President Obama is the One Peddling Fiction on State of US Economy

Economics / US Economy Mar 14, 2016 - 12:32 PM GMTBy: Michael_Pento

In his final State of the Union Address, President Obama chided, "Anyone claiming that America's economy is in decline is peddling fiction." Following the recently released February Non-farm Payroll Report, which showed a net increase of 242 thousand jobs, he doubled down on that same contention. The seemingly robust number of new jobs created prompted the President to remark, "The numbers and the facts don't lie, and I think it's useful given that there seems to be an alternative reality out there from some of the political folks that America is down in the dumps. It's not. America is pretty darn great right now."

In his final State of the Union Address, President Obama chided, "Anyone claiming that America's economy is in decline is peddling fiction." Following the recently released February Non-farm Payroll Report, which showed a net increase of 242 thousand jobs, he doubled down on that same contention. The seemingly robust number of new jobs created prompted the President to remark, "The numbers and the facts don't lie, and I think it's useful given that there seems to be an alternative reality out there from some of the political folks that America is down in the dumps. It's not. America is pretty darn great right now."

But the truth is, that headline jobs number for February was very misleading, and it is you, Mr. Obama, who is peddling fiction.

First, even though there were 242 thousand net new jobs created, there were fewer hours worked during the month. The Index of Aggregate Hours Worked shrank by 0.4 points to 104.9, from 105.3 in January. This means there were actually less total hours worked in the economy during February than in January.

This could only be the case if the number of full-time jobs diminished at a faster clip than the amount of part-time jobs created. In fact, the Household Employment Survey hints at this conclusion, as the number of part-time jobs created outstripped the number of full-time jobs by 7.5 to 1.

It makes perfect sense that this part-time, Uber-driver economy would also produce an average hourly work week that shrank by 0.2 hours, to 34.4; and that average hourly wages declined for the month by 3 cents.

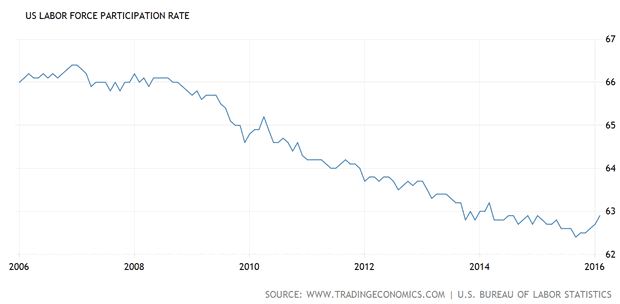

Then we have the labor-force participation rate, or the share of American non-institutionalized civilians over the age of 16 who are either working or looking for a job. This ratio dropped dramatically in the wake of the 2008 financial crisis, yet has also failed to make a meaningful rebound since.

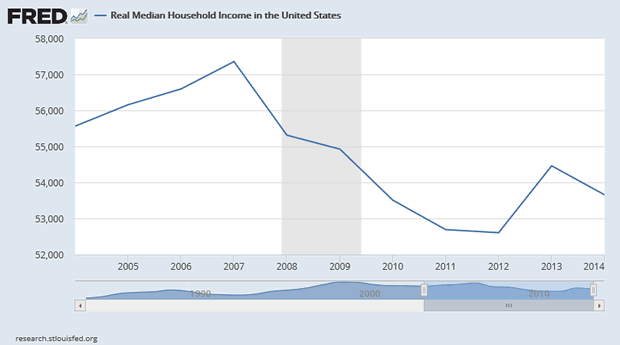

Adding to this number of despondent would-be workers, is the fact that those who enjoy gainful employment have suffered with a lack of real income growth.

A falling work week, dropping wages and fewer hours worked does not make for a good employment report or a healthy consumer. However, it isn't just the employment conditions in the U.S. that depict a weak economy.

According to the Census Bureau, a record 46.2 million persons, roughly one in seven Americans (14.2%), currently live below the poverty line. That rate was 12.5% before Obama took office. And we have an astonishing 51 million Americans who live just above this official threshold--making 50% of all Americans living in or near the penury class.

Despite the recovery myth touted by Mr. Obama, the amount of wealth held by the bottom 50% of the U.S. population declined to 1.05% in 2013. This is less than half of what it was in 2007, when the share of the country's wealth held by the poorest 50% of the population was 2.5%.

According to government statistics, the rate of poverty for every year under the Obama presidency has been higher than it was for each year during the horrific economic stewardship of George W. Bush's presidency.

In addition, the number of beneficiaries on the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, has surpassed 46 million, according to the Department of Agriculture (USDA)--that's 14.6% of the population. Back In 2008 there were 28.2 million people on food stamps, or 9.2% of the population. To put this in perspective, in 1969 participation in the SNAP program stood at $2.8 million, or just 1.4% of the population.

With Americans living less prosperously, it's not surprising that household debt has increased back to 2007 record levels of $14.1 trillion. Business debt has also ballooned from $10.1 trillion, to $12.6 trillion. And our National Debt boomed from $9.2 trillion, to $19 trillion. And to keep all this debt more palatable, the Fed's balance sheet has exploded from $880 billion, to $4.5 trillion. All this means the tenuous and anemic state of the U.S. economy is merely held together by the tape and glue provided by the Fed's artificially-low interest rates.

To be sure, President Obama is clueless about what will happen to the fragile U.S. consumer after interest rates normalize. But once inflation targets are achieved by the Keynesian counterfeiters that run global governments and central banks, interest rates will indeed spike. And then it will become shockingly clear that the economic recovery was just a mirage created by the real fiction peddlers in Washington, Beijing, Brussels and Tokyo.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.