Gold: What's Next?

Commodities / Gold and Silver 2016 Nov 16, 2016 - 03:47 PM GMTBy: Axel_Merk

After an initial surge in the hours after Donald Trump’s election, the price of gold has been under pressure. To gauge what’s ahead for the yellow metal, we dissect the forces that may be at play.

After an initial surge in the hours after Donald Trump’s election, the price of gold has been under pressure. To gauge what’s ahead for the yellow metal, we dissect the forces that may be at play.

We have argued in the past that for investors to consider any investment, including gold, in their portfolio, it needs to satisfy two conditions: it needs to exhibit low correlation to their existing investments; and there should be an expectation of a positive return. Let’s evaluate the changing investment landscape for gold in the context of the election:

Gold as a diversifier?

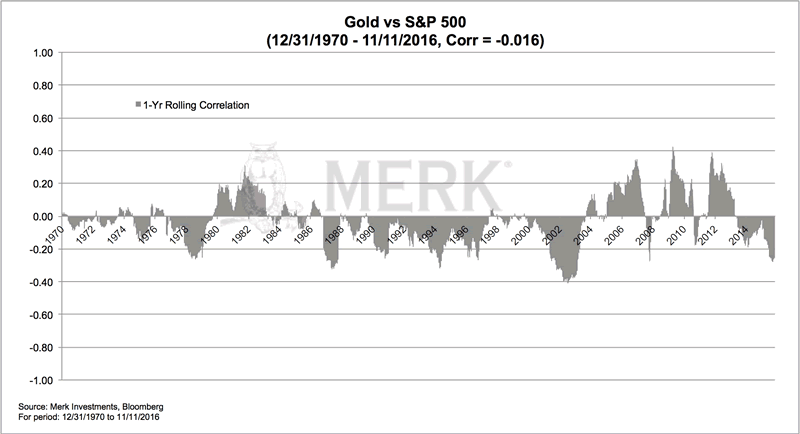

Since 1971, the price of gold has had a zero correlation to the S&P 500 index based on our analysis (-0.016 based on daily returns, to be precise). From that point of view, gold may be a long-term diversifier. That said, there are times when the correlation is positive; others when it is negative:

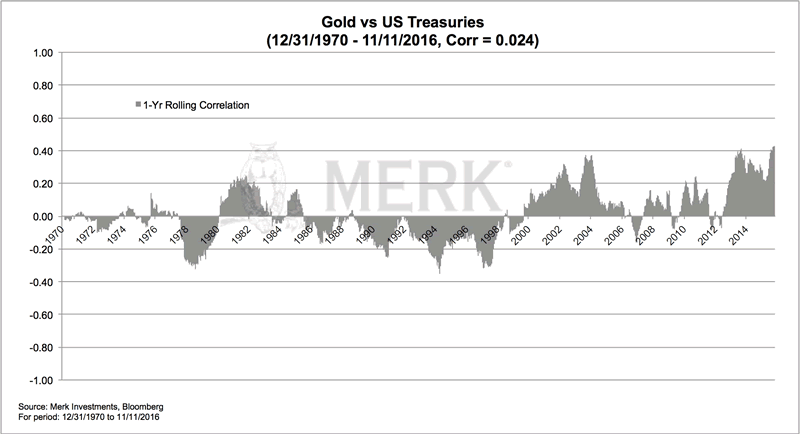

The traditional way to look at a portfolio is one that contains both equities and bonds. As such, let’s also look at the correlation of gold versus bonds: since 1971, that correlation is 0.024, i.e. also quite low. However, if you look at the chart below, you will see that the correlation to bonds has been at historical highs of late:

We will talk more about bonds below when we discuss fundamental drivers, but as far as whether the relatively high correlation to bonds of late will persist - if history is any guide, it may well fizzle out rather soon.

Differently said, when it comes to gold as a diversifier, we believe the long-term case is strong, but some investors may not appreciate it when correlations to equities or bonds flares up.

In the past, we have said gold may well be one of the ‘easiest’ diversifiers, meaning gold is easier to wrap one’s head around than, say, a long/short equity or currency strategy that, by design, may also have a near zero correlation to other asset classes. But that ‘easy’ diversification comes with a price: the low correlation isn’t stable, and there are times when correlation can be elevated.

Gold in a market downturn

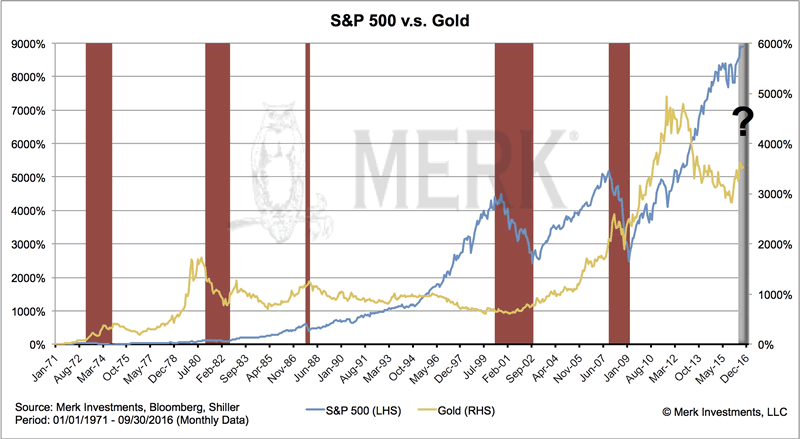

Staying on the theme of gold as a potential diversifier, the price of gold has had a positive return in each bear market in equities since 1971, with the notable exception of what I might call the Volcker-induced bear market when interest rates were rose substantially:

We will talk about interest rates in a second, but let me explain a fundamental reason why gold might have performed well in each of these bear markets: in an era where “risk premia” are compressed, i.e. where prices of risky assets - be that junk bonds or equity prices - are elevated, we believe those prices are vulnerable should risk premia rise once again. That is, if for whatever reason, the market is allowing risk once again to be priced more highly into assets, it could provide major headwinds to both stocks and bonds. As a result, gold, with its low correlation to risk assets, might shine in a bear market.

Gold to provide positive returns?

While investors may appreciate diversification, they may appreciate positive returns even more. We have had a notable selloff in bonds since the election; and, as one can see from above, the price of gold has, of late, been correlated to those of bonds. So what is going on?

We have often argued that the biggest competitor to gold is cash: if investors get properly compensated for holding cash, the case to hold gold, an unproductive asset, is reduced. A “proper” compensation for cash may be an acceptable real interest rate on cash.

Currently, real interest rates, i.e. interest rates net of inflation, are close to zero (let’s sidestep the discussion whether any particular metric of inflation fully reflects cost of living increases). The question then is to what extent will a Trump presidency change that. Two of the major themes that come to mind are infrastructure spending and less regulation:

- Infrastructure spending. We believe a) Trump will get at least some infrastructure spending done, and b) that it will be inflationary. Trump is a deal maker, so he may well promise some Senator their favorite bridge to nowhere if he will let him build his wall. This is a simplified way of saying that in Washington, it should be possible to spend money by making promises across the aisle, even if budget conscious Republicans object. In an environment where unemployment is already low, we believe this will induce wage inflation. Last time we checked, the government is usually not the most efficient in allocating resources, i.e. a fiscal spending program may foremost increase the deficit. Incidentally, we observe that currencies of countries where inflation ticks up often rise versus peers; while that may sound counter-intuitive, the reason is that investors assume central banks will counter inflationary pressures with higher interest rates. As such, if one believes the Fed will be “ahead of the curve”, i.e. hike interest rates before inflation picks up, that would be a negative for gold. If, however, investors believe that the Fed will fall further “behind the curve,” we believe there’s a good chance gold will do well, even as nominal rates move higher.

- Even if Congress doesn’t pass legislation a President Trump proposes, he should have substantial influence on how agencies are run, suggesting that he should be able to execute on his promise to reduce the regulatory burden on business. If history is any guide, the pendulum is unlikely to swing quite as much as hoped for (or feared - depending on where one stands on this debate); however, on the margin, this should be a positive for investments. One of the reasons the long-term bonds have yielded so little is because businesses have preferred to purchase financial assets (e.g., share buybacks) rather than invest in real business. As such, to the extent that the selloff in the bond market reflects that businesses would now rather invest in new ventures (rather than the prospect of higher inflation), we believe it is negative for the price of gold.

There’s also the proposed tax cut; we’ll have to see to what extent what is on the drawing board can be implemented, but any simplification of the tax code might also encourage investment.

We have not seen Trump propose any serious fix to what may be the soaring cost of entitlements. That is, even before additional fiscal spending proposed by President-elect Trump, deficits may balloon in a few years.

What we haven’t mentioned is the potential impact of a trade war. At this stage, the market appears to suggest that Trump might back off from his anti-trade rhetoric. The reason we think so is because we think the dollar is vulnerable in a trade war; that’s because we need foreigners to finance U.S. deficits; the U.K. is the latest example of a country that relies on financing from abroad to have seen its currency suffer when trade barriers have risen (a vote for “Brexit” suggests the introduction of trade barriers). The dollar might not decline versus the Mexican peso or other emerging market currencies, but it may well decline versus major currencies and gold.

So what will happen to the price of gold?

We expect to see a battle of the various forces discussed above. For now, the market may be pricing in stronger real growth through less regulation, with a Fed able to raise interest rates as the economy strengthens. In many ways, we have seen this movie before, with the market anticipating a rate hike due to improving fundamentals.

The problem is that we have such a leveraged economy, that higher bond yields and the anticipation of higher rates may well cause risk premia to rise, i.e. volatility in the market to increase, possibly toppling over equity prices. The associated volatility may cause ‘financial conditions to deteriorate’ as the Fed likes to put it, causing them to back off from any hawkish plans. That is, the anticipation of higher real rates may fizzle out yet again, providing support for the price of gold.

And aside from higher rates being a source of market volatility, it may well be that Trump policies themselves, such as the introduction of trade barriers, may cause volatility to rise and gold to benefit.

In short, if investors believe the future is bright, with businesses increasing investments and with the Fed’s magic wand doing wonders to keep inflationary pressures just right without causing too much of a stir, gold might not rise in value.

If however, investors believe that this tug of war between the different forces will ultimately get the Fed to be ‘behind the curve,’ i.e. inflationary pressures to increase; or if investors believe the stock market might experience another bear market, then gold may continue to be a worthy diversifier.

For those who believe that this will be a repeat of Reaganomics, we would like to caution that Reagan came into office when unemployment was much higher and with a most hawkish Federal Reserve Chair.

Finally, in addition to all of the above, the Fed continues to sit on a huge balance sheet; that balance sheet hasn’t been a problem with lackluster growth; but we see major challenges ahead for both stocks and bonds if indeed we get significant growth out of the Trump policies. We shall dive into these risks more in a future analysis.

We don’t have a crystal ball, but we believe in prudent risk management. As such, we encourage investors to assess the risks of certain scenarios unfolding. If we then add to that the fact that gold has a low correlation to bonds and equities, we believe investors may want to consider including gold in a prudent asset allocation.

Please register for our 2017 Outlook Webinar on Thursday, December 8, where we expand on the discussion, but also focus on portfolio construction in the context of the election. Also make sure you subscribe to our free Merk Insights, if you haven’t already done so, and follow me at twitter.com/AxelMerk. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.