GOLD MARKET FLASH NOTE: Ending With a Bang, Not a Whimper

Commodities / Gold and Silver 2016 Sep 29, 2016 - 05:43 PM GMTBy: The_Gold_Report

Rudi Fronk and Jim Anthony, co-founders of Seabridge Gold, discuss how extreme monetary policy does not stimulate growth.

Rudi Fronk and Jim Anthony, co-founders of Seabridge Gold, discuss how extreme monetary policy does not stimulate growth.

As we have predicted for some time, central bankers are doubling down on the madness that has failed to achieve economic lift-off. It is no surprise to us that easy money has not stimulated growth. There was never any reason why it should. It reminds us of trying to force hay into the wrong end of an elephant.

Savings and investment should always lead consumption and not the other way around, as the central banks seem to believe. Investment should increase productivity and incomes, causing increased demand, higher inflation and tightening monetary conditions. This is not the way central banks see it. For them, everything goes in reverse. They think that cheaper money means more investment and more consumption which will stimulate investment. The central banks want more inflation because they think that will generate growth, rather than growth generating inflation.

We have now had nearly 30 years of Keynesian reverse logic and it is clear that it does not work. Investment is down; there has been essentially no recovery in capital spending since the Financial Crisis. Productivity has declined and is now negative. Incomes have stagnated and consumer spending has slowed. Cheap capital has gone into yield-chasing speculation, share buybacks and mergers. Low interest rates have destroyed savers, pension funds and bank profits while generating bond and equity bubbles.

In our opinion, there is no way back from the extreme monetary policies of QE, ZIRP and NIRP. Normalizing interest rates will destroy the bond and equity markets which need minuscule interest rates to retain their relative value. Reversing QE will remove the surplus dollars that have kept the system from imploding. The only option the central banks have left is more of the same until markets no longer co-operate.

Already, many investors understand that extreme monetary policy does not stimulate growth. However, most still think that central banks can banish downturns in asset prices and recessions and so they continue to be fully invested. The rising risks that accompany asset bubbles are discounted because monetary policy is still perceived as a magic risk-reducing potion rather than the very source of the extraordinary risks we now face. Markets are remarkably complacent while pressures build in the EU banking system, the Chinese economy and credit market and the pension system worldwide.

Last week, Japan took the next step along the road to complete madness and eventual collapse. Most commentators seemed to miss the significance of their shift in policy. Japan is no longer announcing specific asset-purchase targets in yen. The new approach is to target interest rates along the yield curve. Essentially, this means no limit to the amount of assets it can purchase in order to maintain its interest rate objectives.

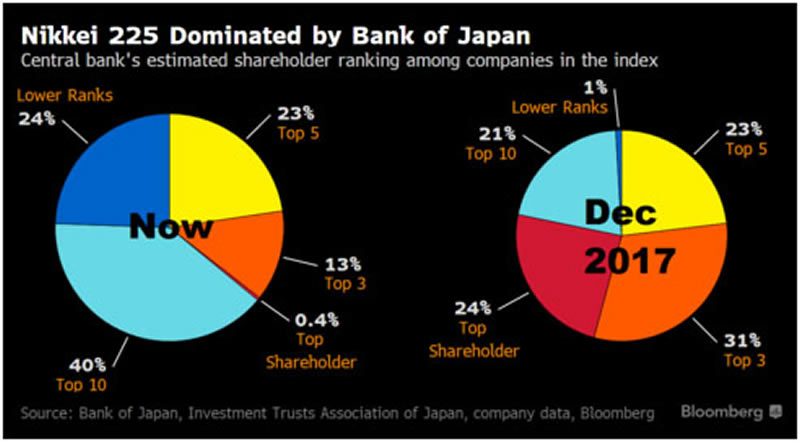

The Bank of Japan already owns nearly 40% of the entire Japanese treasury market and is a top-five owner of 81 of Japan's 225 largest companies. The BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg.

Soon the BOJ will have trouble finding enough assets to buy, just as the ECB appears set to run out of bonds to buy. According to analysis from Credit Agricole's Mehreen Khan, the ECB will have hoovered up an astonishing 50% of the entire universe of eligible government debt by the end of this year and more than two-thirds of the sovereign bond market that qualifies for purchase will be on the ECB's balance sheet by next September. What then? What happens when the market becomes dependent on one purchaser who has no profit motive and is running out of supply? The market ceases to be a market.

Japan is the testing ground for the next steps in monetary mania. Other central banks are watching. Fed governors have already expressed interest in NIRP and spoken favorably of its effectiveness in Europe. Do not imagine that only Japan is this crazy. None of the central banks can afford to go back to normal unless they are prepared to accept massive write-downs and defaults throughout the economy.

Perhaps you think that central bank policy can overcome market forces. Perhaps you are part of the complacent majority. Consider this. When the markets lost confidence after the equity bubble popped in 2000, no amount of aggressive Fed monetary accommodation could prevent a 50% decline. In 2008, once confidence was lost, no amount of Fed liquidity injections and rate reductions could save the stock and credit markets from complete dislocation. This time, the bubbles are bigger, they are global and the most extreme one is in credit, which is a far larger and more consequential market than shares. Central bank policy will not prop up markets once confidence is lost. In fact, this time around, the loss of confidence will extend to central banks themselves and the only sure place to hide in our opinion will be gold.

T.S. Eliot's famous poem, The Hollow Men, suggests that the world will end "not with a bang but a whimper." This, the largest financial bubble in history, is more likely to end with a bang.

This article is the collaboration of Rudi Fronk and Jim Anthony, co-founders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article.

2) Seabridge Gold is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Chart provided by the authors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.