Dow Stocks Bull Not Ready to Crash Yet

Stock-Markets / Stock Markets 2016 May 04, 2016 - 06:31 PM GMTBy: Sol_Palha

Have patience. All things are difficult before they become easy.

Saadi

Have patience. All things are difficult before they become easy.

Saadi

Okay, okay, we have heard it before; this market should crash, everything is fake, etc. We are as we have spoken many times over the past two years in a new paradigm. Reality is being recreated; this entire economic recovery is a hoax but despite this, the markets have soared higher. What gives? If you manipulate the data, you can control the outcome, and that’s what has been done throughout this so-called economic recovery phase. Hence, there is no point in looking at the markets through old lenses, because the playing field has changed. The only thing you can focus on now is price and market psychology.

Most players refuse to believe this market can trend higher, and they call us insane when we state that it can. Mind you; they have been calling us insane for over months on end and yet in each instance, they were wrong, but they will never admit to this. When push comes to shove, they will blame everyone, including their bag of tea leaves, skull bones, or crystal ball. Having said that let's look at some random data that illustrates that this market should continue to trending higher. Note that; the upward ride will not be smooth, sharp pullbacks like the ones we experienced in August of 2015 and in Jan of this year should be expected. On each occasion, we stated much to dismay and later surprise of many that these pullbacks/corrections were nothing but buying opportunities

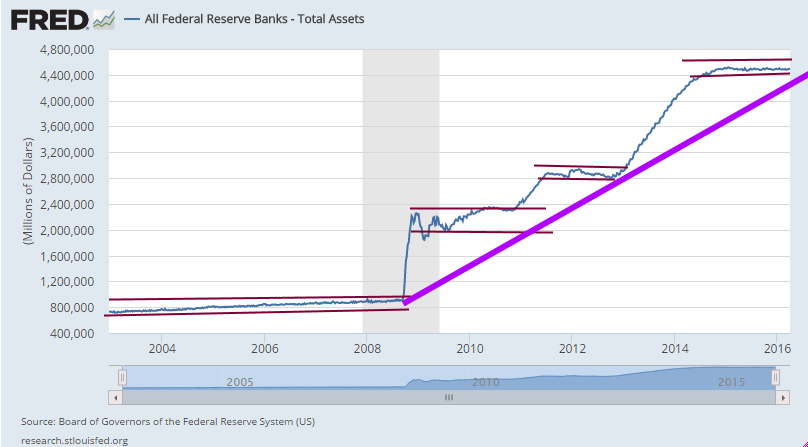

90%-95% will look at this chart and claim the Fed is in deep trouble. How far from the truth that conclusion is. Do you see what being part of the mass mindset does? If the premise is wrong, no matter how many experts you get to join your group, the analysis will be flawed. Look at the channels we have drawn in. The Fed is simply taking a break before they get ready to flood the markets with even more money. The longer the channel, the more explosive the upward move, so expect a massive flood. Naysayers will immediately respond and state; this can’t go on, the world will resist. Oh really; so when the assets doubled from $800 billion to $1.6 trillion, nobody did anything. When they doubled again from $1.6 to $3.2 trillion, still nothing was done. Now the Fed’s assets are up by over 400%, and naysayers feel that the end is nigh. Sorry dudes, the masses are still asleep. The number is irrelevant; have the masses woken up or not is the only question of relevance in this case. In this instance, they have not woken up, so we suspect that the Fed’s assets could surge to $8 trillion with ease. The Fed prints money with one hand, then with other it purchases treasuries in a process that is known as debt monetization, which is just a fancy word for a giant Ponzi Scheme. Do you see the masses revolting? As they are not revolting there is nothing to prevent this process from continuing.

Negative rates

Central bankers worldwide are slowly embracing negative rates. There is no choice now as we are in the “devalue or die era” and the race to the bottom is picking up in intensity. Hence, it is just a matter of time before the Fed embraces negative rates. This will be the equivalent of pouring rocket fuel on a raging fire; the corporate world will kick-start even larger buyback programs as this is the easiest way to boost earnings without having to do any work. The rewards for corporate officers are huge as their pay is based on performance. As greed is the main governing force in the corporate world, there is almost no chance that these chaps will pass up an offer to lock in huge bonuses. Share buybacks have increased every single year since 2009, and will continue to do so as long as rates remain low; you can imagine what will happen if rates turn negative.

Conclusion

We don’t expect the markets to rally upwards in one straight line, it will be more like a zig-zag type of upward move, but overall the markets will trend higher. The markets are currently overbought, after mounting extremely strong rallies from their Jan lows, so a nice pullback would not surprise us. All strong pullbacks should be viewed as buying opportunities and not as signal to run for the hills.

Anybody who gets away with something will come back to get away with a little bit more.

Harold Schoenberg

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.