AMAT Chirps, b2b Ramps, Yellen Hawks and Gold’s Fundamentals Erode

Commodities / Gold and Silver 2016 May 31, 2016 - 06:07 AM GMTBy: Gary_Tanashian

If we are going to highlight improving fundamentals, which we did as gold out performed commodities and stock markets, then we also have to highlight and respect eroding fundamentals; no ifs, ands or buts.

If we are going to highlight improving fundamentals, which we did as gold out performed commodities and stock markets, then we also have to highlight and respect eroding fundamentals; no ifs, ands or buts.

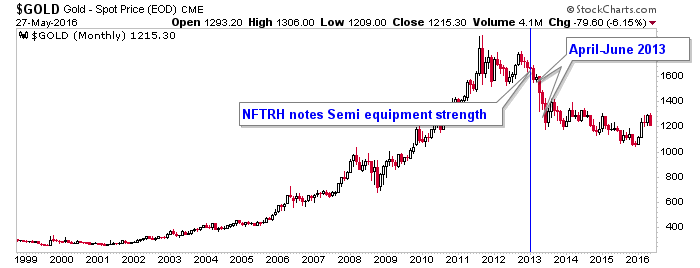

The plain and simple fact is that the Semiconductor Equipment sector is firming, with the April Book-to-Bill (b2b) joining Applied Materials’ quarterly report noted in NFTRH 396’s opening segment as another bullish [economic] indicator. Semi Equipment was a leader to the general Semi sector in early 2013, which in turn led the economy and job creation. Our fundamental gold view improved in January 2016 as gold launched upward vs. global stock markets, joining its positive status vs. commodities.

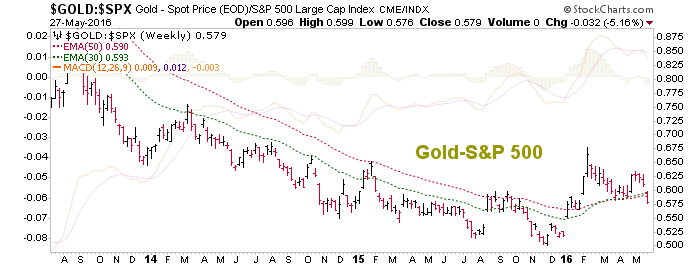

Today, gold is losing that performance vs. stocks and now the positive Semiconductor discussion in NFTRH 396 is more positive still, after the b2b numbers. Sentimentrader had a piece on Wednesday entitled “Economic reports are not keeping up” (with stock prices). I have seen this elsewhere and we have recently included graphs from Yardeni.com showing the same thing.

But that is why we follow a cycle leader like Semi equipment, not the laggards. It’s implication at least, is that future economic reports will catch up.

For her part, Janet Yellen had this to say on Friday: “It’s appropriate — and I have said this in the past—for the Fed to gradually and cautiously increase our overnight interest rate over time, and probably in the coming months such a move would be appropriate.”

If the SEMI b2b improvement is not a blip and things proceed in a logical manner for the economy, they will raise the Funds Rate as stated. That will not be good for gold unless what develops is an inflationary ‘Fed’s behind the curve’ type of situation.

I know there are a lot of gold bulls in the subscriber base and I am not trying to alarm anyone. This cycle could be completely different than 2013, if the inflation/deflation dynamics are different, as I suspect they are. But here is a simple monthly chart of gold showing when we became alerted to Semi equipment firming in January of 2013, and gold then having the worst 3 month stretch of its bear market that April through June.

Could an inflationary phase lift all boats, including the gold sector? Well, we were right about the Semi cycle in 2013 but I was personally wrong in initially thinking it may be a potential inflationary signal. It was not. Global deflation and US ‘Goldilocks’ ensued. Maybe this time, if indeed the economy firms as indicated, it will be an inflationary phase. But I am not willing to gamble on that outcome with the gold sector. Not until gold proves it can hold up vs. stock markets. Here is gold vs. SPX…

Here we should consider that even in an inflationary phase there would probably be many other places to invest besides gold mining, which would not be special as the average gold promoter might try to portray. Gold mining is special during economic contraction.

Speaking of gold promoters, the assumptions out there are heavily leaning to a new gold bull market. Even most bears are only assuming a correction and buying opportunity. I would guard against automatic thinking as long as the fundamentals are wobbling.

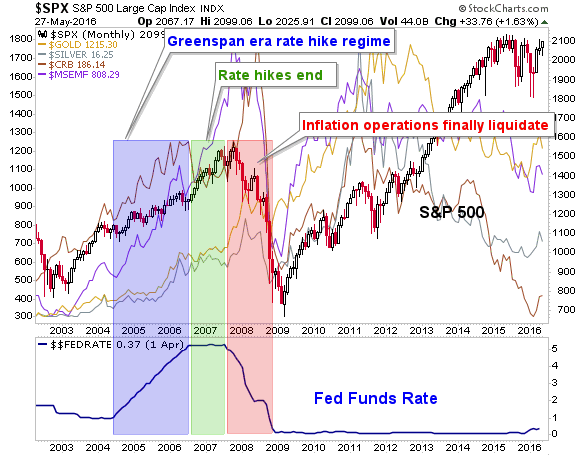

But assuming the economy is going to bump up (this is still just an indicator-based extrapolation after all), for the gold bugs to remain on the soap box they will need inflationary effects to manifest, unlike the post-2011 period. Here is a modified version of a chart from a post about inflation last week adding gold, silver, commodities and emerging markets to the view of the S&P 500.

In the best case (the Greenspan 2003-2007 era) gold and silver rose but commodities and EM’s rose even better (after gold had led the launch phase in 2001-2002).

Just some perspective for the next time your local card carrying gold bug gets persuasive about and transfixed by gold in a vacuum. There is a world out there and it is subject to inflation. It would be a time to speculate in a more well rounded way, with actual gold being a sensible part of a portfolio, as insurance and monetary value.

NFTRH 397 went on to cover the gold sector fundamental and technical situation in detail as well as US and global stocks (many but not all markets are at the intersection of Bull Avenue), commodities, currencies and more on the prospect of an inflationary economic growth phase. We also had a look at the Robotics industry further to the discussion at the site last week. Finally, several NFTRH+ trade ideas were updated as well using daily and weekly charts.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.