Brazil Impeaches President Rousseff; Where to for Brazil and its Currency?

Stock-Markets / Brazil Apr 18, 2016 - 05:53 PM GMTBy: Mike_Shedlock

In a 367-137 vote with two absent and seven abstentions, Brazil's lower house of Congress voted to impeach President Dilma Rousseff.

In a 367-137 vote with two absent and seven abstentions, Brazil's lower house of Congress voted to impeach President Dilma Rousseff.

342 vote were needed. To reach that total, members of her own party had to abandon Ms. Rousseff.

Rousseff and high level officials in her administration are accused of massive corruption and bribes involving state-owned oil company Petrobras.

Corruption, no matter how blatant, is typically overlooked in good economic times. However, Rousseff presides over a Brazilian economy that is in its worst recession in over a century.

What's Next?

For more details let's turn to the Financial Times report Brazil Congress Votes to Impeach Rousseff.

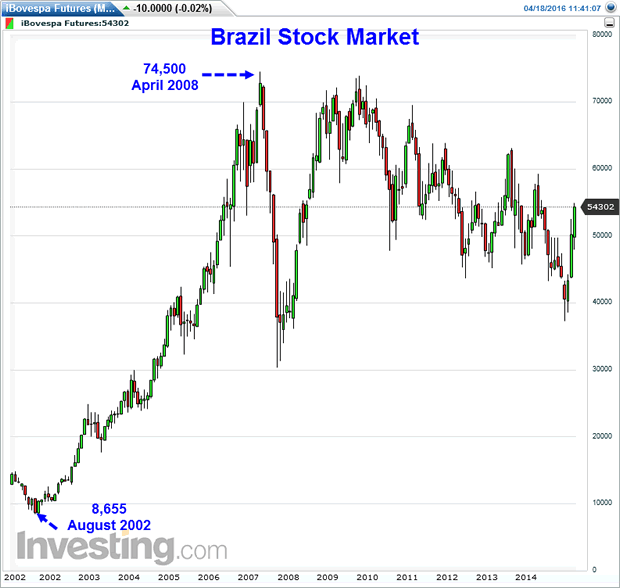

Brazil Stock Market

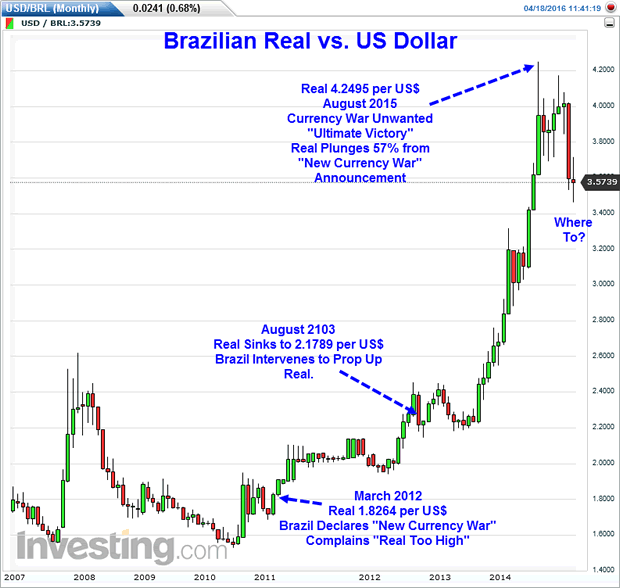

Brazilian Real

In early 2012, Guido Mantega, Brazil's finance minister declared New Currency War on US and Europe.

Mantega was the first high level official to use the controversial term "currency war". In 2010, Mantega said the government would not "sit by passively" as developed nations continue to pursue expansionary monetary policies at the expense of Brazil.

On August 25, 2013, Mantega was not exactly pleased with his success in winning the war. At that time, Brazil Announced $60 Billion Currency Intervention Scheme to prop up the Real.

As you can see, that failed to work. Currency wars, once started progress to conclusion, no matter what officials want.

Where To?

Michel Temer, Rousseff's vice president is now acting president.

Unlike Rousseff whom is a member of the Socialist Workers' Party (PT), Temer is a member of the centrist Brazilian Democratic Movement Party (PMDB) party.

According to the Financial Times report, "Temer has promised to adopt more orthodox economic principles, including a balanced budget and removing structural impediments to Brazil's long-term fiscal health, such as the indexation of salaries, benefits and other payments to inflation."

If Temer delivers on that pledge, the Real has only one way to go in value following the massive slide since 2012 - up.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.