Why the Average Person Should Own Some Gold and Silver

Commodities / Gold and Silver 2016 Jun 23, 2016 - 10:41 AM GMTBy: Sol_Palha

"Ability is of little account without opportunity." ~ Napoleon Bonaparte

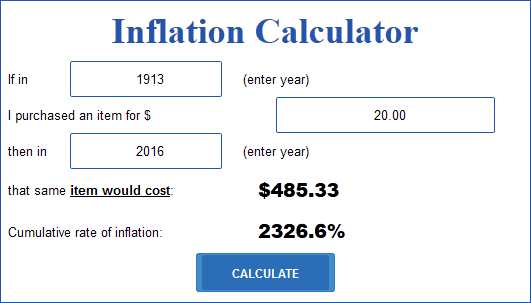

We live in a world where the main driving force behind this illusory economic recovery is hot money and data manipulation. According to Government stats, inflation is nonexistent, but anyone with a grain of grey matter understands that this is not the real case. Rents, education and medical costs are soaring, and salaries are dropping when inflation is factored in. In simple words, you are working more and more for less and less. This is not the American dream; in fact, it sounds more like the American nightmare. The purchasing power of the dollar has been eroded dramatically over the years. According to the website usinflationcalculator.com, an item that set you back $20.00 in 1913 would cost you over $485 in 2016, for a cumulative rate of inflation of 2320%.

Source: www.usinflationcalculator.com

The main driver of chaos and instability is hot money; cut this supply and the economic recovery comes to an end. Central bankers are aware of this, and that is why they are embracing negative rates as it's the only way to maintain this illusion. How long will they be able to pull this act off? They have been extremely adept at conning the crowd and even though many are awakening, the large majority is still deep in slumber.

A logical person looking at all the data would say the end is nigh, but this is the same line of thought that has governed these logical individuals for decades, and yet the illusion continues. Our Central bankers have not embraced negative rates yet (but they will), so from a relative stance, our bond market is offering yields that appear incredible when compared to Europe and Japan. Thus, this illusion of economic prosperity could last a lot longer than most experts are willing to admit. In fact, it is even conceivable that the US dollar could remain strong relative to other currencies even after we embrace negative rates because we will be joining the party late. And our rates even though negative will be relatively higher than those nations that have already jumped on the negative rate bandwagon.

Gold and Silver bullion should be viewed as a form of insurance against a future financial disaster, and it goes without saying that we will experience another disaster sooner or later. We are not advocating that you back the truck and load up on bullion. We are talking about a balanced portfolio and in a balanced portfolio it makes sense to allocate some funds to Gold and Silver bullion. Think of this insurance against another financial crisis; that has the potential to be larger than the 2008 financial crisis. You purchase Insurance not because you know something bad is going to happen, but if something bad happens you know you are covered.

Suggested strategy and Price targets for Gold

Investors that have money that is idling around and Patience can use strong pullbacks to add to their existing positions. We tend to favour Silver more than Gold as the gains on a percentage basis will be far larger on Silver than Gold.

Once Gold closes above $2200 on a monthly basis, it will set the path for a test of the $3300-$3500 ranges. If there is a feeding frenzy stage and there usually is, then our high-end target for gold is $5,000. Those issuing targets of $20,000 and higher are getting ahead of themselves and in doing so, they are leading novice investors astray.

"As life is action and passion, it is required of a man that he should share the passion and action of his time, at the peril of being not to have lived." ~ Oliver Wendell Holmes

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.