The Gold Correction Is Here

Commodities /

Gold and Silver 2016

Mar 12, 2016 - 07:53 PM GMT

By: DW

Ben Morris writes: The price of gold is up 21% since the middle of December... from $1,051 an ounce to $1,270.

Ben Morris writes: The price of gold is up 21% since the middle of December... from $1,051 an ounce to $1,270.

That's its biggest rally since gold peaked in 2011...

And historically, such big rallies are almost always followed by corrections – periods when prices fall.

That's why conventional wisdom says, "If you missed the initial rally, buy on a pullback."

"Buy on a pullback" is good advice for lots of people. If you own some gold and have a little money in gold stocks, you'll likely be able to add to your positions soon, at better prices than today's.

That's what I plan to do personally. And that's what I recommended to readers of my newsletter, DailyWealth Trader (DWT).

But the biggest risk you face with gold today isn't buying just before a sharp correction. It's the possibility that there won't be a significant correction, and that you don't own enough gold... or worse, any at all.

I consider physical precious metals – especially gold and silver – an important part of any "catastrophe-prevention plan." I like to think of them as an alternative form of savings.

They're not a replacement for cash.

I suggest holding cash, too. But cash has a major flaw... Governments can, and do, print massive amounts of it.

Just as creating more shares of a company makes every other share less valuable, adding cash to the existing supply makes it less valuable, too. Over time, your cash savings buys less and less.

On the other hand, gold and silver have been used as money for thousands of years. Governments can't print gold and silver on a whim, as they do with paper currencies. So people turn to these metals when they're worried about the value of their cash declining.

Plus, now negative interest rates are spreading throughout the world... which make it harder than ever to save.

As Steve Sjuggerud said in the latest edition of his True Wealth Systems advisory, "The logic is simple... When both gold and paper pay you zero-percent interest, you should prefer gold over paper."

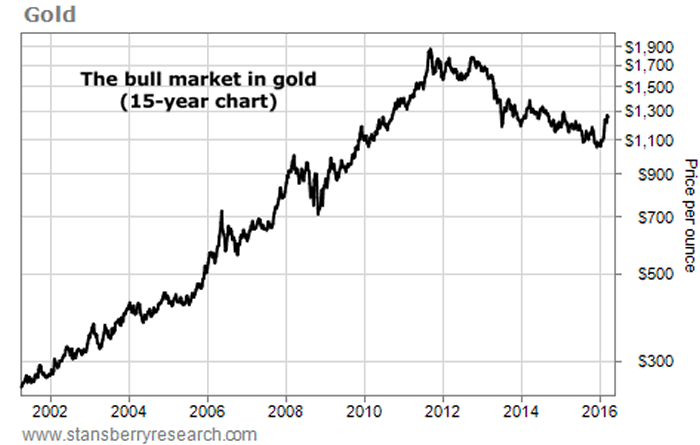

With that in mind, let's take a longer-term look at gold. The 15-year chart below shows the big bull market that took the price of gold from around $250 an ounce... up to $1,900 an ounce... and back down to around $1,270, where it is today.

If you don't have at least 5% of your wealth in precious metals – and you're not buying because you're waiting for a correction – take another look at the chart above...

This IS the correction. It's time to buy gold. While you're at it, buy silver, too.

It's cheap relative to gold. You can also buy the physical gold and silver closed-end fund ("CEF"), which currently trades at a 5% discount to the value of the gold and silver it holds.

Trading gold stocks is a little different. They're not stores of wealth, like physical gold. But they can produce extraordinary returns when gold prices rise.

If you already own gold stocks, congratulations. You may want to wait for a pullback before adding to your positions.

If you don't own any gold stocks, you should consider "dipping your toe in" today. Buy some now... and hopefully you'll get a chance to buy more at better prices.

Gold will pull back at some point. But there's no guarantee it will pull back soon... And there's no guarantee that when it does, it will come back down to today's levels or lower.

This could be the best day to buy gold for the next 20 years.

Regards,

Ben Morris

Editor's note: When it comes to making a fortune in gold, no one is better than John Doody. His one-of-a-kind strategy has led to huge gains... no matter what gold is doing. From 2001 to 2015, while gold stocks fell 12%, his strategy returned 369%. And during the depths of the financial crisis from 2008 to 2010, John's strategy outperformed gold bullion by 11 times, turning every $10,000 into more than $106,000.

Right now, John is offering a special, limited-time deal for Stansberry Research readers. Learn more about this offer – and his trading system –

right here.

Source: http://dailywealth.com/3224/the-correction-in-gold-is-here

http://www.dailywealth.com

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Ben Morris writes: The price of gold is up 21% since the middle of December... from $1,051 an ounce to $1,270.

Ben Morris writes: The price of gold is up 21% since the middle of December... from $1,051 an ounce to $1,270.