Money Velocity Proves Q.E. Failure

Interest-Rates / Money Supply Mar 13, 2016 - 04:44 PM GMTBy: Jim_Willie_CB

The current monetary policy is stuck in place. It is highly destructive to banking systems, working capital, and financial markets. Yet it continues ad infinitum, actually until the great collapse. A systemic Lehman event is in progress, as the global financial structure is collapsing. The only remedy is the Gold Standard installation, which is happening, but its architects are from the East. They are labeled as enemies, when the root problem is in the Western banking hive.

The current monetary policy is stuck in place. It is highly destructive to banking systems, working capital, and financial markets. Yet it continues ad infinitum, actually until the great collapse. A systemic Lehman event is in progress, as the global financial structure is collapsing. The only remedy is the Gold Standard installation, which is happening, but its architects are from the East. They are labeled as enemies, when the root problem is in the Western banking hive.

The quickening has begun in earnest. The end game began in November with events picking up speed, remedy engaged in progressive steps, and geopolitical balance of power shifting in serious manner. The origin of the systemic failure can be found rather easily. Refer to just the last several years. Of course the seminal point was the creation of the Federal Reserve in 1913. Of course another critical event was the murder of President Kennedy, a champion of sound money. He joined Garfield and McKinley in that respect, as assassinated US Presidents, the common link being their favor of the Gold Standard or sound money. Of course another key point was the abrogation of the Bretton Woods Accord in regards to the Gold Standard Agreement. Following the Tequila Crisis in Mexico in 1994, the expansion of margin credit and debt was insane. The climax in recognition was Greenspan's famous admission of Irrational Exuberance, which bears his blame. Following the tech-telecom bust in 2000, the expansion of every conceivable type of credit and debt was insane. A natural recession was actively avoided, assuring a doubled effect several years later. Following the Lehman failure, every possible wrong decision was made, in vigorous pursuit of continued fraudulent money and sustained criminal banking enterprise. To be sure, no solution or remedy or reform has been sought. What comes is a new systemic Lehman event, in a crash of the global bond, banking, and currency systems together.

The systemic failure was guaranteed in my mind, when the big banks were given license to continue operations even while both insolvent and guilty of multi-$billion fraud. Such is the essence of the Fascist Business Model, a term most mainline economists and financial analysts rigorously avoid. No big US or London bank has been convicted of a felony, nor any executive from their bank firms gone to prison. This license was joined with the extraordinary corruption of money in the last gasp of monetary excess. The result was a required liberalization of monetary policy, which put the systemic failure on a guaranteed time line. The Quantitative Easing (QE) monetary policy is highly destructive. It combines with another equally destructive measure in the Zero Interest Rate Policy (ZIRP). Together they are a double barreled shotgun killing the USEconomy and its financial structure. Worse, they are killing the Global Economy and its financial structure based upon the USDollar. Put aside motive or intention to scuttle the nation. Focus instead on the wreckage from official policies in place, both of which the Jackass forecasted to occur, and both of which were also forecasted to remain in place permanently by this analyst.

It is indeed curious that almost no mainstream economists or analysts mention the permanence of the current destructive monetary policy. They might mention its permanence, but they do not attribute blame for the systemic breakdown on the monetary policy, which is highly destructive. They might mention distortions or some accurate observation of aberration, but they do not indict the monetary policy itself as the root problem in the unstoppable decline. The recognized brain trust surely do not recommend a return to the Gold Standard as a viable honorable effective remedy. They do not ever mention license for criminality in the banking centers linked all too closely to the USGovt.

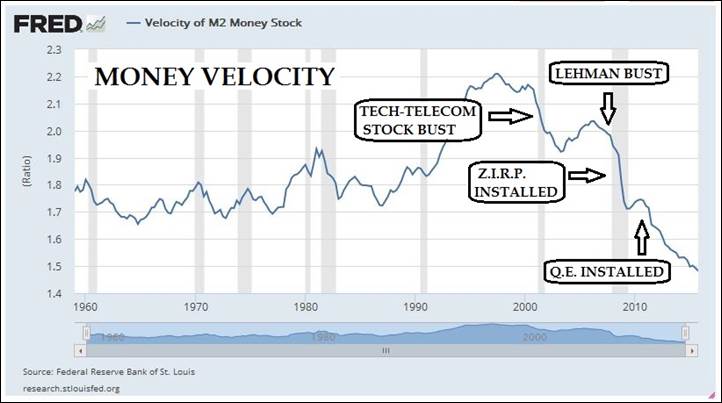

MONEY VELOCITY DECLINE

Stimulus implies greater activity, more encouraged movement. A spur in a horse's flank or a crack of the whip will induce a sudden acceleration in the harnessed animal. That is stimulus. A burst of nitro or naphtha to a racing car engine will induce a sudden acceleration in the souped-up machine. That is stimulus. A couple of whiskey chasers at a bar can give a guy some newfound courage to approach an attractive woman for a dance or a romp. That is stimulus. To be sure, QE & ZIRP help the big bank sector with redeemed toxic bonds, with bond carry trade potential, with rising values of doomed items like junk bonds. They even help the big banks directly with stock buyouts as the USFed illicitly buys bank stocks.

However, QE and ZIRP are not stimulus agents to the USEconomy. They are a death sentence. They are not viable support for the USD-based financial structure. They are destructive elements. The business investment, often called capital expenditures (CAPEX) has largely taken place in foreign lands. Most multi-national corporations did not expand inside the United States for a number of reasons. The US corporate tax rate is the highest in the industrial world. The US environmental regulations are the most strict in the industrial world. The federal regulatory oversight and interference is the most burdensome in the industrial world. So large companies have conducted expansion in the Emerging Market Nations. Where those nations grossly expanded their official debt at the sovereign level, they have been bankrupted on the currency impact. Such is not stimulus. The proof of ineffective policy is found in the fast decline in money velocity. It is defined in loose terms as the number of economic round trips for money within the economy during a given cycle. It is akin to how often your car's oil circulates within the engine, finding the same molecules at the starting point of the pistons shafts and cylinders in a given period of time, like a month.

If monetary policy had any shred of stimulus, the chart below would not appear as such a horrendous decline. The Jackass concludes that QE & ZIRP are the most destructive monetary policy in modern history, rendering the King Dollar not only on a reign of terror, but an instrument like a headache ball at a demolition site. The result has been capital destruction and dampened economic activity for several years. The policy guarantees systemic failure on a time line. A systemic Lehman failure event is in progress, not so much approaching, but already here, in progress.

The systemic failure has a point of origin, the United States and the Federal Reserve. The incredible USDollar shortage from the global margin call has lifted the global reserve currency to troublesome levels, only to cause severe damage across the many nations. The Emerging Market Nations took the bait, and added to their debt, told by Western bankers of no inherent risk. Obviously no interest rate risk was at work, but plenty of currency risk in effect. The USDollar has turned toxic. This margin call pressure comes at the same time as the vast Petro-Dollar machinery is being dismantled. The entire financial structures are crumbling and falling apart, while the official monetary policy only makes the conditions worse.

PERMANENT QE & ZIRP IN REALITY

The QE policy is not stimulus, no way, not by any basic definition. The ZIRP policy is not stimulus, not by any sensible reasonable or logical manner. QE represents multi-$trillion slush money to aid the Wall Street criminal banking center. QE has been expanded abroad, beyond the USFed offices (see BLICS), even to involve confiscations (see Japanese pensions). The QE has been joined since December by the gigantic clandestine arm known as the Exchange Stabilization Fund, operated by the USDept Treasury. With recent additions, one can truly call the monetary policy QE to Infinity. Maybe the term QE to Infinity Squared makes sense, a take-off of their CDO Squared lunatic bond instruments. Refer to Collateralized Debt Obligations, where leverage was applied twice.

The ZIRP enables the more efficient feedstock and lubrication for Interest Rate Swap machinery. The ZIRP enables a bond carry trade for easy Wall Street bank profits. The ZIRP actually slows the USEconomy in an utterly obvious way, with reduced income flows from pension funds, insurance treasuries, and individual retirees. The wet blanket is obvious and universal in its dampening effect. With its integral parts impossible to remove, one can truly call the monetary policy ZIRP Forever. The central bankers are truly stuck, not just in mud, but in quicksand. They are sinking, and their central bank franchise system is facing total ruin.

Together they guarantee a systemic failure. The Zimbabwe hyper monetary inflation undermines the entire global banking system in its reserves management structure. An African style inflation to global reserves cannot continue, and has forced an alternative system to be constructed, by the East. The ultra-low interest undermines the risk reward for savings, inhibits the economic flows, and distorts asset values universally. The USFed has truly destroyed the global economy and financial structure. The unfolding events are toward systemic failure and forcing the installation of the Gold Standard. It is the long avoided solution.

NEW SCHEISS DOLLAR & GOLD TRADE STANDARD

In time, expect an eventual refusal by Eastern producing nations to accept USTreasury Bills in payment for trade. The IMF reversal decision assures this USTBill blockade in time, and might accelerate the timetable. The United States Govt cannot continue on five glaring fronts of gross negligence and major violations. These violations have prompted the BRICS & Alliance nations to hasten their development of diverse non-USD platforms toward the goal of displacing the USDollar while at the same time take steps toward the return of the Gold Standard. The violations are:

1) to import finished goods and crude commodities, paying with IOU coupons

2) to commit multi-$trillion bond fraud in its big banks, done without legal prosecution

3) to do QE bond purchases in applied hyper monetary inflation, monetizing debt

4) to rig all major financial markets in favor of the primal USDollar

5) to engage in numerous regional wars to support the USDollar.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS."As a Golden Jackass subscriber, I greatly enjoy listening to your interviews because it really lends a sense of passion that lies behind the tremendous body of information and formulation that goes into your monthly research. Though I must admit, it scares the hell out of me most of the time. Still, I will not miss it for the world. I feel that having a truly objective insight from your research, in depth analysis, and accurate forecasts gives me and my family an important life saving advantage. And I mean that sincerely."

(MichaelS in Ontario)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.