Gold In Sterling 2.2% Higher After Bank Of England Cuts To 0.25% and Expands QE

Commodities / Gold and Silver 2016 Aug 05, 2016 - 06:24 PM GMTBy: GoldCore

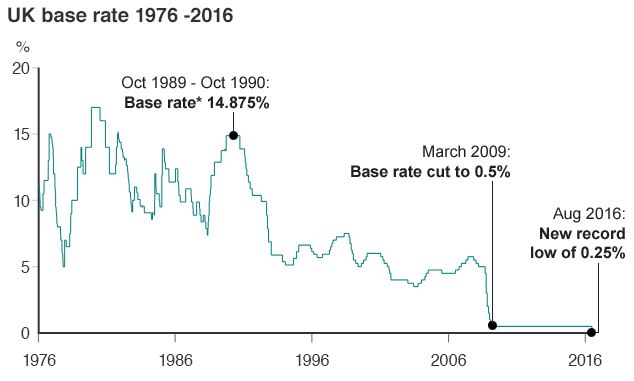

Gold in sterling was 2.2% higher yesterday and was marginally higher in dollar terms after the Bank of England cut interest rates to all time, 322 year record low at 0.25% and surprised markets by renewing and aggressively expanding quantitative easing or QE.

Gold in sterling was 2.2% higher yesterday and was marginally higher in dollar terms after the Bank of England cut interest rates to all time, 322 year record low at 0.25% and surprised markets by renewing and aggressively expanding quantitative easing or QE.

Sterling fell sharply on markets and gold rose from £1,014/oz to over £1,036/oz where it remains this morning. Ultra loose monetary policies are now even looser after the BOE cut interest rates for the first time in more than seven years and launched a bigger-than-expected package of monetary measures.

Gold in GBP (10 Years)

The Bank cut official interest rates to a new record low of 0.25% from 0.5% and signalled they would be reduced further in the coming months. The deepening of ultra loose monetary policies is bullish for gold, especially in sterling terms.

Sterling gold is 38.4% higher in 2016 year to date. This means that gold is now just 14% below the all time record nominal high of £1,179/oz reached on the 5th of September 2011. Gold remains one of the best performing assets in all currencies over a 10, 15 and 20 year period.

Governor Carney also aggressively renewed and expanded its QE and launched a new £100bn funding scheme for banks. The BoE also launched a new £70 billion a month bond-buying programme which was quickly termed a ‘sledgehammer stimulus’ by analysts. This will include £10 billion of sterling denominated investment grade corporate bonds, from companies the BOE judges make a “material contribution” to the UK economy.

Source: Bank of England via BBC

The BOE clearly signalled that this as just the start and the minutes of the rate setting Monetary Policy Committee stressed there was even “scope for further action” in all elements of the package.

The declared reason for the aggressive easing was to protect jobs and prevent a post-Brexit recession. However, the recent stress tests showed how vulnerable UK banks and the UK banking system is with Barclays, Royal Bank of Scotland and HSBC all vulnerable.

Indeed, the concern is that many large European banks and the European banking system remains vulnerable. This has been seen in the sharp fall of Portuguese and Italian bank shares and indeed of European behemoth banks such as Credit Suisse and Deutsche Bank.

Some have even questioned the recent “stress tests” and argue that they are seriously flawed as they fail to consider the real risk of contagion in the Eurozone banking and financial system.

A few analysts, including GoldCore, believe that the UK is heading for new financial crisis on a greater scale than 2008 and the Bank of England has been lulling consumer and investors into a false sense of security in recent years. This has meant that consumer, company and corporate balance sheets far from being repaired have actually deteriorated and total debt levels in the UK are now higher than they were in 2007. This vulnerability means that bail-ins remain a real risk to all UK depositors.

The BOE rate cut and renewed and expanded QE reminds participants that we remain in an ultra loose monetary policy environment and this is very supportive of gold. Ultra low and negative interest rates, concerns about the economic outlook and geopolitical risk are also supporting gold.

Stocks are mixed today and the dollar is essentially flat. Should risk aversion raise its head and stocks or the dollar move lower, we would expect a safe haven bid to come into the gold market.

All eyes will be on the non-farm jobs number today at 1330 BST. A poor jobs number will likely see gold eke out further gains on safe haven demand. A forecast-beating jobs number should lead to gold seeing selling pressure.

Gold Prices (LBMA AM)

05Aug: USD 1,362.60, GBP 1,036.39 & EUR 1,222.52 per ounce

04Aug: USD 1,351.15, GBP 1,016.60 & EUR 1,213.87 per ounce

03Aug: USD 1,364.40, GBP 1,023.16 & EUR 1,218.96 per ounce

02Aug: USD 1,358.15, GBP 1,025.13 & EUR 1,213.10 per ounce

01Aug: USD 1,348.85, GBP 1,022.97 & EUR 1,207.76 per ounce

29July: USD 1,332.50, GBP 1,012.03 & EUR 1,200.18 per ounce

28July: USD 1,341.30, GBP 1,017.64 & EUR 1,208.78 per ounce

Silver Prices (LBMA)

05Aug: USD 20.22, GBP 15.36 & EUR 18.14 per ounce

04Aug: USD 20.16, GBP 15.24 & EUR 18.11 per ounce

03Aug: USD 20.59, GBP 15.43 & EUR 18.39 per ounce

02Aug: USD 20.71, GBP 15.65 & EUR 18.51 per ounce

01Aug: USD 20.51, GBP 15.56 & EUR 18.37 per ounce

29July: USD 20.40, GBP 15.20 & EUR 18.03 per ounce

28July: USD 20.41, GBP 15.51 & EUR 18.41 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.