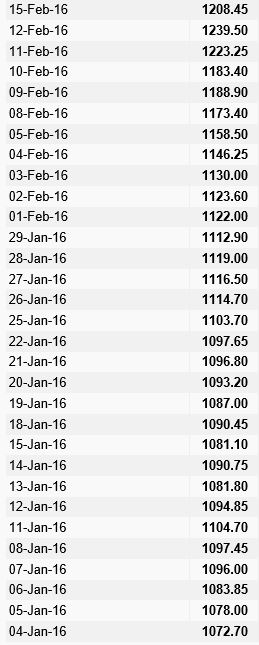

Similar price weakness and poor sentiment happened at the end of last year when gold had an intermediate bottom on the last day of 2015, December 31 at $1,062.25 per ounce (LBMA AM Fix). This was prior to very strong gains in January 2016 and in the first half of 2016.

Gold prices in January, February 2016 (LBMA.org.uk)

Sentiment today is very similar to that seen at the end of last year. Part of the bearishness was because the Fed promised 3 rate rises in 2016. They managed just one – yesterday’s rate rise.

As the great orator, ex-President George W Bush once attempted to say:

“Fool me once, shame on you; fool me twice, shame on me…”

From a long term investor, pension owner and physical buyers perspective, it is prudent to ignore the noise and focus on the fact that the Fed’s monetary policies, along with most central banks in the world, remains extremely accommodating.

The market perception and narrative is that a rise in rates, even by a marginal 75 basis points will be negative for gold in 2017. This may be true in the short term as perception, even misguided perception, can drive markets in the short term.

However, rising interest rates per se are not negative for gold. What is negative is positive real interest rates and yields above the rate of inflation. This is unlikely to be seen any time soon.

The data and the historical record shows that rising interest rates are actually positive for gold. The most recent example we have of rising interest rates is when the Fed increased interest rates in the 2003 to 2006 period (see table above and research note here). As can be seen in the table above, in June 2003, the Fed funds rate was at 1% and by June 2006, it had been increased to over 5.5%.

Even if the Fed increases rates, interest rates remain close to zero not just in the U.S but in most major economies. Thus, there is no opportunity cost to owning the non yielding gold. Indeed there remains significant counterparty and systemic risk in keeping one’s savings in a bank and government bonds look like a bubble that is being supported by money printing and debt monetisation.

This period of ultra-loose monetary policies needs to come to end as soon as possible as debt levels are surging globally creating the real risk of a new debt crisis in 2017.

Gold is looking shaky in the short term and the technicals and momentum is on the side of the bears. This could push gold lower into year end, back to test support at $1,100/oz.

Today, after a near 50% correction in recent years, gold again has significant potential for substantial capital gains in 2017 and during the Trump Presidency.

For investors looking to diversify and hedge the significant risks facing us in 2017, gold is again at a very attractive entry point.

Gold Prices (LBMA AM)

15 Dec: USD 1,132.45, GBP 904.37 & EUR 1,080.70 per ounce

14 Dec: USD 1,160.95, GBP 917.38 & EUR 1,091.99 per ounce

13 Dec: USD 1,157.35, GBP 911.18 & EUR 1,090.80 per ounce

12 Dec: USD 1,154.40, GBP 916.82 & EUR 1,089.41 per ounce

09 Dec: USD 1,168.90, GBP 927.64 & EUR 1,100.75 per ounce

08 Dec: USD 1,174.75, GBP 925.47 & EUR 1,088.64 per ounce

07 Dec: USD 1,171.25, GBP 929.62 & EUR 1,092.19 per ounce

Silver Prices (LBMA)

15 Dec: USD 16.14, GBP 12.95 & EUR 15.51 per ounce

14 Dec: USD 17.11, GBP 13.52 & EUR 16.07 per ounce

13 Dec: USD 17.01, GBP 13.39 & EUR 16.04 per ounce

12 Dec: USD 16.86, GBP 13.34 & EUR 15.90 per ounce

09 Dec: USD 16.95, GBP 13.45 & EUR 16.03 per ounce

08 Dec: USD 17.13, GBP 13.50 & EUR 15.88 per ounce

07 Dec: USD 16.77, GBP 13.32 & EUR 15.64 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.