Sri Lanka is Intriguing: Areas to Consider for Value Investing

Economics / Asian Economies Apr 29, 2016 - 12:24 PM GMTBy: Dylan_Waller

The stock market discount and comparatively stronger trends of growth present in frontier Asia is intriguing, and a buy frontier, sell emerging approach is one of the most clear cut ways to prosper when investing in Asia. These trends, coupled with noteworthy political improvements, can be combined to create a strong value investing case. Sri Lanka is a strong frontier market in Asia that meets all of these requirements, yet is being relegated by many foreign investors. Sri Lanka has been benefiting from the end of the country’s 26 year civil war that ended in 2009, which has resulted in an improved political landscape. This improvement has been coupled with Sri Lanka’s new government, which was elected in January 2015.

The stock market discount and comparatively stronger trends of growth present in frontier Asia is intriguing, and a buy frontier, sell emerging approach is one of the most clear cut ways to prosper when investing in Asia. These trends, coupled with noteworthy political improvements, can be combined to create a strong value investing case. Sri Lanka is a strong frontier market in Asia that meets all of these requirements, yet is being relegated by many foreign investors. Sri Lanka has been benefiting from the end of the country’s 26 year civil war that ended in 2009, which has resulted in an improved political landscape. This improvement has been coupled with Sri Lanka’s new government, which was elected in January 2015.

On top of this, the country has been experiencing rapid growth in consumption, and has some interesting investment opportunities found in areas such as banking, healthcare, tea exporting companies, construction, manufacturing, logistics, and consumer goods. The country of 21 million has comparatively lower wages, and a literacy rate of 92%, the highest in South Asia, and among the highest in Asia. However, the most salient, and overlooked opportunity, is the country’s strategic geographical placement on the Indian Ocean, allowing it to be strong economic center for logistics. This strategic benefit, will be modestly complemented by other strong trends, and allow Sri Lanka to eventually emerge as a salient asian market in the future.

Relegation of Sri Lanka’s Geographical Benefits

Sri Lanka is strategically located on the Indian Ocean, a few miles away from the East-West shipping port, where it is estimated that 60,000 ships pass each year, carrying 2/3 of the world’s oil and half of all container shipments. The country’s SAGT Terminal, is one of three terminals in Colombo Port, which handles shipments to India and other subcontinent countries. Transshipments from India account for approximately 75% of its shipments. The other two ports are run by the government and Colombo International Container Terminals.

China has been spearheading investment in Sri Lanka, which has included highways, ports, and an airport in the south. China also wants to build a controversial $1.4 billion port city in Sri Lanka, and was recently given permission, after delays from this project due to protests. China has also identified the country as a key point on the maritime Silk Road, which will extend from China to Africa.

This strong attention from China has been balanced with significant FDI from India, which was reluctant after 2009 due to human rights concerns for the Tamil population in Sri Lanka, as India also has a large Tamil population in Tamil Nadu. India seeks to be active in FDI in Sri Lanka, in order to compete with China, and to foster close relations with Sri Lanka, which is already a strong trade partner.

Stock Market

Sri Lanka’s stock market has approximately 294 listed companies in 24 business sectors, with a market capitalization of around $18 billion. The appeal of its stock market is for a long term hold, as performance this year has not been stellar.

- The index has declined by 7.7% in the past year.

- Sri Lanka trades at a strong discount to emerging Asia, with an average P/E of 11.8.

As with many frontier markets, it is simple to construct a portfolio with lower valuation, mainly by avoiding high valuation found in certain sections of the consumer discretionary sector, and identifying areas that have had a boom in earnings growth. A target single digit P/E is certainly feasible for Sri Lanka.

Inflation

Sri Lanka’s inflation most recently fell to 2%, a far cry from the higher levels experienced during 2012-2014.

Annual GDP Growth

Sri Lanka’s economy is projected to grow by 5.6% annually through 2016-2020, driven strongly by tourism, tea exporting, logistics, IT, and construction. Sri Lanka’s economy already has a strong benchmark of growth, as annual GDP growth has averaged at 6.15% since 2003.

Consumer Spending

Consumer Spending growth has been strong in Sri Lanka, making the appeal of value investing in this industry very strong. Tea exporting companies and distilleries are two noteworthy areas where valuation is particularly low.

Growth in the Tourism Industry

Sri Lanka’s tourism industry has much to offer, due to the end of the country’s Civil War in 2009, and tourist arrivals increased by 16% during 2015, with a notable 30% increase in tourists from India. Mark Mobius’s views on Sri Lanka’s tourism industry are very positive.

” The entire country is really a tourist haven. It has history, it has beautiful beaches, it has nice people and it’s small enough so you can see everything in a week or less”

The end of Sri Lanka’s Civil War in 2009 has served as a catalyst for the increased appeal of its tourism industry, and there is still ample room for growth ahead.

Healthcare Industry

Sri Lanka’s healthcare industry is an area for strong consideration, driven by the following advantages:

- 9% of its population is currently over 65 years old, and this amount is likely to double by 2030 according to a rating by Fitch

- Private Hospitals have achieved 21% CAGR in the past four years, compared to the public sector’s growth of 10%

- 70% of the country’s population uses private hospitals

- Health expenditure per capita in Sri Lanka is only $127, significantly lagging behind much of emerging Asia.

This area provides strong opportunity for growth in the future, and several listed private hospitals are available at reasonable valuation.

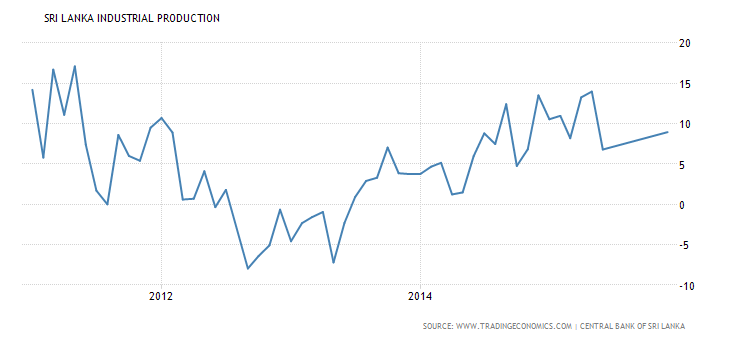

Industrial Production/Manufacturing

Sri Lanka’s industrial production has risen substantially, and the country’s manufacturing industry presents strong opportunities. Sri Lanka is poised to benefit more if it can join trade agreements, and bring in more FDI, as FDI currently only accounts for 2% of its GDP. Employment in the manufacturing sector is comparatively attractive, as workers can earn substantially more than working in the agriculture sector. One particularly strong, high growth area is for tile manufacturers, as several stocks in this area have surged in earnings growth, and trade at very low valuation.

Banking Industry

The opportunity in Sri Lanka’s banking industry is also worth noting, as several listed banks traded at a strong discount to the CSE Index. NPLs historically averaged near 4.5% since 2010, and declined to 4.2% as of September 2015. The main threats for the increase of NPLs in the future include slowed economic growth, rising interest rates, and banks having exposure to SOEs in their assets. In addition to low valuation, some banks in Sri Lanka can also be positively noted for high CAR, ROE, and profit margins. Sri Lanka is also a strong outlier in frontier Asia in terms of its high banked population, as around 83% of its population is already banked, yet other Asian frontier markets such as Bangladesh, Vietnam, and Pakistan can offer more in terms of growth, due to their comparatively lower banked population.

Areas of Concern

Overall we can clearly see strong trends of economic growth, low valuation and a consequent strong appeal for Sri Lanka’s stock market, as well as improvement of previous political and economic risks. The following areas of risk should be noted, although fundamentals are certainly strong enough to create a strong case for value investing.

- Low Liquidity: A common challenge for any frontier market.

- Debt: Sri Lanka’s Government Debt to GDP is 75.5%, notably higher than its frontier Asian peers. Sri Lanka requested a $1.5 billion loan from the IMF, and is also planning to sell $3 billion worth of bonds in global markets this year. The yield for Sri Lanka’s bonds has soared to 11.6%!

- Corporate Tax Rate: Sri Lanka’s corporate tax rate is 28%, well above other attractive destinations such as Vietnam, which offer further incentives beyond the existing low 20% corporate tax rate.

- SOEs: SOEs, which account for 18% of the country’s GDP, have been criticized for poor financial performance.

- Trade Deficit: Sri Lanka’s trade deficit has averaged at -$457 million since 2003. The country’s main exports are textiles and tea, which both account for approximately 57% of its exports.

Conviction

Sri Lanka has witnessed strong recovery on the political front, and its strategic geographical location and strong trends of growth both make it a strong futuristic investment destination in Asia.

Dylan Waller is a Contributor for Seeking Alpha and Smartkarma, and a Macroeconomic Researcher for the crowdsourced consultancy Wikistrat. His research focuses on frontier and emerging markets, with a primary focus on the strategic advantages of Vietnam, Pakistan, India, The Philippines, and Mongolia.

Email: dylan@nomadicequity.com

Website: www.nomadicequity.com

Copyright © 2016 Dylan Waller - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.