A Falling Stock Market Cannot Be Allowed - Financial Repression Is Now “In-Play”!

Stock-Markets / Financial Markets 2016 Oct 17, 2016 - 05:36 PM GMTBy: Gordon_T_Long

A FALLING MARKET CANNOT BE ALLOWED – at any cost!

A FALLING MARKET CANNOT BE ALLOWED – at any cost!

The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment , excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for a major correction. A correction because of the high degree of market correlation that likely would be instantaneously contagious across all global financial markets.

Any correction more than 10% must be stopped. As a result of the level of instability, even a 10% corrective consolidation could get quickly out of control, so any correction becomes a major risk. What the central bankers are acutely aware of is:

- If Collateral Values were to fall with the excess financial leverage currently in place, it would create a domino effect of margin calls, counter-party risk and immediate withdrawals and flight to areas of perceived safety.

- The already massively underfunded pension sector (which is now beginning to experience the onslaught of baby boomers retiring) would see their remaining assets impaired. This could lead to social and political pressures that would be simply unmanageable for our policy leaders.

- A falling stock market is the surest way of alarming consumers and signalling that things are not as “OK” as the media mantra has continuously brain washed them into believing. In a 70% consumption economy, a worried consumer almost guarantees a further economic slowdown and a potential recession.

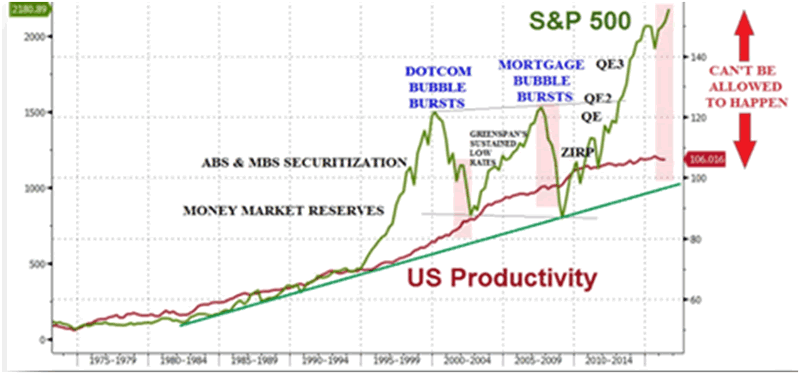

As our western society continues to consume more than it consumes, productivity is not increasing at the rate that justifies the developed nations standard of living as well as the current levels of equity markets. A possible corrective draw-down to the degree shown in this chart is simply “out of the question”! The central bankers acutely aware of this.

MARKETS TEMPORARILY HELD UP

The markets are presently, temporarily held up due primarily to three factors:

- Historic levels of Corporate Stock Buybacks,

- The chasing of dividend paying stocks for investment yield in a NIRP environment,

- Unusual Foreign Central Bank buying (example: SNB)

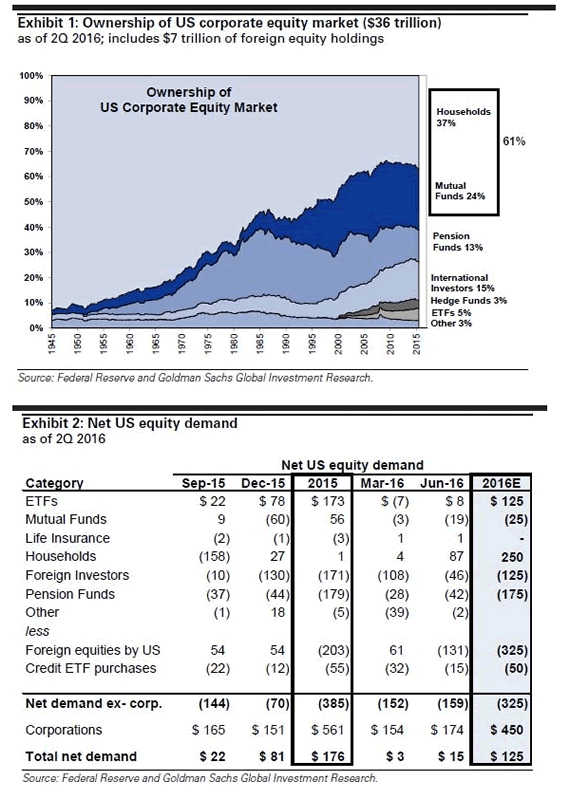

Professionals, institutions, hedge funds etc have been steadily lightening up on equity markets (or simply leaving completely) leaving the public holding the back.

It is estimated that the $325B that will leave the US equity markets in 2017 will be replaced by an artificial $450B of corporations buying their stocks. With corporate cash flows now falling and debt burdens triggering potential credit rating downgrades, this game is quickly slowing. The central bankers are aware of this.

TECHNICALS INDICATING AN END TO THE DEBT SUPPER CYCLE

The Market Technicians of all persuasions are almost unanimously calling for a major correction. What is most troubling here is that their indicators are not just short and intermediate term measures but critical long term indicators.

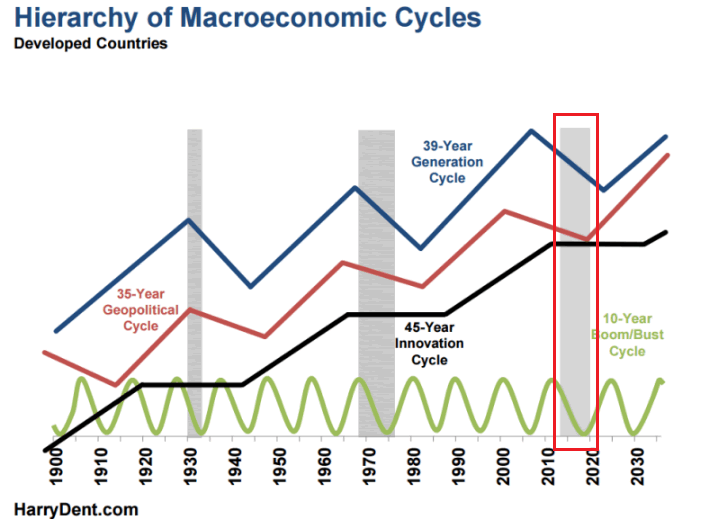

- KONDRATIEFF CYCLE: The 55 Year generational Kondratieff Cycle shows an overdue major downturn with a cleansing of debt as part of the end to what has been termed the “Debt Supper Cycle”,

- DEMOGRAPHIC CYCLES: Harry Dent has done some major work on Demographic Cycles and cycles overall. I interviewed him for the Financial Repression Authority where you can find the video and he lays out the seriousness of the shifting demographics and how it overlays of many different types of cycles he has studied.

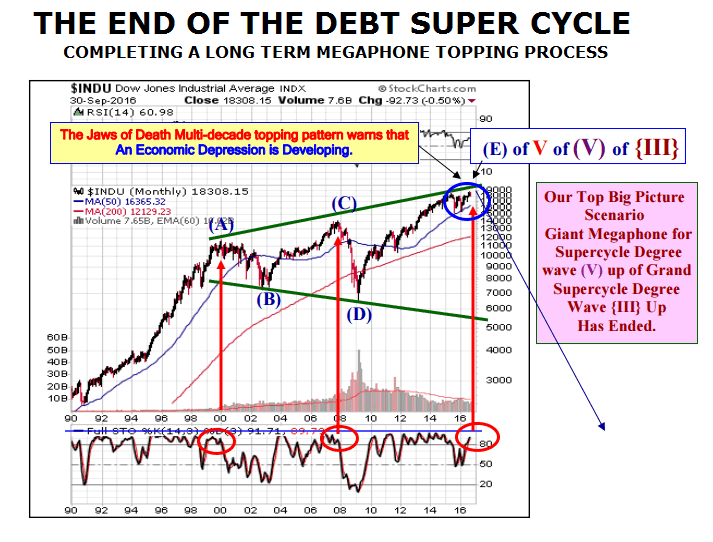

- ELLIOTT WAVE

The technicians who study Elliott Wave see clear evidence that we are now completing a multi-decade topping pattern in the form of a classic megaphone top.

Chart courtesy of Robert McHugh

The central bankers are aware of this.

- TECHNO-FUNDAMENTALS

I could keep on illustrating the types of warnings we are seeing, but let me share what the central bankers likely most concerned about regarding Correlation, Liquidity and Volatility ETPs.

The markets have become so correlated (think of this as everyone on the same side of the boat) with asset correlations not only being higher, but the correlations themselves are becoming more correlated. While traditionally rising cross-asset volatility has resulted in volatility spikes, that is no longer the case due to outright vol suppression by central banks. While central banks may have given the superficial impression of stability by pressuring volatility, they have also collapsed liquidity in the process, leading to less liquid markets, a surge in “gaps”, and “jerky moves” that are typical of penny stocks.

The greater the cross asset correlation, the lower the vol, the greater the repression, the more trading illiquidity and wider bid ask-spreads, and ultimately increased “gap risk”, which becomes a feedback loop of its own. Global central banks are now injecting a record $2.5 trillion in fungible liquidity every year – in the process further fragmenting and fracturing an illiquid market which is only fit for notoriously dangerous “penny stocks.”

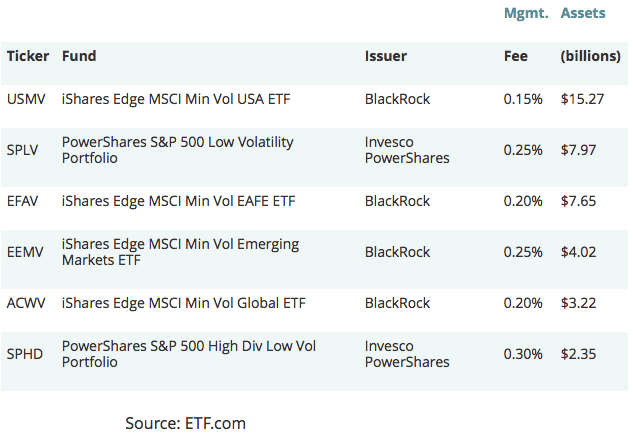

“More than $50 billion has poured into low-volatility indexed exchange-traded funds over the past five years or so, in the wake of the 2008-09 market meltdown. There are now 14 “lo-vol” ETFs with assets exceeding $100 million each, and many more with less. Whenever the market hits a pothole, these ETFs enjoy a bump-up in assets.”

Even more concerning are Volatility ETPs (Exchange Traded Products) which are derivative of some underlying asset. Volatility ETFs are particularly strange animals since you’re buying a derivative (ETF) on a derivative (the futures contract) which itself is based on a derivative (the implied volatility of options) and those options themselves of course are derivatives which themselves are based on the S&P 500. Getting the picture? The folks at Capital Exploits warn:

….everyone is on the low volatility side of the boat, because the central banks have managed to create a sense of calm in the markets exhibited by record lows in volatility and investor have used linear thinking extrapolated well into the future assuming ever greater risk ignoring market cycles and extremes at their peril.

Every time you sell volatility you get paid by the counter-party who is typically hedging the volatility (going long) of a particular position and paying you for the privilege. This is not unlike paying a home insurance premium where the insurer takes the ultimate risk of your house burning down and you pay them for the privilege. The difference however between selling volatility in order to protect against an underlying position and selling volatility in order to receive the yield created is enormous. And yet this is the game being played.

The central banks have managed to create a sense of calm in the markets exhibited by record lows in volatility and for their part Joe Sixpack investor has used linear thinking extrapolated well into the future assuming ever greater risk ignoring market cycles and extremes at their peril.

Again, none of this is going unnoticed by t increasingly worried central bankers.

THE NEXT FED POLICY SHIFT

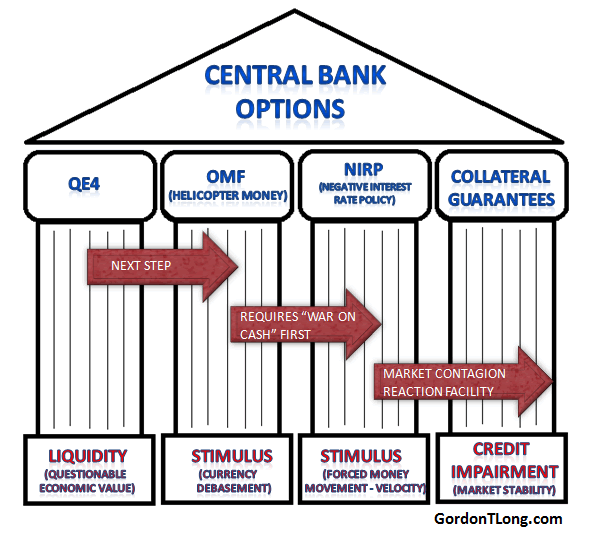

So what can the central bankers be expected to do? We laid out this road-map at the Financial Repression Authority well over a year ago. We anticipated in our macro-prudential research much of what has now become mainstream discussion:

- Helicopter Money (now openly discussed)

- Fiscal Infrastructure Stimulus (has become part of all candidates election platforms)

- Collateral Guarantees

- Buying Corporate Bonds – DONE (ECB, BOE)

- PLUS more on Collateral Guarantees

We now believe the Central Bankers and Federal Reserve specifically is preparing for more in the way of Collateral Guarantees.

We believe it will actually take the form of direct buying the US stock market similar to what the Bank of Japan is already doing with ETFs.

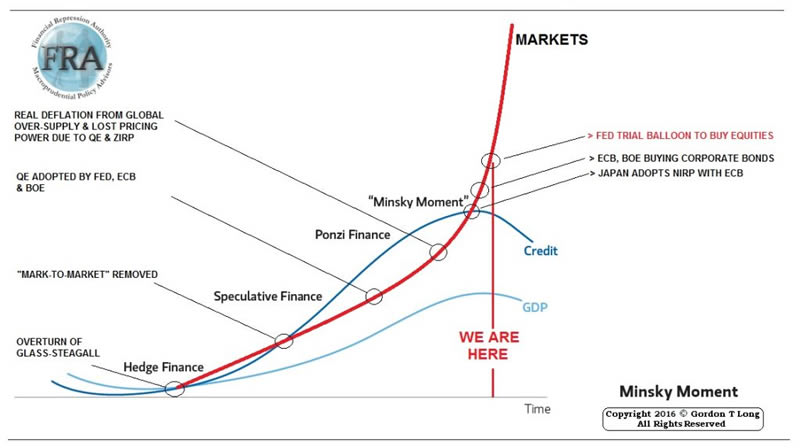

THE “MINSKY MELT-UP”

My long time Macro Analytics Co-Host, John Rubino concludes in his most recent writing “Flood Gates Begin to Open“:

Individual countries have in the past tried “temporarily higher rates of inflation,” and the result has always and everywhere been a kind of runaway train that either jumps the tracks or slams into some stationary object with ugly results. In other words, the higher consumption and investment that might initially be generated by rising inflation are more than offset by the greater instability that such a policy guarantees.

But never before has the whole world entered monetary panic mode at the same time, which implies that little about what’s coming can be said with certainty. It’s at least probable that a combination of massive deficit spending and effectively unlimited money creation will indeed generate “growth” of some kind. But it’s also probable that once started this process will spin quickly out of control, as everyone realizes that in a world where governments are actively generating inflation (that is, actively devaluing their currencies) it makes sense to borrow as much as possible and spend the proceeds on whatever real things are available, at whatever price. Whether the result is called a crack-up boom or runaway demand-pull inflation or some new term economists coin to shift the blame, it will be an epic mess.

And apparently it’s coming soon.

It is our considered opinion that the monetary policy setters are presently even more worried about the current global economic situation than we are – if that is possible?

This is evident because over the last 14 days Fed Chair Janet Yellen, former Treasury Secretary Lawrence Summers and JP Morgan have all been out talking openly and publicly about the possible consideration of policy changes that would allow the Federal Reserve to buy US equities. These releases must be seen as trial balloons to condition expectations.

Japan and Switzerland amongst others are already doing it (as we previously reported) , while the ECB is also floating its own trial balloon on the same subject.

If you want to know what could create a Minsky Melt-up, this is it!

Here is our latest Financial Repression Authority Macro Map illustrating what we see unfolding. We believe the dye has been cast!

The US Federal Reserve can soon be expected to get congressional approval for equity purchases.

Of course this will take a post election scare and a new congress to receive.

For more articles signup for GordonTLong.com releases of MATASII Research

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.