Take Advantage of Gold, Silver, Platinum and Palladium Different Seasonal Trends

Commodities / Gold and Silver 2016 Dec 14, 2016 - 03:15 PM GMTBy: Dimitri_Speck

Prices in financial and commodity markets are exhibiting seasonal trends. This applies to the precious metals gold, silver, platinum and palladium as well.

Prices in financial and commodity markets are exhibiting seasonal trends. This applies to the precious metals gold, silver, platinum and palladium as well.

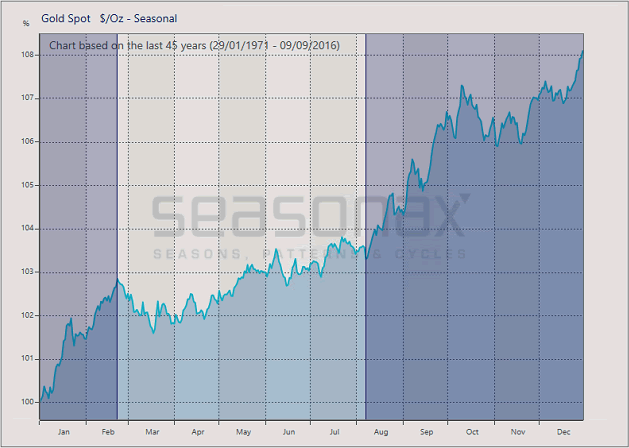

The chart below depicts the seasonal trends of the gold price over a time period of 45 years.

Gold price in USD, seasonal trend over 45 years

The price of gold typically rises from early August until the end of February

Source: Seasonax

Gold prices typically experience a seasonal rally in the second half of the year, with the advance beginning in early August and extending into late February of the following year. The positive seasonal trend in gold prices is highlighted in dark blue.

The gold price has increased until the end of February in 29 out of 45 cases

Gold prices have risen in 29 out of 45 cases during the seasonally strong period. In the 29 rally years, the average gain over this time period amounted to 17.85%, while the average loss in the 16 years exhibiting declines amounted to 8.17%. An especially large gain of 133,25% was recorded in 1979. The largest loss occurred in 1976, but amounted a much smaller 20.36%.

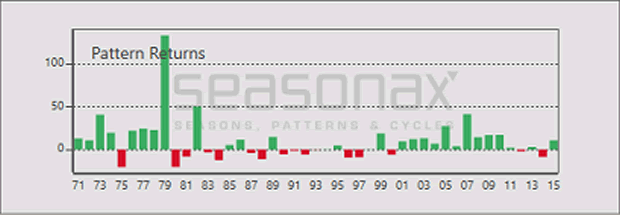

The bar chart below shows the gains and losses gold has posted during the seasonally strong time period in every year since 1971 (green bars represent gains, red bars losses):

Gold in USD, return in percentage points between August 7 and February 21 for every year since 1971

Gains (green bars) significantly exceed losses (red bars).

Source: Seasonax

Evidently, gains in gold prices are both more frequent and larger than losses during the seasonally strong period. However, between 1980 and the late 1990s, no large returns were generated during this time period, as gold was mired in a large-scale bear market.

Festivities are driving the gold price

The main reason for the positive seasonal gold price performance between early August to late February are various festivities, including Christmas, the Chinese new year celebrations and the Indian wedding season. Gold is frequently given as a gift on these occasions. Jewelry makers and merchants tend to stock up on gold prior to the festivities, and tend to push up gold prices in the process. Around two thirds of annual mine production are used by the jewelry trade.

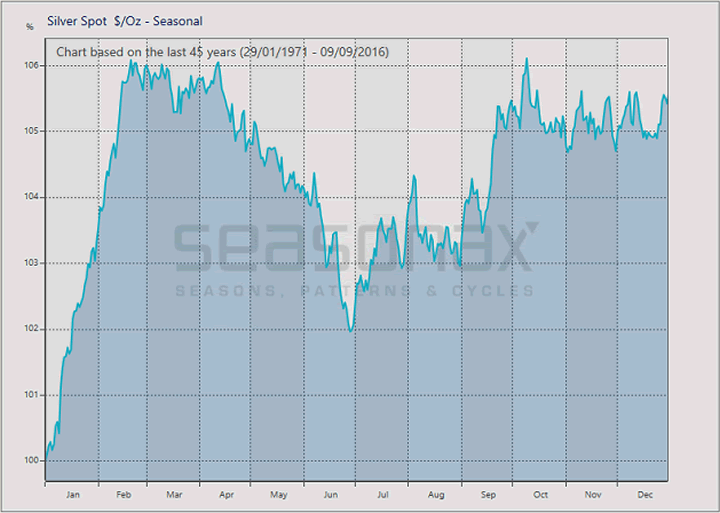

Silver: shooting star at the beginning of the year

Silver's industrial metal characteristics are far more pronounced than those of gold. The next chart illustrates the seasonal trend of the silver price.

Silver price in USD, seasonal trend over 45 years

Silver tends to exhibit a rapid seasonal rally at the beginning of the year

Source: Seasonax

As you can see, the seasonal price trend of silver is completely different from that of gold. Silver typically rises rapidly at the beginning of the year. It has done so in 30 out of the past 46 years. Gains of up to 47.35% were posted - in a mere 26 trading days from the beginning of the year until February 19.

Industrial metals are subject to seasonal trends of their own

Interestingly, platinum and palladium prices are also recording strong seasonal gains at the beginning of the year - instead of from August onward like gold. In other words, industrial demand is the dominant driver of their seasonal price trends. Very likely many industrial users tend to place their buy orders early in the new financial year.

While such calendar-driven business practices appear detrimental if one wants to obtain the best possible prices, annual planning and ordering procedures are often aligned with the financial year. Purchasers of precious metals may not be aware of the seasonal price trends, may be ignoring them because their in-house procedures are taking precedence.

Take advantage of the seasonal trends in precious metals!

As an investor or trader you can take advantage of the seasonal trends in precious metals in order to improve the timing of your purchases and sales and to manage the appropriate level of investment. Over time, this should result in obtaining more favorable prices. Keep in mind that seasonal price trends are averages and deviations are possible in some years. Nevertheless, seasonal trends can benefit you by making probability work in your favor.

Dimitri Speck,

© 2016 Copyright Dimitri Speck - All Rights Reserved - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.