Gold Relief Rally Coming and in Gold Stocks

Commodities / Gold and Silver 2016 Dec 05, 2016 - 12:35 PM GMTBy: Jordan_Roy_Byrne

Last week we wrote that Gold was broken but noted the oversold condition in the precious metals sector as well as the relative strength in the gold stocks. At one moment last week, the gold stocks were trading above where they were in mid-November when Gold was trading some $60/oz higher. In other words, Gold plummeted $60/oz and made a new low yet the gold stocks did not. It took a bit longer than we expected but Gold and gold mining stocks may have started their rebound at the end of last week.

Last week we wrote that Gold was broken but noted the oversold condition in the precious metals sector as well as the relative strength in the gold stocks. At one moment last week, the gold stocks were trading above where they were in mid-November when Gold was trading some $60/oz higher. In other words, Gold plummeted $60/oz and made a new low yet the gold stocks did not. It took a bit longer than we expected but Gold and gold mining stocks may have started their rebound at the end of last week.

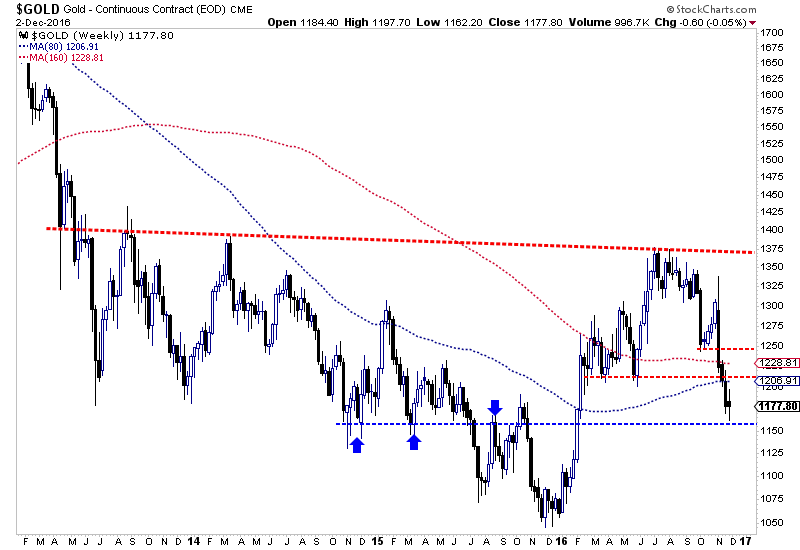

Gold formed a bit of a bullish hammer last week as it managed to close the week well off its low of $1162/oz. Note that Gold managed to rebound from support around $1155-$1160/oz, which is the strongest support between $1080 to $1180/oz. Gold was already oversold when it broke below $1200/oz. The likelihood of a rebound was increasing after Gold lost $1180/oz. Going forward, the rebound targets are $1210/oz, $1230/oz and $1250/oz. We think Gold will test its 40-month moving average at $1230/oz.

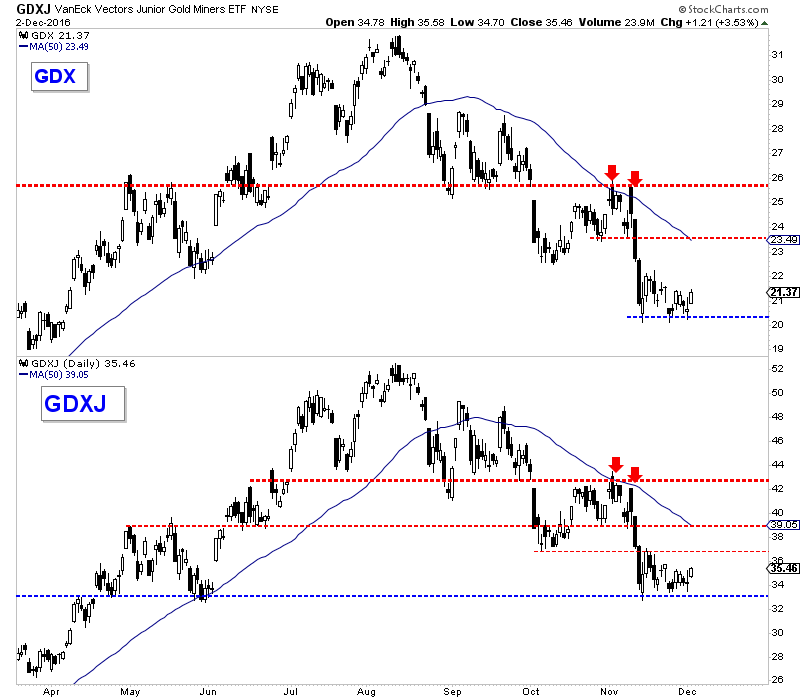

As we noted, the gold stocks have held up very well in recent weeks considering Gold’s continued decline. Most of the recent daily candles signal accumulation and Friday’s gain could be the start of a sustained rebound. The strongest confluence of resistance is at GDX $23.50 and GDXJ $39. These are the conservative, realistic targets. There is also a chance miners could rally a bit farther towards very strong resistance near GDX $26 and GDXJ $42.50.

The short and medium term outlook for the precious metals sector is clear. Traders and investors could use the coming strength to de-risk their portfolios and raise cash for a better buying opportunity at the end of winter. Generally speaking, we do not want to think about buying investment positions until we see sub $1080 Gold and an extreme oversold condition coupled with bearish sentiment. The gold stocks have held up very well in recent weeks and we are curious to see if they can continue to outperform Gold beyond the short term. That could affect our medium term outlook.

For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.