Bitcoin Price Remains above $450

Currencies / Bitcoin May 18, 2016 - 09:46 AM GMTBy: Mike_McAra

In short: short speculative positions, target at $153, stop-loss at $515.

In short: short speculative positions, target at $153, stop-loss at $515.

Banks are looking into the possibility to come up with their own versions of Blockchain. At the same time, none of these emerging solutions are as tested in real life as Bitcoin itself. So, the Bitcoin network has its advantages, even if you are not a Bitcoin believer. On the Bitcoin Magazine website, we read:

LedgerX CEO Paul L. Chou was one of the participants on the recent Cato panel, and noted that the openness of the Bitcoin blockchain was the first thing that attracted him to this new technology. Chou recalled his excitement when first learning about Bitcoin:

“I think, for me, the most exciting thing was really this idea of an open-access ledger that anybody could use and anybody could, importantly, program on. So if you’re a 12-year-old kid with no relationships to Wall Street ... before, it was impossible to get access to any of the ledgers that banks use right now. Now, for the first time, if you’re a talented 12-year-old programmer, you can build an application that ‒ whether you like Bitcoin as a currency or not ‒ it is moving some sort of value around in an automated way.

“We’ll find the next Mark Zuckerberg of finance potentially with this open-access approach,” Chou said. “You want the people who can just tinker on the side and not have to go through a lot of these meetings and things to get access to all these systems that banks currently use.”

This is definitely one of the advantages of an open and largely transparent network. Of course, this doesn’t mean that the banks will reverse their course. Financial institutions need a measure of stability that the Bitcoin network simply can’t provide in its current incarnation. Banks and exchanges are heavily regulated, for instance by the SEC, and for now the only way for them to embrace Bitcoin is to work out a way to use the advantages of the currency in a setting controlled by them, much like they use internal anti-money laundering systems.

On the other hand, the open Bitcoin network provides the measure of innovation the solutions developed by banks are not likely to provide. There are very interesting ideas floating in the Bitcoin space, such as sidechains, which could make the Bitcoin network even more agile than it is right now.

For now, let’s focus on the charts.

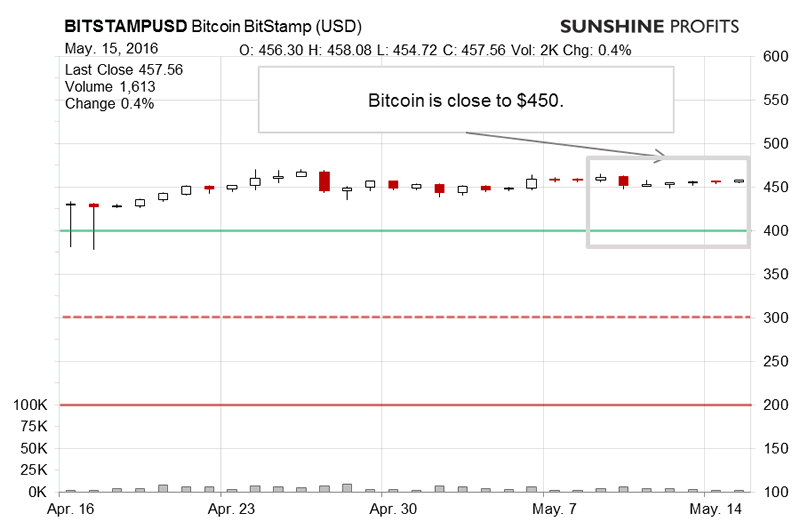

On BitStamp, we see Bitcoin relatively stable, back above $450 but below $460. The situation is pretty much unchanged compared with our recent commentary:

In short, we tend to think that it’s premature to herald a change in the short-term situation. Yes, we saw a more pronounced move higher yesterday and on the day before but this doesn’t necessarily make the situation bullish just yet.

The most important bullish indication is that Bitcoin is now above a possible long-term declining resistance line. This itself makes us reconsider the current position. However, a look at past situations shows that the implications are not as clear. Not all moves above a long-term resistance line resulted in appreciation in the past. Actually, a recent case when Bitcoin moved above the line was in February and the move was followed by declines. There were other cases like this, for instance in May-June 2014.

The move yesterday is a confirmation that the recent appreciation might not be anything more than part of a correction within a long-term downtrend. Today, we have seen relatively volatile action – the volume is already almost as high as it was at the close yesterday (…). We haven’t really seen a decisive move down but the volatility of the move and the lack of a move up suggest that we might be on the cusp of a move down.

The situation is now similar to what we saw yesterday, possibly slightly more bearish as Bitcoin closed below $450. While this is far from sure, it might be sign that Bitcoin is on the verge of moving more significantly.

We are still of a mind that a move below $450 might be the trigger of another move to the downside. This is even more the case as the weak appreciation of the last couple of days has taken place on low volume.

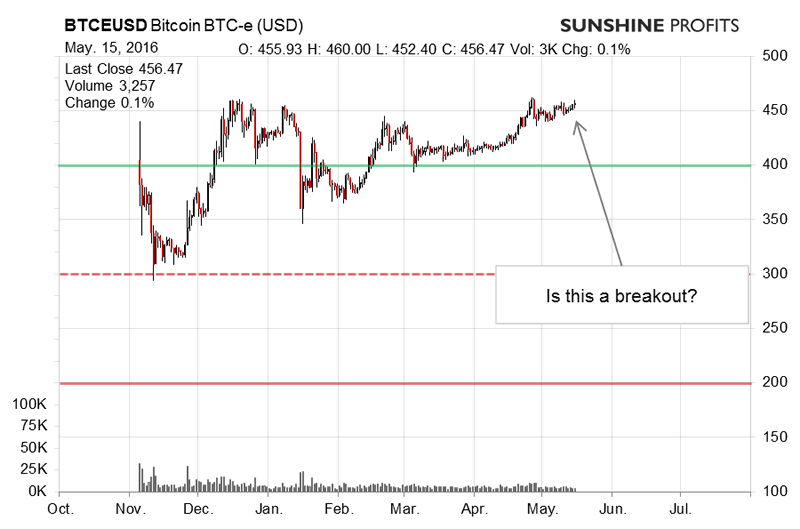

On the long-term BTC-e chart, we see Bitcoin at $450, in a situation very similar to what we wrote previously:

The currency is now above $450 but this doesn’t mean that the situation is bullish. Actually, Bitcoin is still at a possible declining long-term resistance line which is around $460. So, even though we saw a move back to $450, the move might be stopped by the resistance line. This suggests that any appreciation now might be limited and that the situation is still very much bearish.

Bitcoin is not oversold. Actually it’s out of the overbought territory and it very much looks like the currency is after a local top and possibly on the cusp of yet another move lower. The level of $450 also coincides with a possible rising resistance line based on the August low and the March local bottom. This suggests that any break below $450 might result in increased volatility. Another thing is that the next possible resistance level is around $400 and not a very strong one. This means that the next move down might not only be volatile but also possibly steep.

This is very much up to date. The very weak move up we have seen in the last couple of days is not a bullish confirmation in our opinion. Another bearish hint is that we are right at the December-January highs which might be an additional push against future appreciation.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.