USD Still Declining...

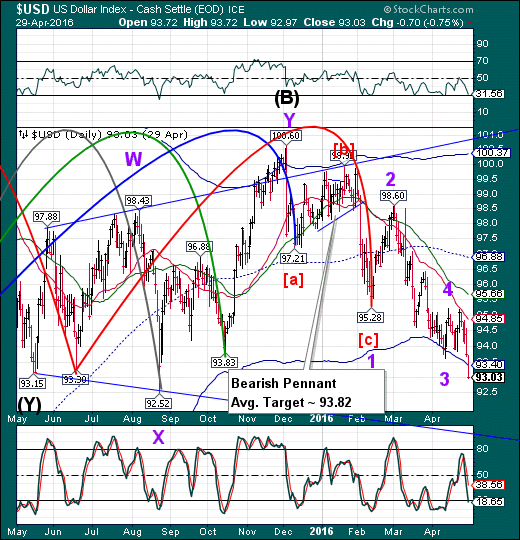

Currencies / US Dollar May 02, 2016 - 03:18 PM GMT USD is plummeting lower today. This is keeping USD/JPY suppressed, even though the Yen is not rallying at the moment.

USD is plummeting lower today. This is keeping USD/JPY suppressed, even though the Yen is not rallying at the moment.

Bloomberg reports, “After falling for three months, the dollar is set to rebound, if this historical seasonal chart is any guide.

The Bloomberg Dollar Spot Index, which tracks the greenback versus 10 peers, has appreciated in May in every year but one since 2007, according to a Bloomberg Seasonality Chart. That’s the best record among the 12 months.

Analysts’ theories include one that says the pattern is linked to a selloff of stocks and commodities that tends to happen in the same month. That drives demand for haven assets that the dollar is perceived to be. Another theory points to U.S. economic data often improving in May.”

The Cycles Model suggests that we may find a Master Cycle low in the USD as early as May 9. That is when the window for a turn may open. However, that window may be extended for as long as a week, so we will be looking for the target low of 90.50 to tell us when the turn may be made.

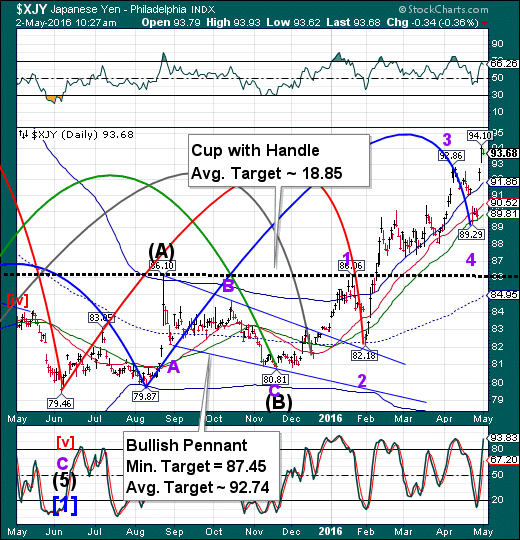

The Yen rally does not appear finished. The Cycles Model suggests that the rally may persist through late June or early July. This may cause havoc for those still left in the Yen carry trade.

ZeroHedge reports, “Days before last week's BOJ "stunner" in which the Japanese central bank ended up doing precisely nothing and smashing market expectations of further "bazooka" easing, we presented Goldman's expectations why the Yen is set to "collapse" in the next 12 months, with Goldman's FX strategist explaining why he believes the USDJPY will surge to 130 in the coming year. For those who missed it, the forecast was based on the assumption of much more aggressive easing including even more balance sheet expansion, something which clearly did not pan out (as we also warned) and the only "crushing" that took place was to the P&L of any Goldman clients who listened to the bank.”

Traders have been looking at the price relationship between the USD and crude to get their clues on the next move in WTIC. However, these relationships start breaking down in fifth waves. In fact, WTIC may have a stronger affinity to SPX since both are topping in their rallies. Both appear to be launching Wave threes, although at a different degree.

Another large player is China, which may be about to see a huge unwind in its markets. If so, that also means a slowdown in its purchases of crude and a resumption of the bear market in oil.

ZeroHedge brings this report, “Ship tracking data from Bloomberg shows that 83 supertankers carrying around 166 million barrels of oil are headed to China, which has stockpiled an impressive 787,000 barrels a day in the first quarter of 2016 - the highest stockpiling rate since 2014.

While the world was speculating about oil prices plunging to $20 and $10 per barrel, China was busy stockpiling its reserves.”

I have updated the Pennant targets to reflect the probable targets for the next decline. The current price of WTIC futures is 45.27. The nearest probable sell signal is beneath Intermediate-term support at 40.90.

Gold has its own agenda. The price is currently faltering, but it has the capability of rallying further. I will keep you updated.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.