Gold and Silver in Review

Commodities / Gold and Silver 2016 Dec 01, 2016 - 12:52 PM GMTBy: The_Gold_Report

Gecko Research reviews the past week in gold and charts their actions.

Gold lost 1.9% or $23 last week to close on Friday at $1,184.10. Silver was, believe it or not, almost flat for the week as it closed at $16.51, down only 4c. The gold to silver ratio was 71.7 at the end of the week.

Total GLD gold holdings

Pas Week: Tonnes 885.04 Previous week: Tonnes 915.29 (source)

We will start to report weekly changes in the GLD holdings as it's a great indicator, and we stress the word indicate, as to where the trend for gold is likely heading. This week's loss comes to 30 tonnes, quite the outflow. That fits in well with our own feeling this week, we didn't at all like the performance in gold and had decided already on Monday/Tuesday that we would lower our exposure for the time being.

We cut our overall exposure by immediately getting rid of half our holdings in Endeavour Mining Corp. (EDV:TSX; EVR:ASX), McEwen Mining Inc. (MUX:TSX; MUX:NYSE ), Silver Wheaton Corp. (SLW:TSX; SLW:NYSE) and Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE). That's the beauty of holding big and liquid names as well, it's so easy to raise cash in an instant. We did sell a tiny bit of Golden Arrow Resources Corp. (GRG:TSX.V; GAC:FSE; GARWF:OTCQB). The GRG we sold were just a smaller trading position we had picked up on Nov 11t; our core position is still intact. In fact, if precious metals will see $1,100 or lower, we expect to pick up a lot of shares cheaper in several names, including Golden Arrow. We love the Golden Arrow story and we are just a few months away from finding out what the deal on Chinchillas will look like.

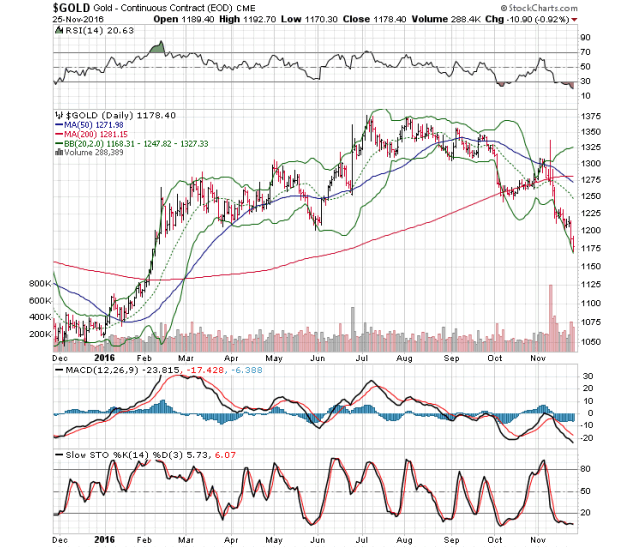

Going back to the subject of not liking what we see in terms of gold's action and performance. The fact is that there has been plenty of damage made in the charts and unfortunately, plenty of damage means plenty of time to repair. It's way too early to say, but there's also a chance that this bull is over. That is not our view, we're simply saying it's a possibility and we have to weigh in all conceivable outcomes.

What we think is more likely to happen is that Fed will hike rates in December which will lead to a stronger US$ and a continued weak gold market. Our first "target" for gold is $1,100 and thereafter $1,075-1,080. We could have a small bounce here up to $1,225 or so but that is no more than an opportunity to raise some cash in our mind.

Although Fed might raise rates further, they can only do so much. There are plenty of signs that inflation expectations are growing, not only in the U.S. but elsewhere as well. With higher inflation, we are likely to remain in a negative real interest rate environment which is where gold thrives. How long gold's "grinding and repairing" will last is anyone's guess, but we would say at least 2-3 months, likely longer. That doesn't mean that the market will be completely dead, the opposite is actually true.

Fortunes are made by contrarian investors and to have the guts and conviction to go against the heard has proved to be a great game-plan in the past. Not only will we now be prepared for adding in our favorite stocks when the opportunity presents itself, we will also be able to introduce new ideas in a better environment. We hate to chase stocks in a strong market, better to buy when no one else dares to.

Gecko Research is composed of a small group of private investors whose aim is to broadly share knowledge and investment ideas. Its research is independent and is based on its view of the company or sector based on publicly available information.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Gecko Research and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article.

2) Gecko Research ("the Author") is not a registered financial advisor and investors should seek professional advice before making any investment decision. Our research is independent and is based on our view of the company or sector based on publicly available information. Factual errors might still occur, and it is every reader's obligation to do their own research and not to solely rely on information given by the Author. The article/newsletter is our view about the stock and do not constitute advice to buy or sell shares in the companies we discuss or any other company. The Author's mission is to provide transparent viewpoints on companies we believe provide good investment opportunities. Gecko Research is almost always invested in the companies we write about and thus one can assume that there is some bias within our investment ideas. Although we see ourselves as long term investors, we might buy and/or sell the stocks we write about at any time. In no event shall the Author be liable to any person for any decision made or action taken in reliance upon the information provided herein. In other words, make your own decisions and proceed at your own risk. Investing in junior companies is associated with very high risk as well as extreme volatility. For those of you who cannot deal with that kind of environment, we think you should perhaps look elsewhere for investment ideas. As Gecko Research might occasionally be reimbursed for costs while visiting project sites or arranging investor presentations, Gecko Research does not get reimbursed for the articles we write.

3) Golden Arrow Resources Corp. and Silver Wheaton Corp. are sponsors of Streetwise Reports. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.