Stocks Bear Market Phases

Stock-Markets / Stocks Bear Market Jul 25, 2008 - 07:01 AM GMTBy: Mike_Shedlock

In a bull market, everyone ignores the greed and fraud that running rampant. No one wants to take away the spiked punch, even after it is perfectly clear that everyone is drunk. The party continues long after any reasonable person might have expected the party to end. Eventually the party goers all pass out on the floor and the pool of greater fools exhausts itself.

In a bull market, everyone ignores the greed and fraud that running rampant. No one wants to take away the spiked punch, even after it is perfectly clear that everyone is drunk. The party continues long after any reasonable person might have expected the party to end. Eventually the party goers all pass out on the floor and the pool of greater fools exhausts itself.

In a bear market, there are more distinct, readily observable phases.

Ten Bear Market Phases

1. A huge buy the dip mentality sets in during the initial decline. Most party goes cannot fathom that party has ended.

2. Moderate concern sets in when buy the dip stops working.

3. Initial panic.

4. Numerous bottom calls are made, all wrong.

5. Search for the guilty.

6. Punishment of the innocent.

7. More panic.

8. Lawsuits fly.

9. Regulatory power is given to those most responsible for spiking the punch bowl.

10. Congress gets in the act and makes things worse

Steps 4-10 are repetitive, may overlap, and may occur in any order during repetition. Certainly there have been numerous bottom calls for months now, but each rally has failed.

Search For The Guilty

In regards to number 5 it is ironic that Sheila Bair, FDIC chairman, is blaming bloggers for bank problems instead of herself. Please see FDIC Chairman Sheila Bair Is Out Of Control for more on how and why the FDIC is partly responsible for the bank mess we are in.

Regulatory Power Grab

Number 9 is in strict accordance with the Fed Uncertainty Principle .

Uncertainty Principle Corollary Number Two

The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Congress Makes Things Worse

Congress already passed a $150 billion "stimulus package" that failed. Now there are plans for another. More importantly, House passes housing bill after Bush says he will sign it .

The House on Wednesday approved far-reaching government assistance for the housing market, including broad authority for the Treasury Department to protect the nation's two largest mortgage finance companies and an aggressive plan to help troubled borrowers avoid foreclosure by refinancing their mortgages.

"We are at a time of considerable turmoil in the private financial markets, and that is a traditional time when government support is needed and called upon," said Thomas Stanton, an author and expert on the mortgage financing industry. Thomas Stanton is preaching socialist claptrap. Government support is not needed and is in fact the problem. There never should have been government sponsorship of GSEs in the first place. Which leads us to. ...

Punishment Of The Innocent

Taxpayers are on the hook. The Fed has already assumed a $29.5 billion responsibility in the take-under of Bear Stearns by JPMorgan (JPM). Now the Congressional Budget Office says Fannie, Freddie Rescue May Cost $25 Billion .

Rest assured the Fannie bailout will be $200 billion (if not far more), after Congress is done meddling.

Innocent taxpayers who sat this bubble out now are on the hook for hundreds of billions of dollars to bail out the drunken party goers. Losses are socialized. Profits go to the already wealthy. Sadly, this is how our corrupt system works.

Lawsuits Fly

In the last few days there has been a pair of ridiculous lawsuits that are no doubt a waste of time and money for all involved. The two lawsuits I am talking about are "San Diego sues Bank of America to halt foreclosures" and "Los Angeles Sues MBIA, Ambac, Others Over Bond Insurance".

Please see Ridiculous Lawsuits Fly At Taxpayer Expense for more information.

Short Squeeze Over?

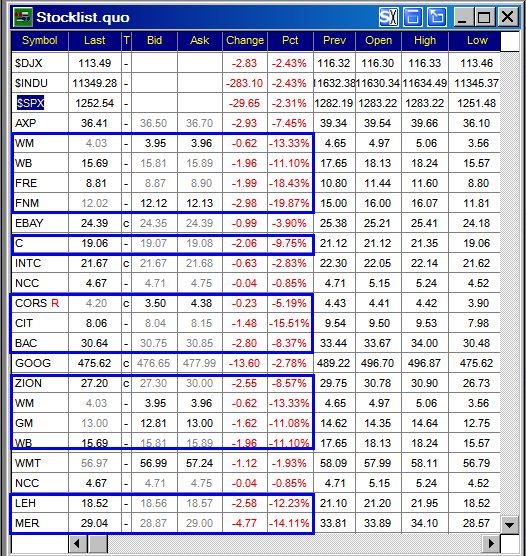

There was a stunning reversal in the stock market today. Financials were solidly in the red. Fannie Mae and Freddie Mac gapped up again, but both failed in spectacular fashion.

Here is a snapshot of some of the stocks on my screen. It was a sea of red.

It's too early to say if this was the end of the short squeeze, but as of now, Fannie Mae and Freddie Mac appear poised to fall now that they have to depend on genuine buying interest rather than bureaucratic meddling in the not-so-free markets.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.