Trump Could Fuel A Nuclear Energy Boom In 2017

Commodities / Uranium Dec 08, 2016 - 04:43 PM GMTBy: OilPrice_Com

With Trump at the helm, sentiment gives way to practicality in the energy industry. For the vast untapped potential of the nuclear energy industry and the uranium that feeds it, this could contribute to a market-disrupting revival that no longer bows to fear and the politics of economy.

With Trump at the helm, sentiment gives way to practicality in the energy industry. For the vast untapped potential of the nuclear energy industry and the uranium that feeds it, this could contribute to a market-disrupting revival that no longer bows to fear and the politics of economy.

While there have been some oversupply issues keeping uranium prices down, the bigger problem has been negative sentiment rather than real fundamentals, but the Trump presidency will see through that.

Trump’s take on nuclear energy is quite simple. As he noted after the 2011 Fukushima disaster in Japan: “If a plane goes down, people keep flying. If you get into an auto crash, people keep driving.”

Now more than ever, demand for uranium appears to be assured. But more than that, it’s about to truly explode as a number of situations combine to form the new era of nuclear power.

“If you are going to acquire uranium assets, now is the right time,” IsoEnergy Ltd. CEO and President Craig Parry told Oilprice.com. “If it’s not the bottom yet, you can certainly see it. And on that front we see the market at the early stage of what will become a roaring bull market.”

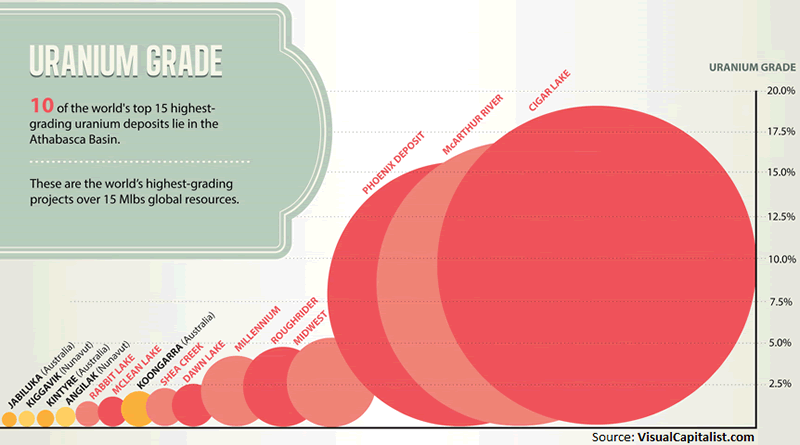

Parry might be onto something, and IsoEnergy is indeed in high acquisition mode, targeting the discovery and development of high-grade uranium deposits in and around the Athabasca Basin in Saskatchewan—home to some of the world’s biggest high-grade deposits.

Getting Ready for Uranium to Become an Irresistibly Hot Commodity

While Trump might inject a major boost of energy into the U.S. nuclear industry and the uranium market through deregulation, there are other factors coalescing around the world to make this a stellar new beginning for uranium and nuclear energy.

We’re already seeing the biggest uranium producers stocks reacting, including Cameco Corporation (NYSE:CCJ), AREVA (EPA:AREVA), BHP Billiton (NYSE:BHP), and Uranium One (TSE:UUU). Canadian Cameco’s stock was up 25 percent in November, and while the spot prices are low and set to rise, Parry points out that spot prices are all but irrelevant in this market, as almost all uranium is sold at long-term contract prices, which are presently coming in upwards of US$40 per pound, significantly higher than the current spot prices.

The outlook for uranium looks even more bullish when you consider that these contracts are now coming to a close, and uranium is poised to become a very hot commodity once again. Major American and European nuclear reactors are coming off supply in 2017 and 2018, and will be looking for long-term contracts once again.

The biggest uranium producer in the world, Canadian Cameco, said earlier this month that some 500 million pounds of uranium will be needed for nuclear reactors in the next ten years, and it hasn’t been contracted out yet. Buyers of this uranium will have to hit the market sooner rather than later.

Analysts at Cantor Fitzgerald recently predicted that there would be a “violent increase” in uranium prices at some point, theorizing that as much as 80 percent of the uranium market might be uncovered in terms of supply by 2025, and that demand would by then outstrip supply.

“The low-price environment has choked off exploration activity for uranium and we are at the point where there are not enough uranium projects in the pipeline that can adequately meet the coming demand,” the London Telegraph quoted Cantor as saying.

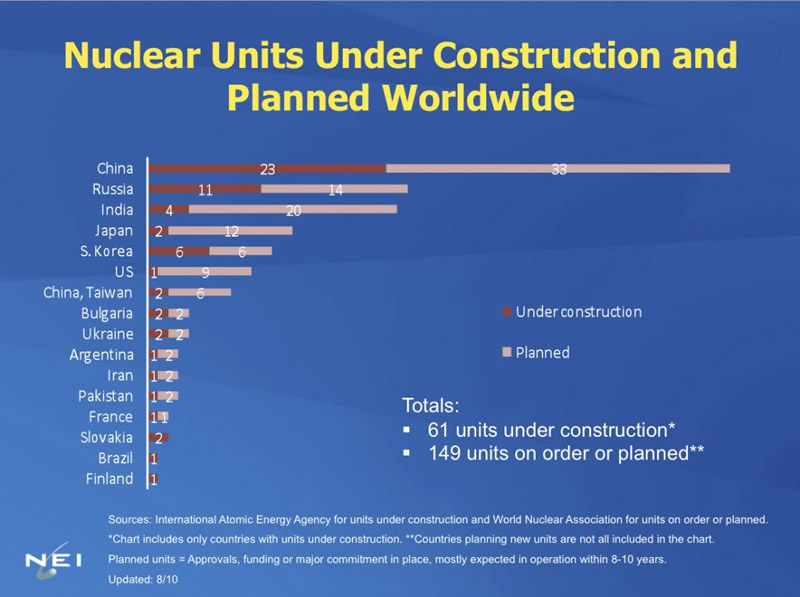

All of this coincides with a phenomenal number of new nuclear reactors being built, which will also enter the market at the same time.

The end result? We’re looking at the biggest deficit ever in the uranium market by 2018.

So we have over 20 Chinese nuclear reactors already under construction, plans from India to significantly increase its nuclear demand, and plans to restart over 20 Japanese reactors. These three things are major demand drivers that will wake the sleeping giant that is uranium.

And as demand soars, North America is sure to play a key role in the future of uranium supply.

In North America—and even from a global standpoint—there is no better place to explore for uranium than Saskatchewan’s Athabasca Basin, which is to uranium what Saudi Arabia is to oil.

Two of the largest producing uranium mines in the world—McArthur River and Cigar Lake--are in the Athabasca Basin. In and around this area, where Canada’s Cameco is the key player, junior IsoEnergy is focusing on new exploration and development at Thorburn Lake, Radio, North Thorburn and Madison.

Now that Trump is president-elect, the speculation is that Trump will make good on promises to reform the licensing and permitting processes for nuclear power plants. What this means is that we could be sitting right on the edge of a revolution in next generation nuclear technology.

This means a major push for next-generation nuclear projects such as PRISM, the brainchild of General Electric and Hitachi.

So not only does demand for uranium across the next two decades seem assured, it is poised to paint an attractively tight supply picture in the coming decades.

As the New Year is ushered in, falsely negative sentiment on uranium is likely to be ushered out the door and the real fundamentals will become more visible.

The bottom line is this: While uranium prices have been on a very long and gradual decline for some 13 years, analysts agree that they’ve reached their bottom and the climb back up is poised to be a lot faster than the decline.

Trump is all about harnessing untapped potential, and as atomic energy advocates are quick to point out: Nothing has more untapped potential on multiple fronts than nuclear energy, and right now is the time to buy into quality assets while uranium is at a multi-year low but at the early stage of a bull market.

By James Stafford of Oilprice.com

© 2016 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.