Stock Market and Crude Oil Price Tops?

Stock-Markets / Stock Markets 2016 Mar 29, 2016 - 08:36 AM GMTBy: Chris_Vermeulen

Stock markets rebounded solidly from their lows of February 11th, 2016, making new multi-month highs, earlier last week. The SPX rescinded 0.7% by the end of last week. These market gains can be attributed to the very bullish decisions of the European Central Bank (ECB) and the FED Central Banks. On March 10th, 2016, the ECB surprised the financial world by announcing a much stronger than expected stimulus package. One week later, the FED announced that it would not raise its’ short-term interest rates. It was only three months earlier, back in December of 2015, that they suggested that they would raise rates four times in 2016. It is now my belief, that they will not raise short- term interest ‘materially’ in 2016.

Stock markets rebounded solidly from their lows of February 11th, 2016, making new multi-month highs, earlier last week. The SPX rescinded 0.7% by the end of last week. These market gains can be attributed to the very bullish decisions of the European Central Bank (ECB) and the FED Central Banks. On March 10th, 2016, the ECB surprised the financial world by announcing a much stronger than expected stimulus package. One week later, the FED announced that it would not raise its’ short-term interest rates. It was only three months earlier, back in December of 2015, that they suggested that they would raise rates four times in 2016. It is now my belief, that they will not raise short- term interest ‘materially’ in 2016.

Most broad-based indexes are now trading flat thus far in 2016, as range-bound conditions persist. FED members will be speaking during the course of this week, including FED Chairwoman Dr. Yellen who will speak, tomorrow morning, Tuesday, March 29th, 2016, to discuss the next move of this unprecedented intervention.

The change of attitude is due to the fact that the global economy is so weak that Central Bankers fear a ‘market crash’. Obviously, they want economic growth. They want inflation, but, so far that has not materialized. They have had the power and independence, in these past seven years to do so, but we are still spiraling towards ‘deflation’. What they have achieved was ‘Asset Inflation’ and ‘Earning Inflation’. We will see and feel the effect of such ‘excessive monetary stimulus’ induced by the Central Banks, very shortly.

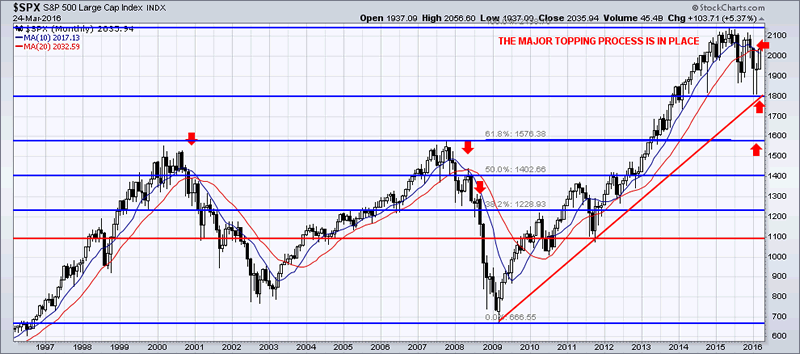

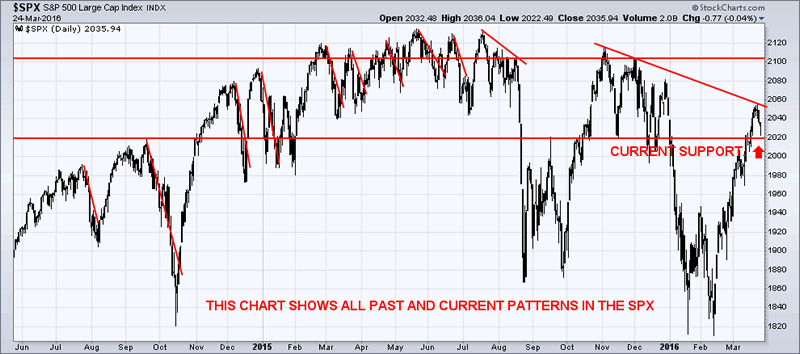

The charts of stock markets are still long- term bearish (refer to the charts below) and are currently approaching a critical juncture! This is a location that we could see a very short -term bounce, but I am not interested in taking any long positions. The markets could still push a bit higher. In April 2016, global stocks will enter their annual period of negative seasonality along with its’ bearish technical internals. I am waiting for confirmation of the top being in place, in order to finally recommend Inverse ETFs.

Overall, this is just the beginning of the major SPX turn. We are currently at an ‘ideal resistance’ area. The SPX is currently in a downward channel. The momentum oscillators are extremely overbought and are now trending downwards. They need to cycle back down. Volume is declining with higher prices and that is a sign of weakness. I will keep monitoring this new major event which continues to slowly unfold.

The U.S Dollar has moved up in the past few days. This is placing pressure on gold, silver and crude oil. The retracement of gold and silver is now in the process, as I have been discussing over the past few weeks. We are heading even lower for a fantastic long term entry.

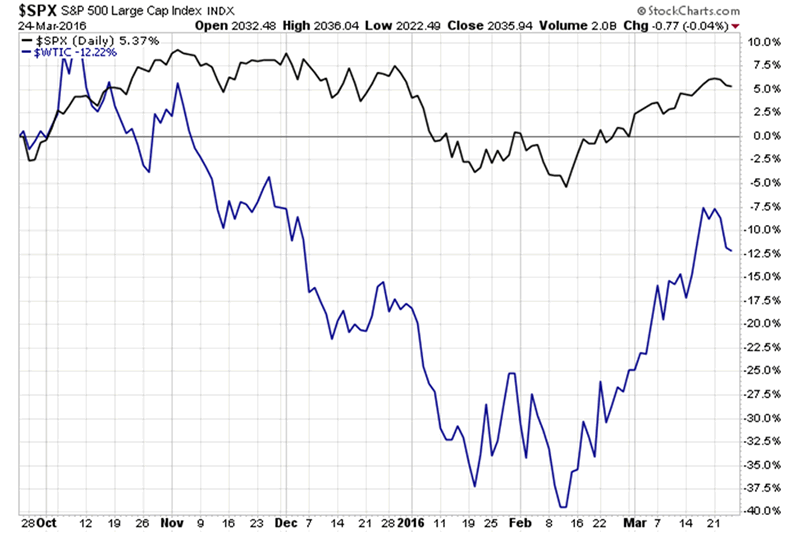

Stock Market & Crude Oil Relationship

The recent month long rally in stocks which started early in February was given a lot of upside momentum from the rising price in crude oil. But when oil stalls, tops and starts another decline expect the stock market to fall fast and hard.

Market Tops: S&P 500 and Crude Oil Conclusion:

In short, the stock market and crude oil prices have posted some serious gains in the past month. But both are not showing signs of weakness in terms of price action, buying volume, and cycle analysis.

We may see stocks and oil hold up and possibly make minor new highs over the next five to ten sessions but it’s going to be a struggle (choppy market) before we likely see the next market selloff.

Time The Market Using Inverse and Leveraged ETF’s: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.