Uncertainty about OPEC and US Election Leads to Oil Price Drop

Commodities / Crude Oil Nov 09, 2016 - 01:41 PM GMTBy: Jason_Hamlin

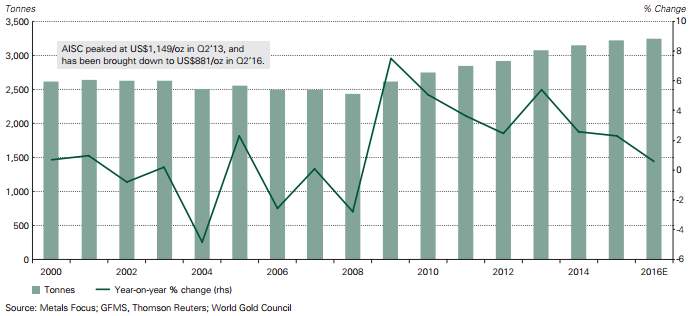

During the third quarter of 2016, global gold production dropped by 0.5%. Miners brought 846.8t onto the market versus 851.2t during Q3 of 2015. While this isn’t a huge decline, it marks the second consecutive quarter that gold production was down versus the previous year. The overall trend of plateauing output remains in place and has increased the odds that we are approaching, or have already reached, peak gold. The chart of annual mine production is shown below.

During the third quarter of 2016, global gold production dropped by 0.5%. Miners brought 846.8t onto the market versus 851.2t during Q3 of 2015. While this isn’t a huge decline, it marks the second consecutive quarter that gold production was down versus the previous year. The overall trend of plateauing output remains in place and has increased the odds that we are approaching, or have already reached, peak gold. The chart of annual mine production is shown below.

Also notice the sharp decline in the line from 2009 to this year. The strong growth trend from earlier years has fizzled out and trended towards zero.

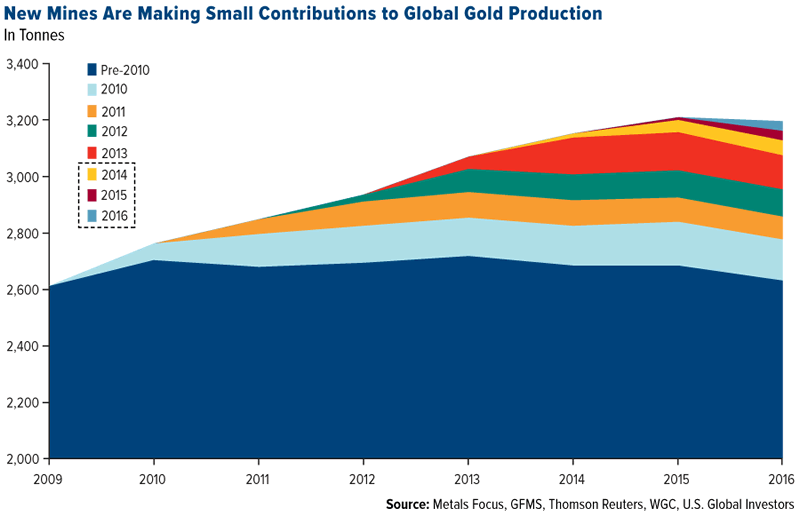

The flat production story is occurring due to operational changes by miners over the past few years. During the 4+ year correction, miners had to focus on cost reductions to remain solvent. Furthermore, they had to reign in exploration and focus on core assets. This will negatively impact gold production for years, as the project pipeline has been scaled back considerably and this will reduce the amount of gold that is being mined annually.

Total gold supply increased, but it was driven entirely by a big jump in recycled gold. The higher price encouraged consumers to sell some of their existing gold holdings. These high levels of recycling, driven by the big jump in gold prices this year, are not likely to be sustained going forward.

Has Peak Gold Arrived?

A few prominent analysts believe that peak gold hit in 2015. Peak gold suggests that total annual global gold production is likely to have peaked and will gradually drop into the future. Reduced gold production and total gold supply is a positive fundamental factor for the gold price going forward.

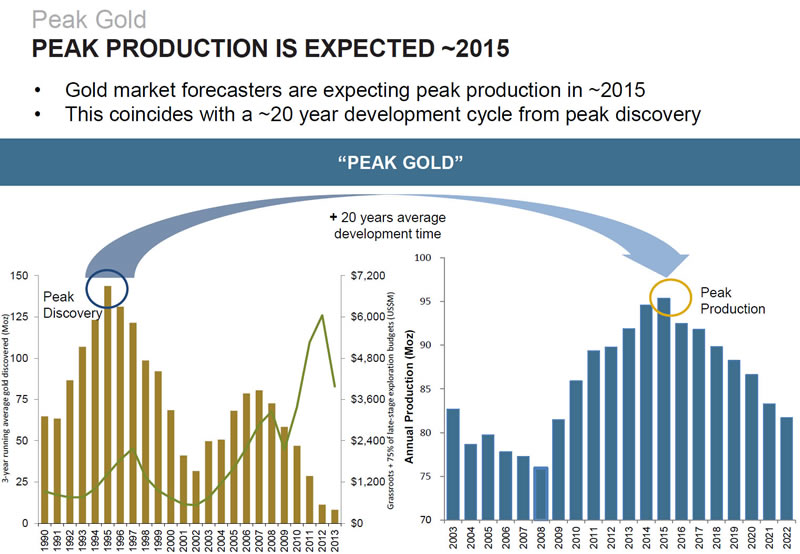

The following chart suggests that peak gold hit in 2015/2016, following peak discovery back in 1995. This gap coincides with the rough 20-year development cycle from peak discovery to peak production.

Another important factor is that the new discoveries are not as large or as high grade as they have been in the past. The result is that new mines are making a smaller contribution to global gold production and failing to replace the quantity or quality of previously discovered mines.

Goldcorp CEO Chuck Jeannes’ has predicted that peak gold is just around the corner.

“There are just not that many new mines being found and developed,” he told the Wall Street Journal in 2014, adding that this was “very positive” for the gold price going forward.

Mr. Jeannes is not alone in his assessment:

Nick Holland, chief executive of Gold Fields: “We were all talking about how production was going to increase every year. I think those days are probably gone … you are not going to see massive production increases in the industry.”

Vitaly Nesis, CEO of Polymetal: “I think supply will drop by 15 to 20 per cent over the next three to four years.”

Kevin Dushnisky, president of Barrick Gold: “Falling grades and production levels, a lack of new discoveries, and extended project development timelines are bullish for the medium and long-term gold price outlook.”

Mark Bristow, CEO of Rangold Resources: Peak gold production may be reached within the next three years as miners fail to replace their reserves. World’s gold output could peak as early as 2019.

Barrick Gold, the world’s biggest producer, had output of 1.3 million ounces in the second quarter, a drop of 7.5% versus year ago. AngloGold Ashanti, the third-largest miner of the metal, notched a 12% decline in gold production in the first half of 2016.

Gold’s value is partly driven by its rarity. Goldman Sachs estimates that we have only “20 years of known mineable reserves of gold.” Of course, unknown gold reserves will be discovered in time, but this helps in understanding just how little gold there is in the world.

To put these numbers into better perspective, all of the gold mined in 2016, melted down into bars, would roughly fit into 2-car garage. In fact, all the gold ever mined would fit snugly into an Olympic-size swimming pool or stacked just 5 stories high on an average residential house lot. Note that estimated of all the gold in the world vary, but we think the higher side estimates closer to 180,000 tonne are likely more accurate. Either way, it is much less than one would imagine, especially when melted down into a cube.

Total gold demand is on track for a 7% increase in 2016, while global mine production is trending essentially flat. Higher demand and flat or declining supply is a recipe for higher price. In the near term, total gold supply growth is matching demand growth thanks to a huge increase in gold recycling. But absent recycling, mine production alone would not be sufficient to cover new demand.

So, we can’t yet say for certain if peak gold has arrived. And even if it has, the price impact is likely to be muted as the large increase in gold recycling fills the gap. But over time, a flatlining of gold production coupled with increasing demand from central banks, investors and ETFs is likely to be supportive of higher gold prices.

Of course, this is just one of the many fundamental reasons that we believe the gold price is heading much higher in the coming years. If you would like to receive our full analysis of the gold market, price forecasts, timing alerts, stock picks, model portfolio, monthly contrarian newsletter and more, sign up for the Gold Stock Bull Premium Membership by clicking here.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2016 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.