Gold Price Has Now Entered Its Strongest Seasonal Period

Commodities / Gold and Silver 2016 Aug 12, 2016 - 05:41 PM GMTBy: Chris_Vermeulen

My analysis indicates that gold will be implemented in order to protect ‘global purchasing power’ and to minimize losses during our upcoming periods of ‘market shock’. It serves as a high-quality, liquid asset to be used whereas selling other assets would cause losses. Central Banks of the world’s largest long-term investment portfolios use gold to mitigate portfolio risk, in this manner, and have been net buyers of gold since 2010.

My analysis indicates that gold will be implemented in order to protect ‘global purchasing power’ and to minimize losses during our upcoming periods of ‘market shock’. It serves as a high-quality, liquid asset to be used whereas selling other assets would cause losses. Central Banks of the world’s largest long-term investment portfolios use gold to mitigate portfolio risk, in this manner, and have been net buyers of gold since 2010.

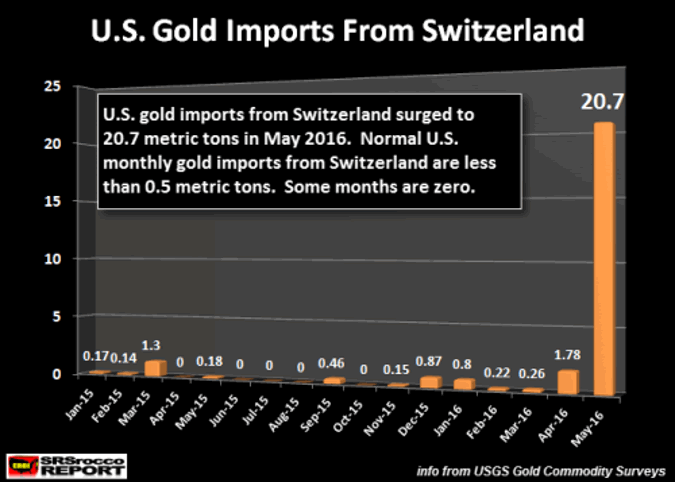

Investors should make use of golds’ lack of ‘correlation’ with other assets which makes it the best hedge against currency risk. Last May of 2016, there was a huge trend change in U.S. gold investment as the Swiss exported a record amount of gold to the United States. There has been a huge increase in gold flows into the Global Gold ETFs & Funds. Something seriously changed, in May of 2016, as the Swiss exported more gold to the U.S. within one month than they have done so over the last year.

Gold has a “clear presence” to play in a world dominated

with ‘global economic uncertainty”

Despite the fact that we are in for a period of great financial turmoil, investors can safeguard themselves by investing wisely in gold. Do not be left behind and witness your dollar assets losing their value.

It is in these very conditions that gold (precious metals) is the only investment that will appreciate in value over time. Gold will continue to perform its’ role as a “safe haven” during these times of crisis which currently appear to be never ending. The metals surge of as much as 8.1% on the day of the “Brexit” vote, last month, is an indicator that its’ luster of safety is undimmed in the current markets. There is little to be gained from arguing whether such beliefs are right or wrong: Governments, around the globe, have moved to a new stage of desperation by toying with the idea of “helicopter money”.

It is my belief that since “Brexit” occurred, it could unleash a general exodus and the disintegration of the European Union is now almost unavoidable.

The list of prominent Hedge Fund Managers who are investing in gold is growing. Paul Singer, of Elliott Management Corporation, is the latest name to lend his support. It is likely that more investment institutions will turn to gold as the logical solution to countervail the effects of many years of ‘quantitative easing”.

Gold has been traded for over 5,000 years and for the first time has a positive carry in many parts of the globe as bankers are now experimenting with the absurd notion of negative interest rates. Some regard it as a precious metal while I regard it as a currency!

Soros Fund Management LLC, which manages $30 billion for Mr. Soros and his family, sold stocks and bought gold and shares of gold miners whilst anticipating weakness in various markets. Investors view gold as a ‘safe haven’, during times of turmoil but they tend to be late to the game as they don’t buy gold until there truly is turmoil and gold will have already appreciated substantially at that point.

“It’s a glaring warning sign of deflation. We’ve never really had deflationary fears throughout such a widespread part of the world before,” said Phil Camporeale, a Multi-Asset Specialist at JPMorgan Asset Management.

The FED is doing everything in its’ power to prevent a rise in the dollar. They are willing to “orchestrate” any scenario so as the stock market will continue to soar and people will feel a “wealth effect” from new stock market highs while the others are experiencing the economy “contracting”. The FED is getting everything it wants, in this regard, and will continue to do so as their number one priority is “debasing” the U.S. Dollar.

As the U.S. Dollar falls from all of the FEDs’ QE, it will lift up gold prices to unprecedented highs.

Investors of all levels of experience are attracted to gold as a solid, tangible and long-term “store of value” that historically has moved independently of other assets classes.

Golds’ importance, even in today’s environment, was clearly visible during the massive rally at the start of the year, when all other asset classes were tanking. Investors piled into gold on the scare of an imminent global financial reset.

Investors should make use of golds’ lack of ‘correlation’ with other assets which makes it the best hedge against currency risk.

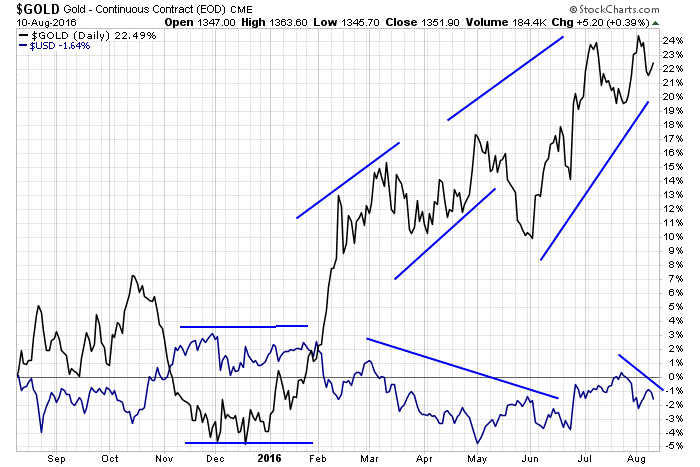

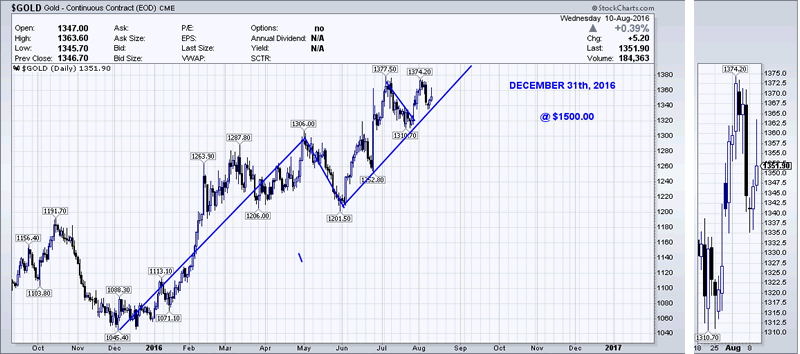

Does Gold Continue Its Bull Market Towards $1500.00?

Conclusion:

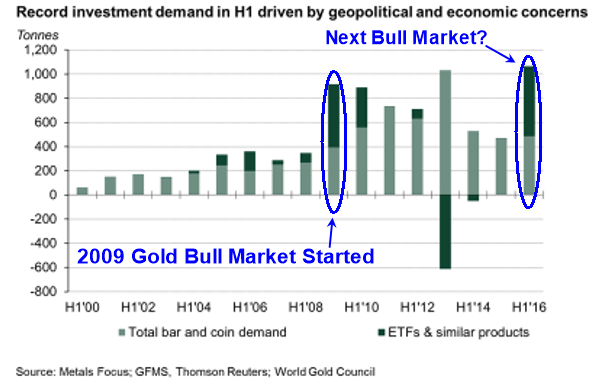

The trend for ETFs to pile in to the precious metal sent the price of gold soaring by 25% in H1, the biggest price rise since 1980. For the first time ever, investment, rather than jewelry, was the largest component of gold demand for two consecutive quarters.

There will be another great opportunity in gold, silver and especially miners in the near future which followers of my work will benefit from. Follow my analysis and trades at: www.TheGoldAndOilGuy.com

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.