Why Stocks Bears Should be Scared

Stock-Markets / Stock Markets 2016 Jul 08, 2016 - 09:17 AM GMTBy: Clif_Droke

The last year has been a scary time to be an investor. In 2015, the slowdown in China's economy caused undue apprehension to investors and contributed to a nausea-inducing rollercoaster ride which began last July and has continued until now.

The last year has been a scary time to be an investor. In 2015, the slowdown in China's economy caused undue apprehension to investors and contributed to a nausea-inducing rollercoaster ride which began last July and has continued until now.

By the end of 2015 low energy prices were taking a toll on the high yield debt market, which in turn catalyzed another stock market swoon. Although the decline wasn't severe, the January 2016 market panic ended with the biggest spike in bearish investor sentiment since the 2008 credit crash. This reflects the pronounced tendency among investors to panic at the slightest hint of danger, a spillover effect from the historic 2008 crisis.

Added to the concerns over China have been the endless scares over the euro zone economy. Beginning with the spill in January, investors have had one concern after another concerning the stability of Europe's transnational economy which in turn has resulted in periodic financial market turbulence. More recently, Britain's exit from the EU has cast an additional pallor over the euro zone outlook and introduced even more volatility to the stock market.

Yet to those who pay attention to stock market internals it should be clear that a change in the market's character began in January and has gradually shifted the main internal trend. Last July the market was plagued with a surfeit of stocks making new 52-week lows on the NYSE and a dearth of new highs. This problem continued to fester throughout the summer of 2015 until finally the market could no longer hold its level and collapsed under the weight of the internal selling pressure last August.

Even after the August 2015 bottom and subsequent recoil rally the new 52-week lows never entirely dried up. As the major indices rallied to their all-time highs in the bounce-back, the new lows once again increased. It wasn't until after the bottom in February of this year that the new lows contracted and fell below 40 on a daily basis to confirm that the market's internal health was finally improving. Except for a handful of instances, the new lows have remained steadfast under 40 since then. The new 52-week highs have also greatly outnumbered new lows since the February bottom.

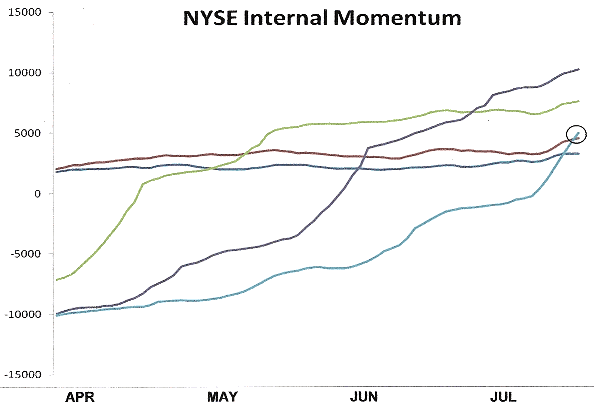

The reversal in the market's internal character has allowed the market to reverse the downside internal momentum that was a staple of last year. This has allowed the market to build a positive internal momentum structure which is reflected in the following graph. Shown here is the Hi-Lo Momentum (HILMO) rate of change indicators which reflect the market's positive internal momentum currents. Note in particular the nearly vertical path of the dominant intermediate-term momentum indicator (circled). This is a veritable needle in the backside of the bears each time they attempt to raid the market. FYI, one year ago the chart looked the opposite of what it does now.

What this means is that the overall path of least resistance for stocks is to the upside. It doesn't guarantee a smooth flight path for stocks, of course. But since February it has meant that sell-offs have been short-lived due to the refusal of the market to stay down for very long. It has also meant that bears have had a frustrating time due to the tendency for the periodic selling panics to reverse quickly and feed on intense short-covering.

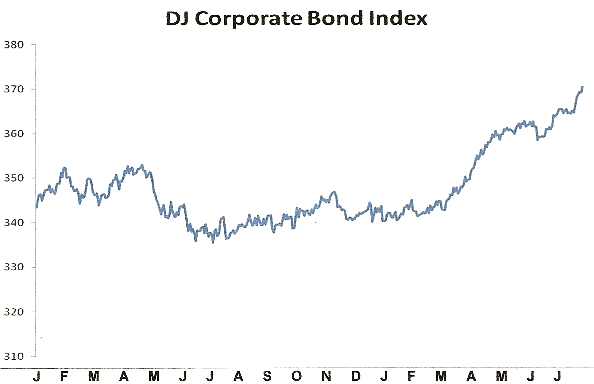

Another indication which doesn't augur well for the bears in the longer-term is the bond market outlook. Not only are 10-year Treasury yields at record lows, a favorable development for the longer-term financial market, real estate and overall economic outlook, but corporate bonds are showing tremendous strength vis-à-vis a year ago. Below is the chart of the Dow Jones Corporate Bond Index. This reflects the increasing demand for high-quality corporate debt; the trend was much weaker in the spring and summer of 2015, but has since turned a corner and is making new highs. Historically, rising corporate bond prices have eventually presaged stronger equity prices.

Moreover, the comparative yield spread between the yields on Dow 30 stocks and 10-year Treasuries is as wide as it has been in years in favor of Dow yields. Last year the spread was at times non-existent as Treasury yields were sometimes higher than the yields on Dow 30 stocks, which argued against owning equities. Now the situation has been reversed and argues strongly in favor of longer-term stock ownership.

For the last year the S&P 500 has been stuck in a lateral trading range. In many ways this resembles the range-bound market of 2005, which was also characterized by positive internal momentum. Yet the 2005 stock market was frustrating for the bulls in that the market clearly wanted to take off but was kept range-bound until finally breaking out emphatically in 2006. Then, as now, the bears were emboldened and are licking their chops for the opportunity to score big on the next "big short." But given the market's buildup of positive internal momentum over the last several months, they should carefully rethink their longer-term strategy. If the market's trading range proves to be consolidative rather than distributive, they are apt to be in for a nasty surprise after November's presidential election.

For now, the see-saw battle among bulls and bears continues with neither side enjoying a distinct intermediate-term advantage. The longer the market's internal momentum profile continues improving, however, the more likely the bears are to be eventually disappointed in the longer term. The trading range, along with its intermittent turbulence, may have a few more months to run before a post-election upside breakout is finally made.

Many investors may express doubt or even frustration at the proposition that the bull market which began in 2009 could continue another one, two or even three years further. The frequent protestation that this bull market is "long in the tooth" is heard both loud and often among the doubters. And why should it continue, they reason? For what possible purpose could be served by having the market push higher without a significant setback, lo, these last seven years? The answer is readily apparent if one merely examines the question from outside the pale of conventional thinking.

Whenever there is a question of motive involving the financial, political and economic destinies of the nations, the single best source for discovering the philosophical basis behind these actions is the great political theorist, Niccolo' Machiavelli. Machiavelli has supplied posterity with perhaps the broadest, finest survey of Greco-Roman history from which every possible political outcome from any event can be derived. His great masterwork is The Discourses on Livy, which distills the great lessons from a thousand years of Roman history into a single tome.

One theme he emphasizes is the constant clash at all times in history between the moneyed ruling class and the great masses of freemen. Concerning this clash he writes, "For without doubt, if one considers the respective aims of the nobles [upper class] and the populace [middle class], one sees in the former a strong desire to dominate, and in the latter merely a desire not to be dominated."

The above sentence provides the reason for most of the discord in the political and economic life of any nation. It can also be applied to the motives of those heavily involved in the financial markets, for the great game of the stock market is nothing if not a desire among the dominant players to fleece the less-dominant participants through tricks, ruses and stratagems. It stands to reason then that successful speculation for the outsider consists chiefly in the ability to recognize these tricks.

"In most cases," Machiavelli says further, "discord [i.e. crashes, panics, and depressions] is caused by those who possess, because the fear of losing generates in them the same desires as those who wish to acquire. Men do not feel their possessions secure if they do not also acquire the possessions of others. And the more they possess, the more power and capacity they have to cause turmoil. Furthermore, their improper and covetous behavior ignites in the hearts of those who do not possess the urge to avenge themselves and rob those who do, gaining the wealth and honors that they see so badly misused by others."

The above statement can be applied to the present bull market and explains why it must continue until the end game strategy among the dominant players is complete. It has been observed that secular bull markets end only when the greatest number of outsiders (i.e. small players) enters the market as indiscriminate buyers of stocks. For the dominant players must have someone to sell to and, as they cannot unload their vast holdings amongst each other, large scale participation among smaller investors is required to complete their final strategy.

Consider that the end game of the previous bull market was the 2008 credit crash, which dealt a grievous blow to the U.S. middle class from which it has yet to fully recover. With millions of middle class Americans dispossessed of their houses and stock holdings, what fruit could possibly be left for the dominant players to pick? The answer is found in a news item on Fortune.com:

"America's upper middle class is larger and richer than it's ever been, controlling about 52 percent of the country's income. The share of households earning between $100,000 and $349,999 for a family of three doubled from roughly 13 percent of the population in 1979 to nearly 30 percent in 2014. The middle class accounts for 32 percent of the population and controls 25.8 percent of the income."

My late mentor, Samuel J. Kress, was of the opinion that most of the major financial market calamities and debt busts are largely fueled by the upper middle class. According to his thinking, they are the economic class which is the most aggressive in trying to become rich. Upper middle class investors are close enough to the upper class that they can "taste it", and so they undertake undue risks in their attempt at reaching the next level. When they fail, the result is credit crises and market crashes. Those who are comfortably middle class, by contrast, are much more likely to remain content with their lot and are more risk averse by nature.

Since the upper middle class emerged from the 2008 credit crisis aftermath relatively unscathed, it's clear that they will be targeted by the dominant players in the run-up to the next major crash. As the conditions for a major crash aren't yet fully developed, the bull market must continue until those conditions have been prepared. Upper middle class investors, moreover, must become committed participants in the stock market much as middle class investors were in the run-up to 2008. Until this happens, the bull market should be assumed to be yet still alive.

The Stock Market Cycles

For the summer months only, the book "The Stock Market Cycles" is available at a special discount to readers of this commentary. The book reveals the key to interpreting long-term stock price movement and economic performance, namely the famous Kress series of yearly cycles. This work was undertaken based on popular demand and was written in a style that casual readers and experts alike can enjoy and understand. The book covers each one of the yearly cycles in the Kress Cycle series, starting with the 2-year cycle and ending with the 120-year Grand Super Cycle.

The book also covers the K Wave and the effects of long-term inflation/deflation that these cycles exert over stock prices and the economy. Each chapter contains illustrations that show exactly how the yearly cycles influenced stock market performance and explains where the peaks and troughs of each cycle are located and how the cycles can predict future market and economic performance. Order your autographed copy today: http://www.clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.