Gold And Silver Charts Reviewed

Commodities / Gold and Silver 2016 Mar 06, 2016 - 03:48 AM GMTBy: Michael_Noonan

In last week’s commentary, February Heralding End Of Down Trend?, we stated: The significance of February is its decided change in market behavior on the monthly and weekly charts.” We are seeing even more evidence to support that premise, and all that is required is to observe the next corrective reaction to see where, at what level, price tests prior to resuming the start of an uptrend that began last December.

In last week’s commentary, February Heralding End Of Down Trend?, we stated: The significance of February is its decided change in market behavior on the monthly and weekly charts.” We are seeing even more evidence to support that premise, and all that is required is to observe the next corrective reaction to see where, at what level, price tests prior to resuming the start of an uptrend that began last December.

We noted that the monthly bar for February [See first chart], was wide range to the up side with a strong close, and it marked the potential for an important change in market behavior that could mean December 2016 may be the final low of this protracted 6 year correction.

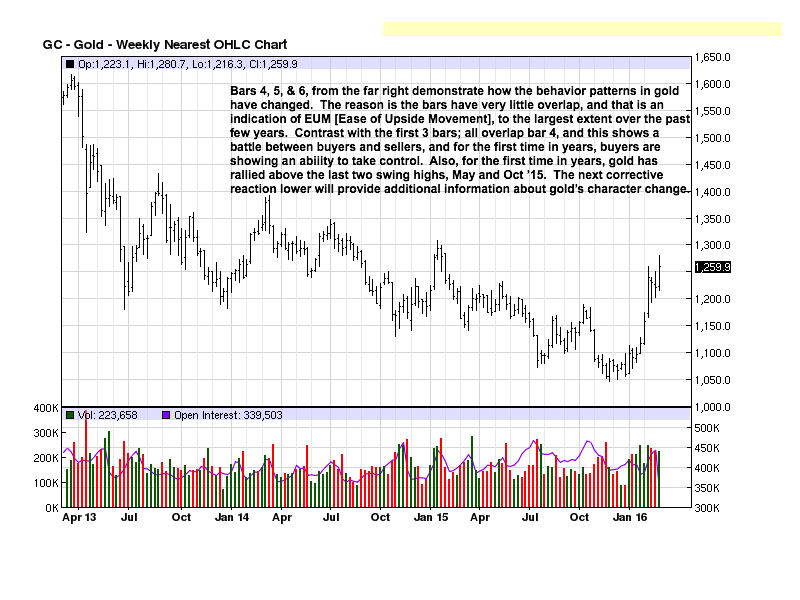

The current weekly chart added yet more gains for gold, and it is rightly attracting a lot of attention. People are always in a hurry to have someone say the bottom is in and a bull trend is underway. That is not how markets work. There were many who called bottoms for gold in the last failed lower swing lows and saying higher prices would soon follow. We were not among them because there was no subsequent market activity to confirm a low, and price made now four more lower swing lows since the failed swing low in June 2013.

“This time, it’s different,” and that may be, but we still need to see a correction that makes a higher swing low, and the correction should have certain characteristics that typify a temporary correction to be followed by another leg higher, as opposed to simply another continuation move lower in a bear trend.

The fact that last week extended the recent gains for gold gives more credence to last December possibly marking the beginning of a turnaround that will start an up trend. Last week’s high, up to the 1,300 area swing high failure from January 2015, will not be as easily exceeded to the upside. Throughout all of last week, there were no signs of supply [selling] entering the market to prevent the gains made. Positive signs are showing up with greater frequency than has been evident in past gold rallies. The daily chart will start to show signs of correction or continuation, and it is where there will be more focus for near-term price development and what it means.

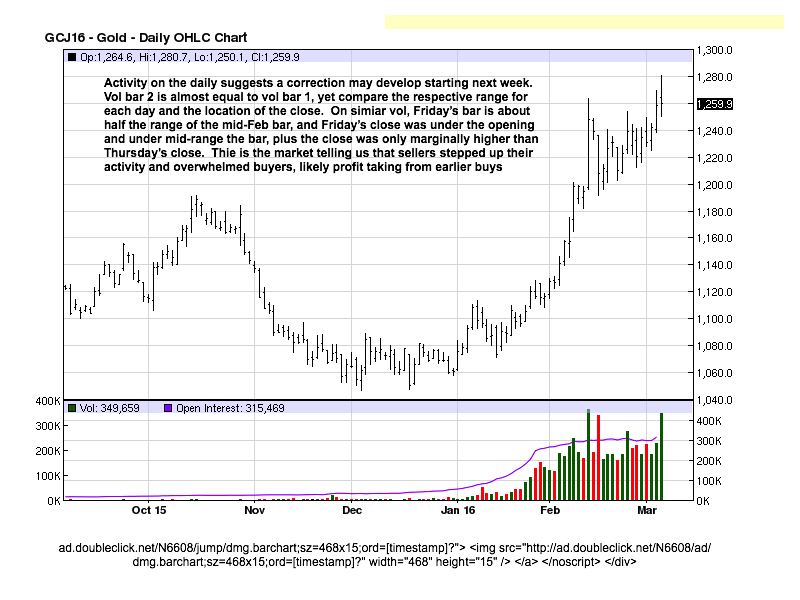

We have stated on many occasions that wide range price bars, particularly when accompanied with sharply higher volume, will usually be controlling subsequent price movement within the wide bar’s range. That was certainly true of the mid-February climatic rally as price traded within that range over the next 14 trading days. Friday rallied higher, but it looks more like a stopping day than one arguing for further upside continuation.

Chart comments note the comparison of the bar ranges for the two highest volume spikes. Friday’s volume spike shows a substantial effort to move price higher, but there was no payoff for all the effort exerted. The range was relatively small, price closed under the opening and under the mid-range point of the bar, and just slightly higher than Thursday.

This is a great example of why market-generated information is the most reliable and most current. The odds, or probabilities, favor Friday as marking a possible turning point, at least for the short-term. Moving averages and almost every other type of mechanical trading tool would lag on making such a determination.

We practice what we preach by having been consistently buying physical silver over the past few weeks. Physical gold and silver have no third-party counter risk, and there are no margin calls when owning and holding the physical. We have not made any buy recommendations for the gold paper futures market simply because the risks from the long side are not small, and there has been no confirmation of a bottom to justify going long against an established down trend.

It has not paid to chase gold rallies in the past, as all have failed. At some point, and

Friday cold be that point, a retest correction will take place. The manner in which any retest correction unfolds will speak volumes about the character or health for a change in trend behavior. If the nature of the next correction shows buyers taking control, that will mark an opportunity for taking long positions to speculate in the paper futures market.

We will keep a pulse on how the next correction develops. For now, keep buying and taking control of physical gold. Overall market and economic conditions will worsen as risks in all paper markets cease to make any sense.

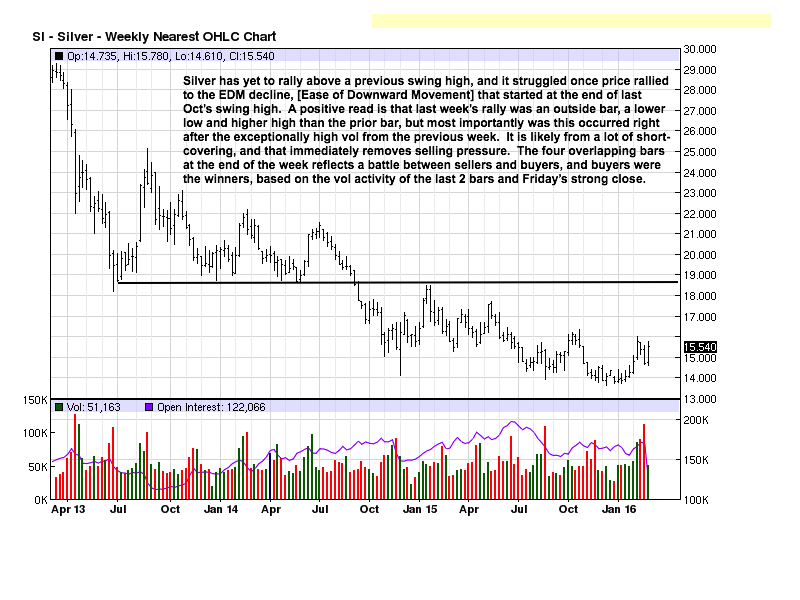

Silver does not even come close to conveying the level of potential change in trend as does gold. Last week did not even rally above the last swing high, so technically, silver remains entrenched in a bear market. The highest trading volume in the past three years was from two weeks ago. For all of that selling effort, there was no downside reward or payoff for the sellers.

That high volume range lower was totally erased with last week’s activity, and that bar may become notable as a reference point for a potential end of correction because exceptionally high volume bars result from controlling factors in the market with the public responding.

It is almost always a transfer from weak to strong hands in market positioning. Still, a change in direction is a process with singular events standing out indicating a change is developing.

The important money to be made will come from buying and holding the physical metal itself with no third-party counter-risk.

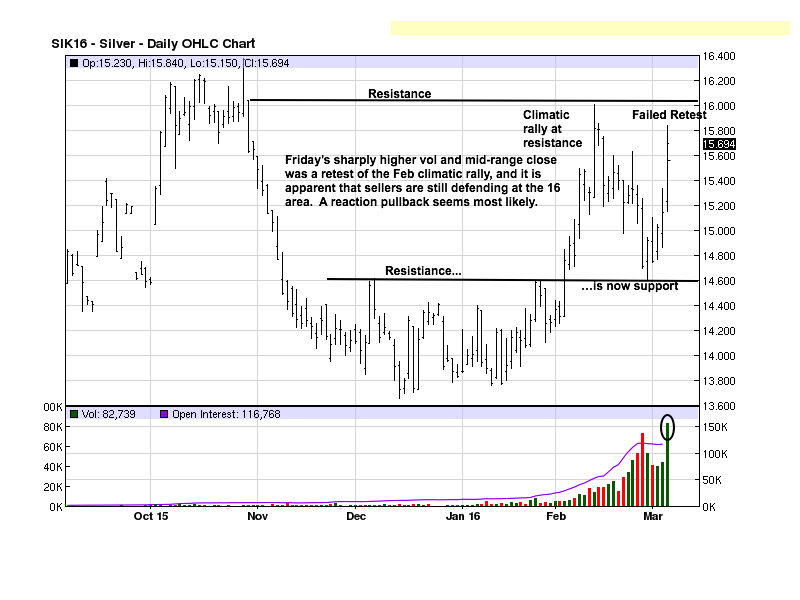

The failed swing high from last October continues its impact on the market, first in the failure itself, then the climatic ending rally in February. [See Charts Only from Feb 20th, 8th chart, daily. It shows the March contract and the climatic volume, and it serves as an example of how high volume surges can be controlling in market activity.]

We see another volume surge from Friday, labeled as a failed retest. The location of the close is around mid-range the bar telling us sellers were present and still controlling price behavior around the pivotal 16 area. Last week, we put a ? on the horizontal line that had been resistance in December and January, asking if that line would now become support.

It held perfectly when briefly touched, last Monday.

Our expectations remain for a reaction lower from last week’s highs as a retesting process for silver in what appears to be the end, or near the end of the manipulated correction.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.