The No Fresh Water Planet

Commodities / Water Sector Apr 03, 2016 - 06:10 PM GMTBy: Richard_Mills

Our planet is 70 percent covered in ocean - 98% of the world's water is in the oceans. Which makes 98% of the world's water unfit for drinking, or irrigation.

Our planet is 70 percent covered in ocean - 98% of the world's water is in the oceans. Which makes 98% of the world's water unfit for drinking, or irrigation.

Just 2% of the world's water is fresh. The vast majority of our fresh water, 1.64%, is in its frozen state and locked up in the polar ice caps, Greenland's ice sheet and glaciers. Once it melts its contaminated by seawater, either by melting directly into the oceans or running to the world's oceans through a stream or river.

Our available freshwater, .36% of the water on the planet, is found underground in aquifers and wells, and on the surface in lakes and rivers.

After the glaciers melt many of our rivers will cease to exist, and a vast number of lakes will no longer be filled by anything more than melting snow - runoff - and rainfall. Refilling our lakes and aquifers by relying on only precipitation, in a warming and much drier climate, does not sound efficient or dependable.

"In many parts of the world, in particular in the dry, mid-latitudes, far more water is used than is available on an annual, renewable basis. Precipitation, snowmelt, and stream flow are no longer enough to supply the multiple, competing demands for society's water needs. Because the gap between supply and demand is routinely bridged with non-renewable groundwater, even more so during drought, groundwater supplies in some major aquifers will be depleted in a matter of decades. The myth of limitless water and the free-for-all mentality that has pervaded groundwater use must now come to an end. ~ NASA Jet Propulsion Laboratory hydrologist James Famiglietti, Nature Climate Change

Freshwater aquifers are one of the most important natural resources in the world today, but in recent decades the rate at which we're pumping them dry has more than doubled. These fast shrinking underground reservoirs are essential to life on this planet. They sustain streams, wetlands, and ecosystems and they resist land subsidence and salt water intrusion into our fresh water supplies.

GRACE

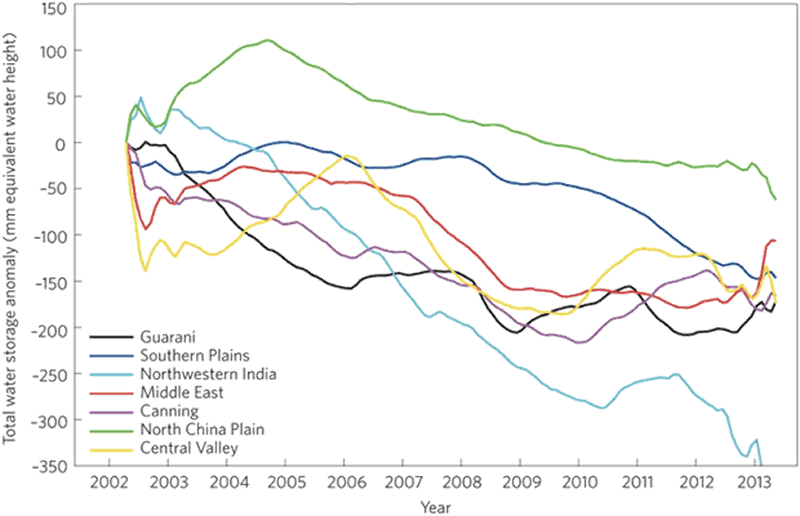

NASA's Gravity Recovery and Climate Experiment (GRACE) satellites measure anomalies in the Earth's gravity brought about by changes in water supplies.

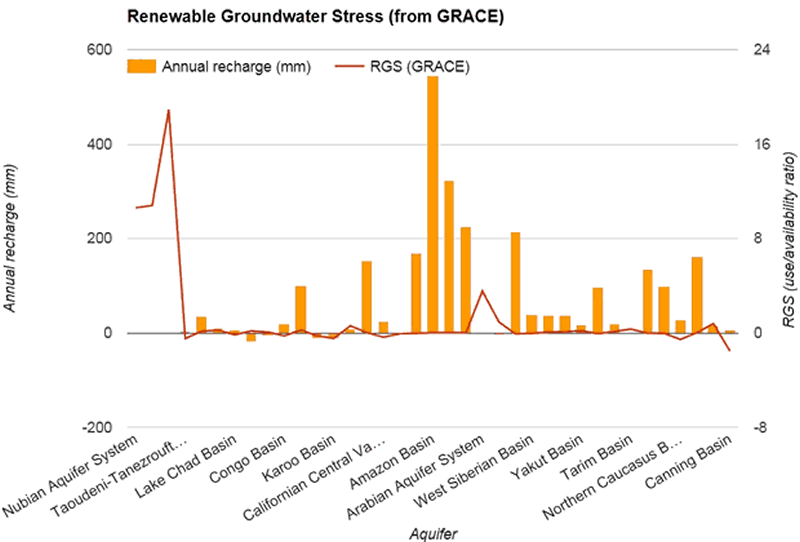

Hydrologists combined the information from GRACE with soil moisture and other data to isolate changes in groundwater storage. They built a renewable groundwater stress (RGS) ratio that compares the rate at which the groundwater is being used to its availability as reflected by the rate at which the aquifer is being replenished. Of the 37 aquifers studied, 16 showed positive accumulating trends and 21 showed declining trends.

Twenty-one of the world's 37 largest aquifers are losing water at a greater rate than they're being refilled.

They include:

- The Arabian Aquifer System, which supplies Saudi Arabia, Syria, Iraq, and Yemen

- Yhe Murzuk-Djado Basin in northern Africa

- The Indus Basin of India and Pakistan

- The Central Valley Aquifer System in California

Most of the unstressed (the 16 accumulating water) aquifers are located in remote forested and rain fed regions. Most of the stressed (21 losing water) aquifers were located in regions with high amounts of rangeland and cropland.

Out of the 21 aquifers losing water, eight were found to be overstressed - meaning there is almost no natural replenishment while five more were extremely stressed signifying they had some water flowing back into them.

The Arabian Aquifer System is an important water source for more than 60 million people and it's the most overstressed in the world. The Indus Basin aquifer of northwestern India and Pakistan is the second-most overstressed, the Murzuk-Djado Basin in northern Africa is third. California's Central Valley, used heavily for agriculture and suffering rapid depletion, was labeled extremely stressed.

For most, a no fresh water planet

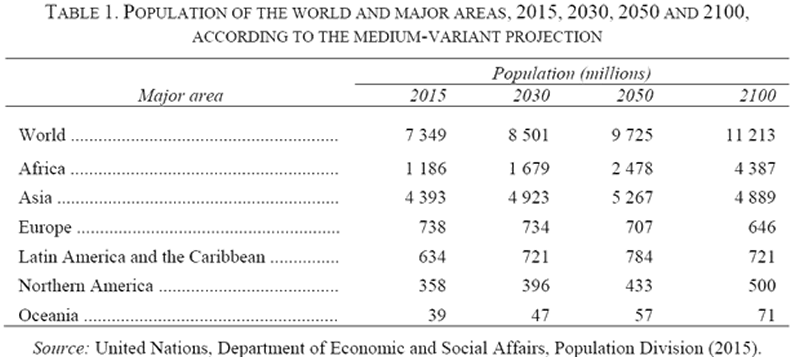

There are currently 7.3 billion of us sharing the world's fresh water resources. By 2050 the United Nations (UN) expects the world's population to reach 9.7 billion. Feeding everyone in 2050 could require 50% more water than is needed now.

Already approximately 1 billion people go to bed hungry each night.

Almost 1 in every 15 children in developing countries dies before the age of 5, most of them from hunger-related causes. Somewhere in the world someone starves to death every 3.6 seconds - most are children under the age of five.

An estimated 90% of the people expected to be added to the population, by 2050, will be in developing countries.

This means hundreds of millions more marginalized people will feel the extreme pinch of shortages in what those people need the most - water, food and clothing - the bare essentials necessary for survival.

Conclusion

Human life, on our one and only planet, is based on sourcing fresh water.

Most of the aquifers in India and the shallow aquifer under the North China Plain are replenishable. When these are depleted, the maximum rate of pumping is automatically reduced to the rate of recharge or refill.

For fossil aquifers - such as the vast U.S. Ogallala aquifer, the deep aquifer under the North China Plain, or the Saudi aquifer - depletion brings pumping to an end.

Scientists do not know how much water is left in the world's aquifers - they can discern trends but they cannot yet determine the total volume that exists.

We need a coordinated global effort to determine how much is left, how much we can take on a yearly sustainable basis from each aquifer and put an actionable, by ALL, conservation plan into place.

Sounds like a lot to do but...

The consequences of a major percentage of our global population running out of fresh water for drinking and irrigation, and how soon we could all be living in a no fresh water world, should be on all our radar screens. Definitely on mine, is it on yours?

If not, maybe it should be.

By Richard (Rick) MillsIf you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2016 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.