Gold and Silver Note Of Caution (And Ambiguity)

Commodities / Gold and Silver 2016 Mar 06, 2016 - 02:57 PM GMTBy: John_Rubino

Suddenly, gold and silver are good again. In two short months, they've morphed from targets of derision to shiny new toys on the financial playground.

Suddenly, gold and silver are good again. In two short months, they've morphed from targets of derision to shiny new toys on the financial playground.

Not surprisingly, questions have been pouring in from people who kind-of sort-of know the precious metals story and are wondering if they should jump in with both feet. A reasonable response: "If your time frame is the coming decade, sure, go for it. But if you're thinking in terms of months rather than years, you should be considering entry points and accumulation strategy."

Which brings us to the Commitment of Traders (COT) report. Most new precious metals investors have never heard of it. And since it seems to be a pretty good indicator of those metals' short-term price fluctuations, this might be a useful time to define and explain it. So here goes:

Gold and silver prices are set in the "paper" market where big players trade futures contracts that enable them to buy (or require them to deliver) large amounts of metal at some point in the future. There are two main groups in this market: The fabricators who buy metal and turn it into coins or jewelry or whatever, and the speculators (hedge funds and other institutional gamblers) who use futures contracts to bet on the metals' price movements.

Over and over again, the fabricators trick the speculators into piling in or out at exactly the wrong time, thus moving prices in ways that benefit the former. They might, for instance, sell a few contracts into the market when most traders are at lunch or home for the night, pushing the price down and activating hedge fund stop-loss orders. Those sales push prices down further, activating technical signals that cause momentum traders to short the market, producing yet another sharp drop. Then the fabricators step in and buy very cheaply -- raising prices a bit and leading speculators to go long, pushing prices back up to where the game began. As observers like to say, "wash, rinse, repeat."

The COT report quantifies who's long and who's short and by how much, which makes it a snapshot of how the above game is going.

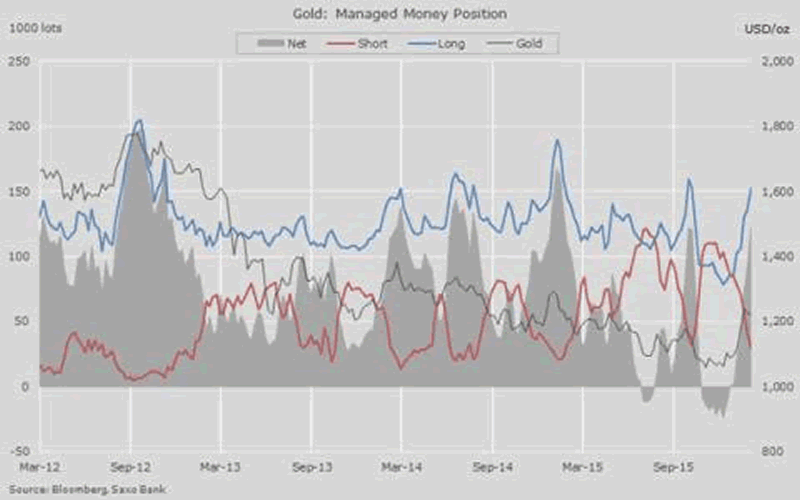

Here, for instance, is a chart showing what the speculators are up to. When the blue line depicting their long positions and the red line depicting their shorts diverge, that means hedge funds and other traders have been suckered into betting on a gold price surge. When the lines converge, speculators have been fooled into betting aggressively on a decline. The thin gray line is the price of gold. As you can see it tends to do the opposite of what the speculators expect.

What is this chart saying now? Well, the lines have diverged, indicating that speculators are extremely bullish. History says they are now sheep lining up for slaughter, in the form of a gold price correction which forces them to cover at a loss. So -- again, based on history -- a better entry point for incoming gold investors might be a few months off.

However -- and this is a very big caveat -- indicators work until they don't. Someday the paper markets will be overwhelmed by a tsunami of demand for physical metal. The commodities exchanges on which futures trade will run out of inventory and default when too many holders of long contracts demand delivery, and gold and silver will rocket higher. On that day everyone who isn't fully invested in precious metals will be out of luck.

And some claim that day is at hand. In a recent King World News interview, metals trader Andrew Maguire noted: "Now that we are entering a negative rate world, I am seeing a lot of very large-sized institutional money looking for a home. Some of this money is flowing into gold, and this is confusing technical traders who are battling what looks like a technically overbought gold market..."

So for new precious metals buyers, is it better to get in gradually, using the COT report and other indicators to help define entry points? Or should they ignore the squiggles, stop being cute and just fully commit on the assumption that whatever price they pay today will be dwarfed by what prevails when the system finally breaks down?

There isn't, alas, a one-size-fits-all answer to such a question. So why bother discussing it? Because it's interesting. And more information is always better than less.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.