NIRP is the Fuel that Will Rocket Gold Price to $5,000 or Higher

Commodities / Gold and Silver 2016 Oct 04, 2016 - 05:09 PM GMTBy: Graham_Summers

For decades, the primary argument by Warren Buffett and other financial elites for not owning gold was that “gold doesn’t pay you anything.”

Once the ECB took interest rates to NIRP in 2014, this argument became null and void. In a world in which bonds are charging you to hold them, gold with its ZERO yield has become attractive as an investment.

Yes, we have reached the point at which NOT getting paid is considered an advantage for an investment.

One NIRP cut was bad enough, but the ECB has since engaged in three more. And the Bank of Japan got in on the action too in early 2016.

As a result, today, some $13+ TRILLION in bonds are posting NEGATIVE yields.

Globally the sovereign bond market is roughly $40T in size. This means that 1/3 of global sovereign bonds are posting NEGATIVE yields.

Put another way, Gold is now more attractive than 1/3 of the sovereign bond market from an income perspective.

And now we get to the worse news.

Any reduction in NIRP will only make this situation worse.

If the BoJ or ECB were to raise rates (thereby moving them to closer to positive) this would force bonds to fall and yields to rise.

This would potentially mark the end of the current bond bubble.

Investors have been piling into bonds to front-run Central Bank QE programs. This has spun finance on its head with investors now buying bonds for capital gains and stocks for income (dividends no matter how small, are better than being charged to hold bonds).

If Central Banks began tightening, the trend will reserve and all those front-running investors and momentum algos will start dumping bonds.

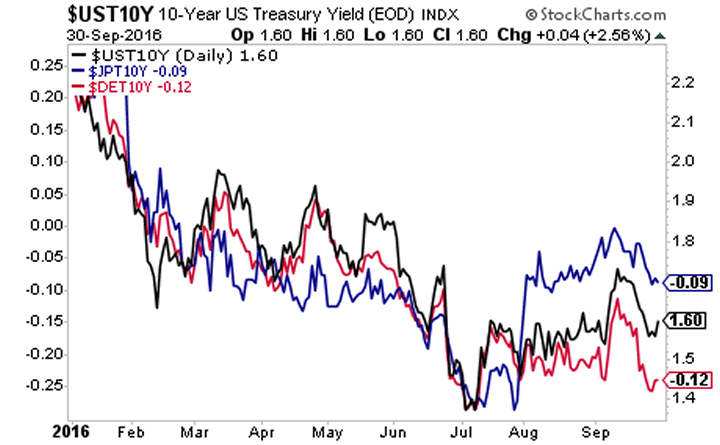

Looking at the surge in bond yields that began in August, one could potentially argue that the market is already anticipating this. Both the BoJ and the ECB have disappointed in terms of additional stimulus and have begun pushing for fiscal stimulus from Governments (a signal that more easing is not coming from CBs).

IF the market DOES believe this is happening, then bonds will be falling in price, pushing yields higher and Gold will go THROUGH THE ROOF.

A spike in yields signals the inflation genie is out of the bottle. Core CPI has already been above the Fed’s target for 10 months.

Again, NIRP has been a disaster as a monetary policy. And it has set the stage for the next leg up for Gold. Even if Central Banks reverse policy on NIRP and begin tightening, Gold will erupt higher.

We believe the next leg up is about to begin for Gold. Those who remember form the last Gold bull market in the ‘70s, it was the second leg of Gold’s bull market that saw the most gains.

From 1970 to 1974, Gold rose 550%. It then took two-year breather before beginning its second, much larger leg up. During that second leg, it rose over 900% in value.

If Gold were to stage a similar move now, it would rise to over $10,000 per ounce.

On that note, we just published a Special Investment Report concerning a secret back-door play on Gold that gives you access to 25 million ounces of Gold that the market is currently valuing at just $273 per ounce.

The report is titled The Gold Mountain: How to Buy Gold at $273 Per Ounce

We are giving away just 100 copies for FREE to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/goldmountain.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.