Trump Negotiating NAFTA's Future, Mexico Economic Uncertainty

Politics / US Politics Nov 21, 2016 - 03:13 PM GMTBy: STRATFOR

In Mexico, uncertainty abounds over U.S. President-elect Donald Trump and, in particular, his promises to change NAFTA. Although the next president will have the power to unilaterally pull out of the trade bloc, as he has threatened to do, congressional opposition and legal challenges from private companies may discourage him from doing so. Aside from the political and legal battles that would doubtless ensue, withdrawing from the North American Free Trade Agreement would be economically painful, disrupting business continuity for companies around the world — including those in the United States. Still, Trump has a few options with regard to NAFTA. Instead of suddenly withdrawing from the deal, he could try to renegotiate certain aspects of it. He may even decide to leave NAFTA alone (although that seems unlikely given the emphasis he placed on the agreement during his campaign). Regardless of which path he takes, Trump will not be acting in a vacuum. His decision will likely depend on the cooperation of the U.S. Congress and of the trade agreement's other signatories, Canada and Mexico.

In Mexico, uncertainty abounds over U.S. President-elect Donald Trump and, in particular, his promises to change NAFTA. Although the next president will have the power to unilaterally pull out of the trade bloc, as he has threatened to do, congressional opposition and legal challenges from private companies may discourage him from doing so. Aside from the political and legal battles that would doubtless ensue, withdrawing from the North American Free Trade Agreement would be economically painful, disrupting business continuity for companies around the world — including those in the United States. Still, Trump has a few options with regard to NAFTA. Instead of suddenly withdrawing from the deal, he could try to renegotiate certain aspects of it. He may even decide to leave NAFTA alone (although that seems unlikely given the emphasis he placed on the agreement during his campaign). Regardless of which path he takes, Trump will not be acting in a vacuum. His decision will likely depend on the cooperation of the U.S. Congress and of the trade agreement's other signatories, Canada and Mexico.

Analysis

On the campaign trail, Trump made NAFTA a central focus of his platform, frequently vowing to renegotiate or pull out of the deal for the United States' benefit. Despite the repercussions that would entail, his threat of withdrawal was not necessarily an empty one. As president, Trump will have wide-ranging powers over U.S. foreign policy. NAFTA's terms, moreover, allow for a country to unilaterally withdraw from the treaty. Nevertheless, withdrawing would be easier said than done. The U.S. and Mexican economies have become so integrated that the tariffs imposed in the wake of a withdrawal would probably raise prices for consumers in both countries and reduce cross-border trade.

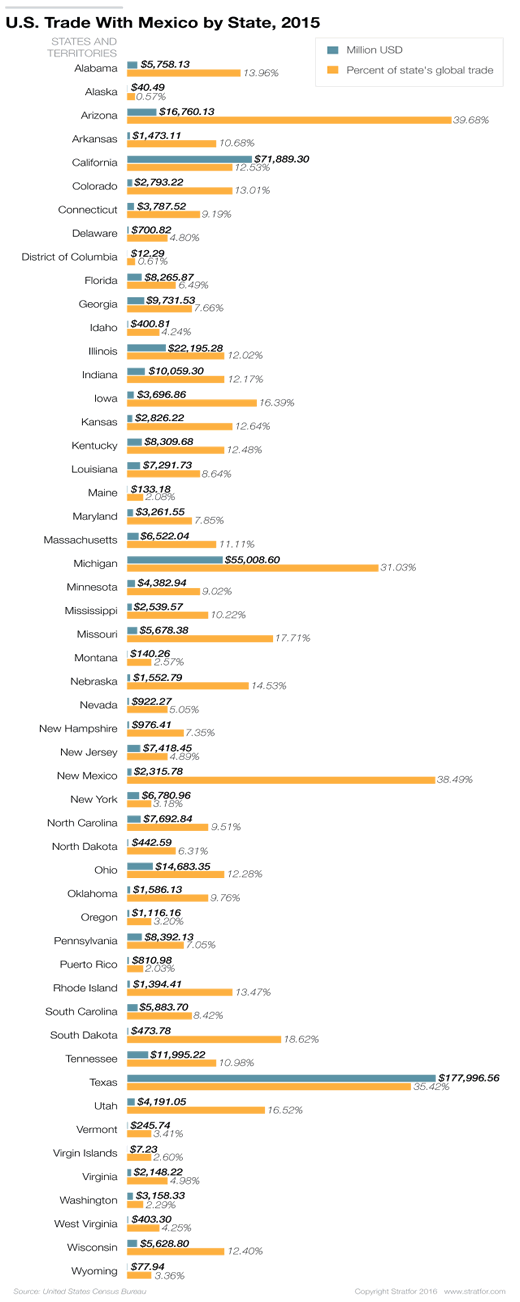

Declining trade would have dire effects on U.S. states such as Texas and Arizona that do considerable business with Mexico — and, by extension, on their representatives in Congress (most of whom are members of Trump's Republican Party). The sheer level of business disruption that a hasty unilateral withdrawal would cause in those states may deter lawmakers from backing such an initiative and could alienate their support on future policy proposals, as well. This is something Trump will likely take into account as he crafts his trade policy toward Mexico.

A Less Disruptive Way

At the same time, Trump has his support base to consider. The president-elect's victory relied heavily on voters in states that have lost the manufacturing jobs that once underpinned their prosperity, such as Ohio, Michigan, Wisconsin and Pennsylvania. If he hopes to maintain their support in the 2020 presidential election, Trump may have to make good on at least some aspect of his promise to overhaul NAFTA. To that end, his administration could opt for a partial renegotiation of NAFTA as a way to appease his supporters while minimizing business disruptions and congressional resistance. The new president could try to engage Mexico in a discussion aimed at amending or further enforcing NAFTA's regional value content stipulations, which dictate the amount of content from member countries that goods traded under the agreement must contain. If all parties agreed to raise the regional value content requirement on certain high-value products such as automobiles, the United States, as the bloc's largest manufacturer, could benefit in the long run. A renegotiation of this sort would also be less disruptive, sparing U.S. companies with operations in Mexico the sudden negative consequences that a withdrawal from NAFTA would bring.

Whether Mexico or Canada would accept those terms, however, depends on what the United States proposes to address in the renegotiations. Canada has already indicated that it is open to discussing NAFTA's terms again, and in the wake of Trump's election, Mexico appears hesitant to challenge the United States. Even so, there may be limits to their cooperation. If Mexico sees an increase in regional value content as a threat to its automobile industry — currently the country's main source of export revenue — Mexican politicians and businesses on both sides of the border would likely object.

From Washington to Mexico City

Along with the economic fallout, Trump's policy decisions on NAFTA and other thorny issues, including immigration reform and border security, could have a profound effect on politics in Mexico. As that country's 2018 elections approach, opposition candidates such as Morena's Andres Manuel Lopez Obrador could capitalize on public resentment toward the United States' policies. If negotiations over NAFTA or moves to tighten the U.S.-Mexico border coincide with Mexico's presidential and legislative campaigns, voters may eventually channel their dissatisfaction through their ballots.

Over the next year, Mexico, the United States and Canada will probably work together to come up with a mutually agreeable strategy for dealing with NAFTA. To a great extent, the solution they reach will depend on policies that are still taking shape. As the Trump administration crafts its stance toward NAFTA, Mexico and Canada will likewise define their positions. The most likely — and least disruptive — option for all parties involved is to meet in the middle at the negotiating table.

"Negotiating NAFTA's Future is republished with permission of Stratfor."

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2016 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.