FOMC Interest Rates and Their Impact on the US Economy

Interest-Rates / US Interest Rates Jul 28, 2016 - 05:48 PM GMT To me, interest rates and their future direction seems to be obsessively discussed and debated by many investors. So much so, that I often get the impression that many investors believe that interest rates coupled with Federal Reserve policy are the primary drivers of our economy. From my perspective, interest rates and Federal Reserve monetary policy are contributing factors to economic growth and stability. However, I would stop short of considering them of primary importance.

To me, interest rates and their future direction seems to be obsessively discussed and debated by many investors. So much so, that I often get the impression that many investors believe that interest rates coupled with Federal Reserve policy are the primary drivers of our economy. From my perspective, interest rates and Federal Reserve monetary policy are contributing factors to economic growth and stability. However, I would stop short of considering them of primary importance.

The Most Important Factors of Economic Strength

The true strength of an economy is fundamentally related to its capacity to produce sufficient goods and services in order to meet the needs and wants of its people. Strong economies are highly productive, and production is the true source of wealth. In order for an economy to be productive it must possess the resources required to produce goods and services. In economic terms these are referred to as factors of production. Under modern economic theory there are four factors of production, they are land, labor, capital and entrepreneurship.

Importantly, the reader should notice that money is not included in that list. Money is simply a medium of exchange, and as such, it has no intrinsic value in its own right. Its only value comes from the product (goods and services) that buyers or sellers are willing to accept in exchange for the goods and services they want or are offering. There is an excellent series on the Federal Reserve Bank of St. Louis website titled “Economic Lowdown Podcast Series” that I highly recommend to readers interested in learning more about how the economy works. Here’s an excerpt from Episode 2-Factors of Production:

“You will notice that I did not include money as a factor of production. You might ask, isn't money a type of capital? Money is not capital as economists define capital because it is not a productive resource. While money can be used to buy capital, it is the capital good (things such as machinery and tools) that is used to produce goods and services. When was the last time you saw a carpenter pounding a nail with a five dollar bill or a warehouse foreman lifting a pallet with a 20 dollar bill? Money merely facilitates trade, but it is not in itself a productive resource.”

At this point, the reader might ask what is my point? This is a good question that deserves a rational response. My point is that the Federal Reserve’s role and/or mandate deal with the supply of money as a method to maintain economic stability. In this sense, it is attempting to control the medium of exchange called money; however, money does not directly produce anything. Instead, it is the vehicle that allows us to divide and share the productivity that our economy produces. The role of the Federal Reserve was described in Episode 14 of the series cited above titled “Getting Real about Interest Rates” as follows:

“In the United States, the Federal Reserve System has been charged by Congress to maintain price stability and maximum employment. Price stability means a low and stable inflation rate, and the Fed uses monetary policy to achieve this goal.”

“More specifically, the Fed’s goal is to maintain a 2 percent inflation rate over the longer run.

Savers, borrowers, and lenders all benefit when inflation remains low and stable—they can conduct their transactions without having to consider whether a high or rapidly changing inflation rate might impact their finances in real terms.”

However, the reader should also understand that changes in interest rate policy by the Federal Reserve are not analogous to flipping a switch. The truth is that changes in Federal Reserve policy take time to have an effect or impact on the economy or inflation. According to a report titled “How does monetary policy affect the US economy?” on the website of the Federal Reserve Bank of San Francisco they had this to say:

“HOW LONG DOES IT TAKE A POLICY ACTION TO AFFECT THE ECONOMY AND INFLATION?

It can take a fairly long time for a monetary policy action to affect the economy and inflation. And the lags can vary a lot, too. For example, the major effects on output can take anywhere from three months to two years. And the effects on inflation tend to involve even longer lags, perhaps one to three years, or more.”

Episode 9 of the series on Economic Education in this article is titled “Functions of Money” found here.

I believe it’s worth a read for anyone that wants to understand more about interest rates and their relationship to the economy. However, the primary point that I am attempting to get across regarding interest rates is that they affect the money supply more than they do the economy. On the other hand, this can have a positive or negative long-term effect on the economy relative to the willingness of people to make purchases.

This is why I referred to interest rates as a contributing factor rather than a driver of economic growth. Furthermore, the effects that changes in interest rates and/or monetary policy have are never immediate as pointed out above. Therefore, I’m not suggesting that interest rates are not important. Instead, I’m simply trying to offer a rational perspective of the role that interest rates and Federal Reserve policy play.

Entrepreneurship (Technological Advances)

When I was initially studying economics in the late 1960s, I was originally taught that there were only three factors of production - land, labor and capital. Today, as previously stated, entrepreneurship has been added and generally accepted as a fourth factor of production. I bring this up, because I believe that investors’ attention would be better served by focusing more on what truly drives economic growth and strength rather than obsessing with interest rates and/or what the Federal Reserve might do at the next FOMC meeting.

Episode 15 of the Economic Education series I have been quoting titled “Economic Growth” discusses the importance of entrepreneurship and technological advancements and their importance and contribution to economic growth and strength. This is an area that I believe investors should really be paying attention to and thinking about. Here is an excerpt from this episode:

“But what specific factors lead to economic growth?

Now, let’s connect what we’ve learned about production with what we’ve learned about growth.

For the economy to grow over time, the market could employ more factors of production—more, land, labor, and capital. But, the quantities of these factors are limited, and they need to be balanced. More inputs don’t necessarily translate into more output. Imagine a tiny restaurant with 50 waitresses all clamoring to take your order—not very productive.

The biggest driver of economic gain—the force that sustains long-term economic growth—is technological progress. Technological progress increases labor productivity—that is, it increases how much work can be done in the same amount of time. Technological progress occurs when an innovation becomes widely used. Innovations include things such as new products, scientific discoveries, and improvements to management and work processes. Going back to our restaurant, how could it increase its productivity? Well, it could have better recipes—that is, better recipes for how the chefs prepare the food and how the customers pay for the food. And it could use new technology like the mobile card reader to speed the checkout process.

So, innovation—and encouragement of innovation—drives technological progress which drives economic growth.

Very often, entrepreneurs are innovators. Many develop new ideas and are often the first to use technological advancements. So, investment in human capital is vital for keeping ideas flowing. Remember, human capital is the knowledge and skills obtained through education, experience, and training.”

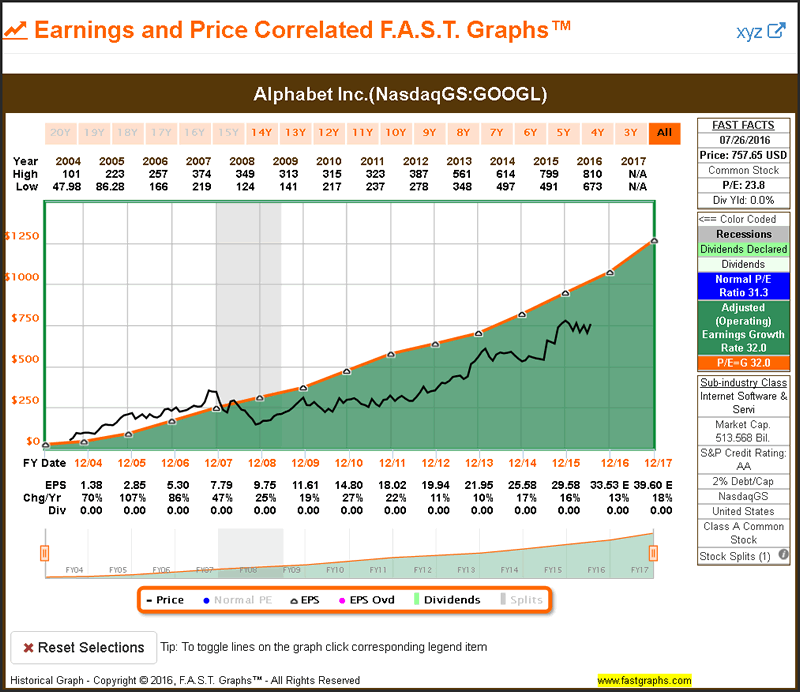

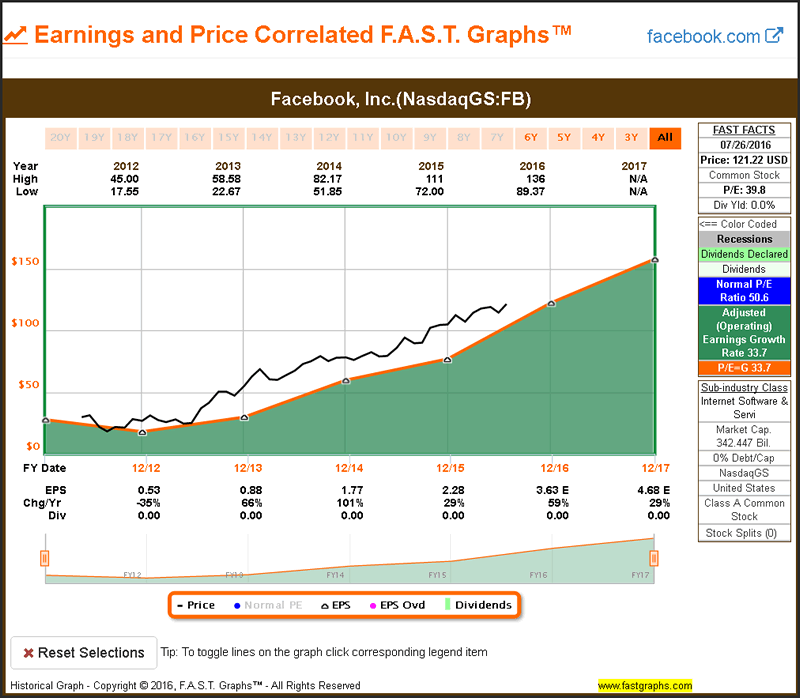

We don’t have to look very hard to find glaring examples of technology and entrepreneurship at work to see how big an impact they can have on our economic growth. In just the past decade or so we can look to two technological giants that have created their own industries. Of course, I’m speaking about Alphabet (Google) and Facebook. In just a short period of time these companies have built business with a combined market of approximately $856 billion.

Take a moment to think about the economic growth that these entrepreneurial organizations have generated for our economy. Both have become almost ubiquitously used by almost every member of our economy, and both represent industries that were not even thought of a couple of decades ago. But most importantly, I doubt that the entrepreneurs that founded either of these two incredible success stories were thinking too much about interest rates prior to starting their businesses. This is especially true considering that neither of them depended very much on debt to fund or grow their enterprises.

Alphabet (GOOGL) via FAST Graphs

Facebook, Inc. (FB)

Summary

There is no question that changes in interest rates can, and will, have an impact on our economy because of the way they affect the public’s demand for goods and services. However, the effects of changes in interest rates are never immediate. With that said, changes in interest rates can often have an immediate effect on the psychology of investors, but it takes the passing of time before they have a true impact on the economy.

As it relates to investors in the stock market, I discussed this extensively in part 1 of this series found here.

Interestingly, in part 1 I pointed out that the expected impact on stock prices doesn’t always follow common beliefs. With this part 2, I tried to provide some additional insights into why all the fuss about what will happen to interest rates may be causing undue concern in the minds of investors.

Additionally, I think it’s important to recognize and consider that the media loves to engender fear and concern in the minds of the general public. The old idiom that “no news is good news” comes to mind. Or perhaps the old Wall Street adage is even more pertinent to the thesis of this series that states “Wall Street climbs a wall of worry.” The key word in this last phrase is that it climbs - in spite of the worry.

Conclusions

Nothing that I’ve written in either of these two articles is intended to suggest that investors should completely ignore interest rates. However, it is my intention to point out that macro economic factors and forces such as interest rates are but one of many contributing factors to investing success. In my personal opinion, I believe that investors are best served by studying the micro aspects of the specific businesses they are invested in, or considering investing in.

At the end of the day, for companies that do have debt, changes in interest rates would simply represent one of many items on their expense ledgers. Management teams are continuously dealing with numerous cost changes that can affect their business. However, just as it is with the economy, what drives the economic value of the businesses they are operating is directly proportionate to the productivity and profitability of those businesses. Although I don’t run a public company, I can emphatically state that I have never made a decision about my business based on what I thought interest rates might or might not do. But then again, I’ve never utilized debt in my business either.

Disclosure: Long GOOGL

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm. Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2016 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Chuck Carnevale Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.