SPX Premarket is Higher, But No Stock Market Breakout

Stock-Markets / Stock Markets 2016 Dec 09, 2016 - 02:05 PM GMT Good Morning!

Good Morning!

The SPX Premarket has held steady all night. It is currently challenging the 2-hour Cycle Top at 2247.18, but no breakout has occurred.

ZeroHedge reports, “European and Asian shares rose again and S&P futures were little changed, as world stocks were set for a weekly gain and held near 16-month highs on Friday, while the euro steadied after swings following the European Central Bank’s decision to extend its stimulus program. Oil rose a second day before a meeting between OPEC and other major producers on output cuts, industrial metals gain.”

SPX conformation with Elliott Wave guidelines does not mean it cannot go higher. However, be aware that guidelines have been met and it may just be a matter of time, if the reversal hasn’t already happened.

Meanwhile, VIX futures appear to be ramping up for another positive day.

Schaeffer’s Investment Research comments on the VIX, “Record highs for the S&P 500 Index (SPX) have grown almost commonplace since the presidential election, and today is no exception. However, what is unusual is that while the SPX is flirting with all-time highs, the CBOE Volatility Index (VIX) -- or the "fear gauge," as some call it -- is also set to close notably higher. According to data from Schaeffer's Senior Quantitative Analyst Rocky White and Quantitative Analyst Chris Prybal, this could set off a bearish signal seen just twice since 1999.”

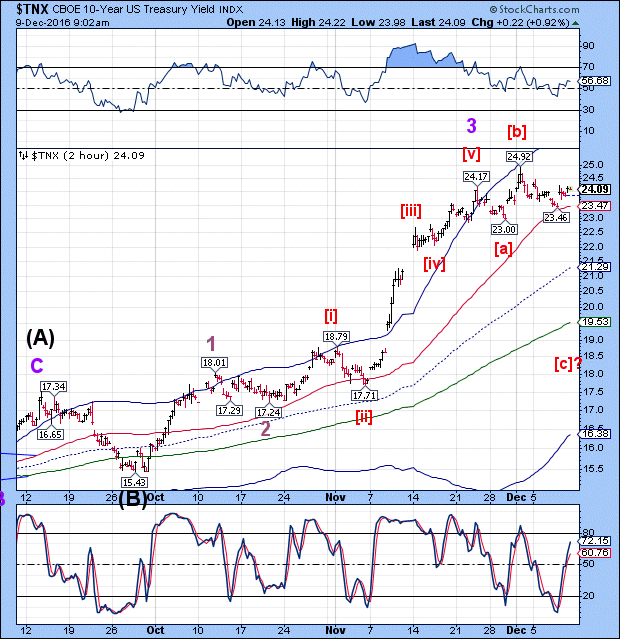

TNX is higher, but not above yesterday’s high. I would expect to see TNX decline as the stock reversal becomes apparent.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.