Future Gold Prices

Commodities / Gold and Silver 2016 Mar 07, 2016 - 03:29 PM GMTBy: DeviantInvestor

The internet is filled with predictions for the price of gold, from $500 to $50,000 per ounce. It depends on your world view.

The internet is filled with predictions for the price of gold, from $500 to $50,000 per ounce. It depends on your world view.

If you are a central banker or a powerful financial player which often supplies loyal employees to serve as Secretary of the U.S. Treasury, the low gold numbers look good.

Or, if you understand the incredible $200+ Trillion of debt the world has accumulated and realize it can’t be repaid, then gold at $10,000 probably looks inevitable. Crashes occur and sovereign debt markets look like paper bubbles with disastrous potential to send gold much higher.

A better approach to estimating future gold prices, in my opinion, is to start with a world view and project relevant gold prices. I suggest three simple scenarios, as I stated in my article, “Silver Prices in Five Years?”

Scenario One – status quo: The next five years could look much like the last 20 – 40 years. Politicians spend too much money, debt expands exponentially, central banks monetize debt and desperately inflate and reflate bubbles to maintain their power and continue the transfer of wealth from the many to the few. This is “status quo” or “more of the same” and indicates that gold prices will rise substantially, but not in a hyperinflation.

Scenario Two – deflationary crash: Deflationary forces overwhelm the financial system and central bankers and politicians can’t or won’t reverse those deflationary forces. In that scenario most paper assets crash while the purchasing power of gold increases far more. Central bankers will do almost anything to avoid this scenario.

Scenario Three – deflation and hyperinflation: Deflationary forces temporarily crash the financial system (signs are visible in 2016-Q1), and eventually central bankers and governments inflate currencies, possibly to hyperinflationary levels in their heavy-handed reaction. In this scenario gold prices will go into the stratosphere – perhaps $5,000 or $50,000+ per ounce. The ultimate gold price in a hyperinflationary scenario is unpredictable since hyperinflationary forces feed upon themselves and destroy purchasing power unpredictably. Gold reached nearly 100 trillion Weimar Marks per ounce in 1923. Gold, if currently priced in 1945 (pre-devaluation) Argentina pesos would be over 10,000 trillion 1945 pesos. Hyperinflation is an ugly, destructive, and unpredictable process, even for a reserve currency.

In Scenario One – more of the same – we can reasonably expect:

Politicians and central bankers will manage the crisis of 2016-2017 as they have most other crises (such as 1987, 1998, 2000, 2008) by increasing spending, addressing an excess debt problem with even more debt, and pumping more “funny money” into the global financial system.

- Official US national debt increases more rapidly than its typical 9% per year compounded rate. (perhaps 10 – 12% per year)

- Dollars, euros, yen and other currencies devalue against each other and against real assets. (currency wars)

- Stock markets collapse further, and then, buoyed by central bank “printing” and currency devaluations, will rise.

- Depressed commodity prices will move much higher as currency devaluations are aggressively pursued by central banks.

- People and investors eventually realize that currencies are devaluing and they must avoid over-valued bonds, negative interest rates, crashing stock markets, and paper promises to preserve their savings. Gold prices will rally much higher based on increased investor demand in a supply constrained market.

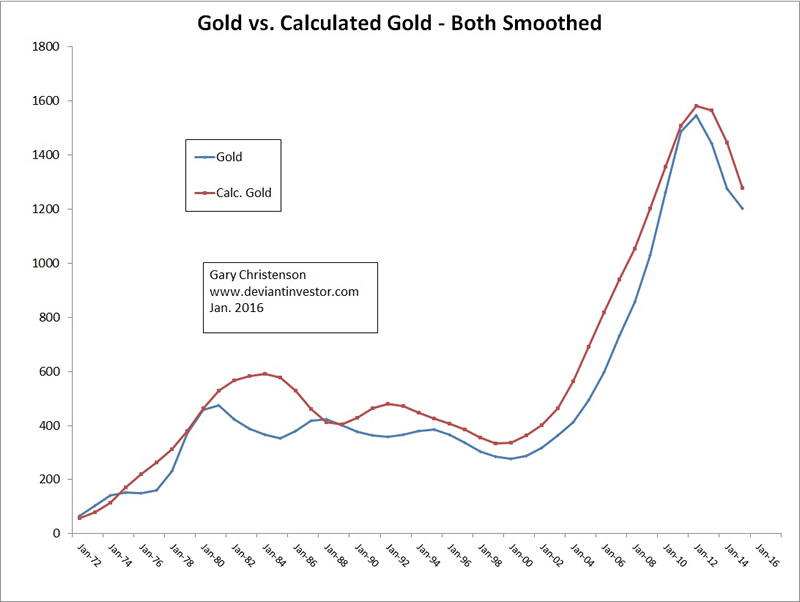

Given the above “status quo” scenario, the VALUATON model I described in my book, “Gold Value and Gold Prices From 1971 – 2021” is relevant. The model is based on three variables, the official US national debt, the price of crude oil, and the S&P 500 Index. I used prices smoothed with moving averages since 1971 to define the basic trend of gold prices. The correlation of the calculated gold (using smoothed prices) with the actual smoothed annual prices was about 0.98 since 1971.

This valuation model works well within a broad range of economic conditions, including stock and bond bull markets, bear markets, crude oil bubbles and crashes, various forms of Quantitative Easing, Democratic and Republican Presidents, wars, and occasional peace.

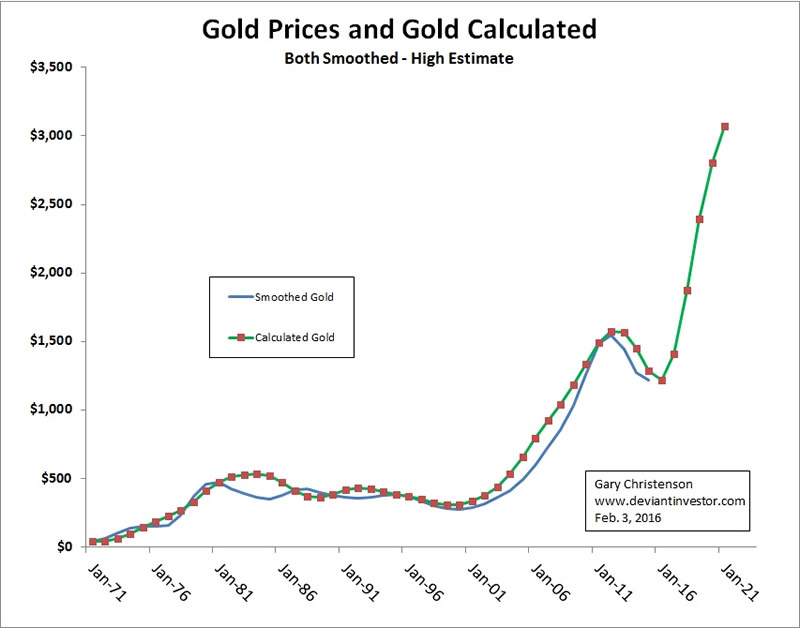

Using “status quo” assumptions for future increases in official national debt and crude oil, and a collapsing S&P 500 Index, I created the following graph of “calculated gold” for the next several years.

This is a model based on reasonable assumptions but there is no guarantee those assumptions will be fulfilled. Strange and unexpected events have unfolded in the past decade. Examples:

- In 2007 few expected the S&P 500 to fall below 700.

- Who expected seven years of essentially zero interest rates in the US after the 2008 crisis?

- Three years ago who would have predicted that in excess of $7 Trillion in sovereign debt in 2016 would yield “negative interest?”

- Who in 2013 would have predicted sub-$30 crude oil?

My Point is:

- Strange and unpredictable events occur in a central banker controlled world dominated by overwhelming debt.

- Secondary and tertiary consequences of stupidity, wars, QE, ZIRP, and negative interest rates are difficult to predict.

- A deflationary collapse and hyperinflation are perhaps as likely as the four strange and unexpected examples above.

- Gold prices in a deflationary collapse or hyperinflationary blow-off are difficult to imagine.

- The more likely expectation, in my opinion, is a continuation of the “status quo” financial conditions we have experienced since 1971.

The model suggests that a reasonable “status quo” valuation for gold in 2021 is around $3,000. Prices will fall below and occasionally spike much higher than the valuation so a gold price of $5,000 in 2020 – 2022 is plausible. This is not a prediction! It is based on the observation that central banks devalue their currencies, governments spend to excess, and those actions affect the prices for crude oil, stocks, commodities, and gold. The model suggests that central bank devaluations and government actions could push gold prices to $3,000 to $5,000 in roughly five years, as central bank devaluations and government actions have pushed gold prices from about $40 in 1971 to about $1,200 in 2016.

CONCLUSIONS:

- How crazy will it get? The future price of gold is very much dependent upon the reactions of governments and central banks regarding the current deflationary forces.

- Status quo response: $3,000 – $5,000 per ounce is quite possible at some time in 2020 – 2022, if not sooner.

- Deflationary crash response: Gold will substantially increase in purchasing power, but its price in dollars, euros, yen, etc. is difficult to estimate, depending upon the economic damage that occurs.

- Hyperinflationary response: The price of gold will be unbelievably high.

I encourage you to purchase my book, “Gold Value and Gold Prices From 1971 – 2021.” It describes my empirical gold model. That book is available for $11.00 in paperback at www.gechristenson.com and Amazon. E-books are also available.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.