Stock Market: Massive Breadth Thrust

Stock-Markets / Stock Markets 2016 Jun 30, 2016 - 12:15 PM GMTBy: Gary_Savage

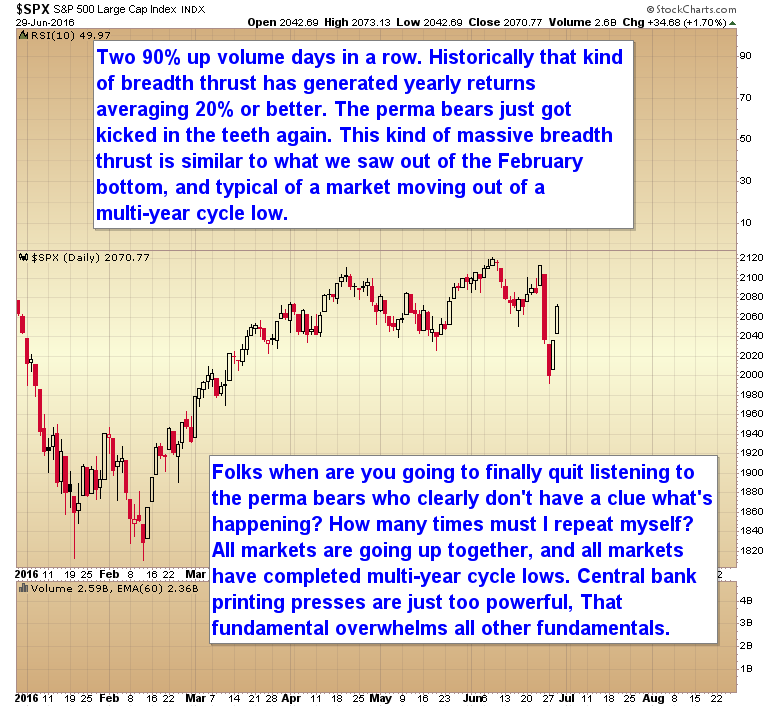

Two 90% up volume days in a row. Historically that kind of breadth thrust has generated yearly returns of 20% or better. The perma bears just got kicked in the teeth again. This kind of massive breadth thrust is similar to what we saw out of the February bottom, and typical of a market moving out of a multi-year cycle low.

Folks, when are you going to finally quit listening to perma bears who clearly don’t have a clue what’s happening? How many times must I repeat myself?

All markets are going up together, and all markets have completed multi-year cycle lows. Central bank printing presses are just too powerful. That fundamental overwhelms all other fundamentals.

Like our new Facebook page to stay current on all things Smart Money Tracker

Gary Savage

The Smart Money Tracker

Gary Savage authors the Smart Money Tracker and daily financial newsletter tracking the stock & commodity markets with special emphasis on the precious metals market.

© 2016 Copyright Gary Savage - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.