Bitcoin Edging Towards Declines

Currencies / Bitcoin Apr 01, 2016 - 03:12 PM GMTBy: Mike_McAra

In short: short speculative positions, target at $153, stop-loss at $515.

In short: short speculative positions, target at $153, stop-loss at $515.

If you have been wondering what kinds of applications there might be for Bitcoin on Wall Street, apart from settlement work, a new idea has been just highlighted. In an article on the Wall Street Journal website, we read:

Depository Trust & Clearing Corp., a firm at the center of Wall Street's trading infrastructure, is about to give the technology behind bitcoin a big test: seeing whether it can be used to bolster the $2.6 trillion repo market.

DTCC said in a statement Tuesday that it will begin testing an application of blockchain, the digital ledger originally used to track ownership and payments of the cryptocurrency bitcoin, to help smooth over problems in the crucial but increasingly illiquid corner of short-term lending markets known as repurchase agreements, or "repos."

Repos play a critical role in the financial system by keeping cash and securities circulating among hedge funds, investment banks and other financial firms.

(...)

Murray Pozmanter, managing director and head of clearing services at DTCC, said in an interview the new arrangement with Digital Asset should help because the ledger would provide a way for all firms to agree on trade terms more quickly.

If anybody has doubted the validity of using the blockchain in financial services, a real-life test is now a lot closer than a couple months ago. It turns out that financial institutions are not only interested in using Bitcoin as a means to confirm the ownership of assets but rather they are able to find other potential niches for blockchains.

These are early days for Bitcoin and even earlier ones for Wall Street in terms of Bitcoin involvement. Large banks and other firms have already started dabbling in Bitcoin but the process is far from established. Startups are currently working on other solutions and trying to figure out additional ways to use the blockchain concept in finance. It is completely possible that we'll see a lot more development in this space and other ideas contributing to smoother operations, perhaps even in the OTC market.

For now, let's focus on the charts.

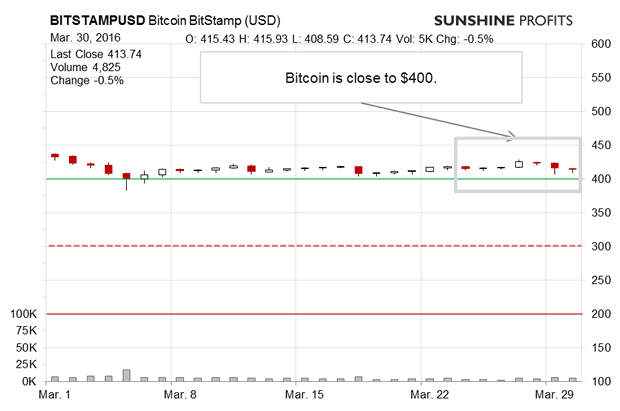

On BitStamp, Bitcoin is still above $400. The currency has been holding up above this level for some time now. Does this mean that the outlook has become less bearish?

We don't think so. Bitcoin is at a possible long-term declining resistance line, not really above it. This means that the outlook for the currency hasn't really changed in a substantial way as far as becoming more bullish is concerned. Zooming in on the last couple of days, Bitcoin is slipping below the 50-day moving average. The move is not confirmed and it is not a very strong bearish indication at this time, but it is a bearish indication nonetheless. The comments from our previous alert are very much up to date:

Generally, Bitcoin went up in the previous week and it shot up on Easter Sunday. This could've looked like a bullish hint but actually the currency paused the appreciation yesterday and it has erased all of the previous gains today (...). Is this the depreciation we've been waiting for? Unfortunately, this isn't clear at this time. The depreciation seems to be the hint that the trend remains down and the recent swing to the upside is nothing more than a countertrend correction. At the same time, we haven't really seen enough depreciation to consider the next major decline underway. It might be, but this is still not perfectly clear.

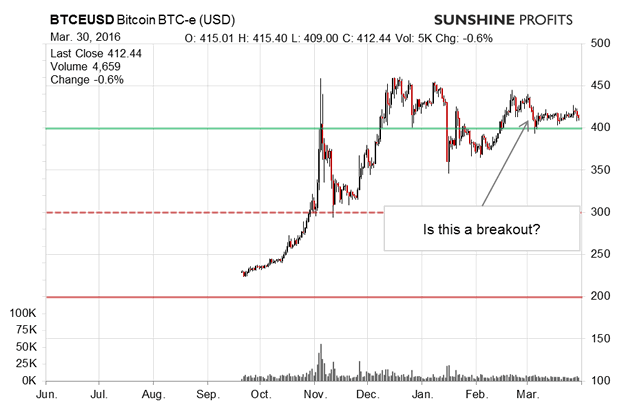

On the long-term BTC-e chart, we see Bitcoin edging toward $400 but there hasn't really been that much action. Bitcoin is well within the range of the downward trend, possibly establishing a series of lower highs. Also, the currency is at a possible rising resistance line based on the July 2015 low and the March 2016 slump. If Bitcoin moves visibly below this level, this would be yet another bearish indication.

The RSI is still at 50, not oversold and the last "extreme" reading was very close to the overbought area. This is also a bearish hint pointing to the possibility of more action to the downside. This is not sure, nothing in the market is, but the bearish indications are very much in place, in our opinion.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

If you enjoyed the above discussion of gold seasonality and our analysis, we encourage you to stay up-to-date with our free articles and alerts - sign up for our gold mailing list today. It’s free and if you don’t like it, you can easily unsubscribe.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.