The Great Corporate Earnngs Fraud

Companies / Corporate Earnings Mar 01, 2016 - 12:33 PM GMTBy: James_Quinn

"What are the odds that people will make smart decisions about money if they don't need to make smart decisions -- if they can get rich making dumb decisions? The incentives on Wall Street were all wrong; they're still all wrong." - Michael Lewis, The Big Short: Inside the Doomsday Machine

Corporate earnings reports for the fourth quarter are pretty much in the books. The deception, falsification, accounting manipulation, and propaganda utilized by mega-corporations and their compliant corporate media mouthpieces has been outrageously blatant. It reeks of desperation as the Wall Street shysters attempt to extract the last dollar from their muppet clients before this house of cards collapses.

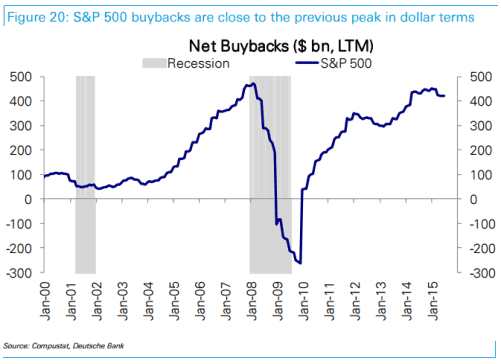

The CEOs of these mega-corporations accelerated their debt financed stock buybacks in 2015 as stock prices reached all-time highs and are currently so overvalued, they will deliver 0% returns over the next decade. This disgraceful act of pure greed by the Ivy League educated leaders of corporate America to boost their own stock based compensation is reckless and absurd.

It is proof education at our most prestigious universities has produced avaricious MBAs following financial models and each other like lemmings going over the cliff. Proof of their foolishness is self evident after perusing the chart below. These intellectual giants evidently never learned the basic rule of buying low and selling high in order to make a profitable trade.

The previous all-time high in stock buybacks occurred in 2008 at the previous peak. That brilliant strategy led to 50% shareholder losses in a matter of months. No Board of Directors fired any CEO for these disastrous strategic blunders. These cowardly ego maniacs didn't buy back any stock in 2009 and 2010 when they could have made a killing with valuations at decade lows. After the stock market recovered by 100%, these stooges then began borrowing and buying. It has now reached another all-time high crescendo.

Dividends and stock buybacks in 2015 topped $1 trillion for the first time according to S&P Capital IQ Global Markets Intelligence. As CEOs have borrowed billions to buyback their inflated overvalued stock, they have put the long-term sustainability of their firms at extreme risk.

When a dead retailer walking like Macy's, which is seeing it's sales fall and profits crater by 30%, announces a $1.5 billion stock buyback when it already is weighed down with $7 billion in debt, you realize the men running these companies have no common sense or concern for the long-term viability of their companies. They'll get a golden parachute no matter how badly they screw the pooch.

The stock buyback scheme by corporate CEOs is just one of the devious methods used to cover-up the dramatic downturn in corporate profits. These titans of industry, their Wall Street heroin dealers, and their corporate propaganda outlets need cover while they abscond with more of the nations wealth, before pulling the rug out from beneath the American people once again.

The 2008 Wall Street created financial crisis will look like a walk in the park compared to what's coming down the pike now. We now have a bond bubble, stock bubble, housing bubble, commercial real estate bubble and central banker confidence bubble all poised to pop simultaneously. The negative interest rate and banning of cash schemes will be dead on arrival, driving a stake into the heart of the Fed vampire.

"Oh, what a tangled web we weave...when first we practice to deceive." - Walter Scott

It's become perfectly clear to me over the last few weeks the deception, misdirection, spin, and outright accounting fraud being used to hide the horrific financial results of S&P 500 companies has been orchestrated by the corporations, Wall Street "analysts" and the likes of cheerleaders like CNBC.

When "dead retailer walking" J.C. Penney reported their fourth quarter results last week the stock immediately soared 15%. The Wall Street propaganda machine was declaring turnaround complete. Modest positive comp store sales after five years of double digit declines were proof J.C. Penney was back. I went to the company press release and no matter how hard I searched, they never mentioned their Net Income. They blathered on about EBITDA and adjusted earnings per share, but not a peep about the actual GAAP Net Income.

Once I was able to access their Income Statement I realized why. Their completed turnaround resulted in a $131 million 4th quarter loss, almost $100 million higher than last year's loss. They finished their turnaround year with a loss of more than a half BILLION dollars. This company will be on the retail scrap heap of history in a couple years, but the Wall Street fleecing machine tells its muppet clients to buy, buy, buy. And the lemmings do as they are told.

The other blatant manipulation and spin is headline after headline stating one company after another beat expectations. What you are not told is expectations at the beginning of the quarter were 20% higher than they were on the day they reported. The highly paid 30 year old MBA "analyst lemmings" are told by the companies to reduce earnings expectations as the quarter progresses.

Sometimes they pre-announce earnings will fall by 20% to $0.45 per share, then three weeks later announce actual results of $0.46 per share, therefore beating expectations. This game is getting long in the tooth. Corporate revenues have been falling for a number of quarters, and they have run out of accounting reserves to make the numbers. So they move on to plan C.

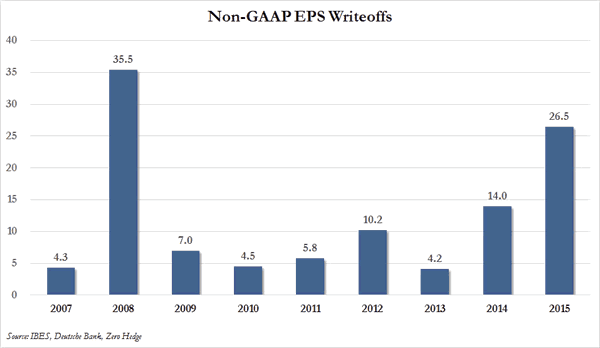

If you can't make the numbers work, just fake the numbers and call them "adjusted". So when a corporate CEO opens 50 retail stores that turn out to be dogs and is eventually forced to close the stores and fire 10,000 employees, they just call those one time charges and ignore the $50 million loss when reporting the results. Heads the CEO wins, tails the shareholders lose. Wall Street reports a beat, and the clueless investors believe the lies. It's all fun and games until the next financial crisis hits, recession sweeps across the land, and the fraud, deception, and lies are revealed.

Even the billionaire oligarch crony capitalist Warren Buffett addressed this despicably flagrant flaunting of basic accounting principles to mislead shareholders in his annual letter last week:

It has become common for managers to tell their owners to ignore certain expense items that are all too real. "Stock-based compensation" is the most egregious example. The very name says it all: "compensation." If compensation isn't an expense, what is it? And, if real and recurring expenses don't belong in the calculation of earnings, where in the world do they belong?

Wall Street analysts often play their part in this charade, too, parroting the phony, compensation-ignoring "earnings" figures fed them by managements. Maybe the offending analysts don't know any better. Or maybe they fear losing "access" to management. Or maybe they are cynical, telling themselves that since everyone else is playing the game, why shouldn't they go along with it. Whatever their reasoning, these analysts are guilty of propagating misleading numbers that can deceive investors.... When CEOs or investment bankers tout pre-depreciation figures such as EBITDA as a valuation guide, watch their noses lengthen while they speak.

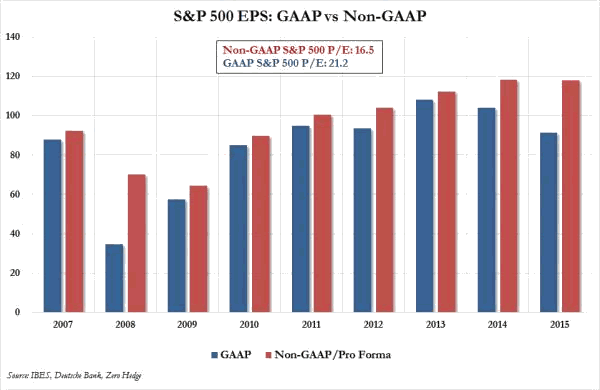

Buffett's words are borne out in the chart below. Based on fake reported earnings per share, the profits of the S&P 500 mega-corporations were essentially flat between 2014 and 2015. Using real GAAP results, earnings per share plunged by 12.7%, the largest decline since the memorable year of 2008. Despite persistent inquiry it is virtually impossible for a Wall Street outsider to gain access to the actual GAAP net income numbers for all S&P 500 companies. With almost $500 billion of shares bought back in 2015, the true decline in earnings is closer to 15%.

The increasing desperation of corporate CEOs is clear, as accounting gimmicks and attempts to manipulate earnings in 2015 has resulted in the 2nd largest discrepancy between reported results and GAAP results in history, only surpassed in 2008. The gaping 25% fissure between fantasy and reality means the S&P 500 PE ratio is actually 21.2 and not the falsified 16.5 propagated by Wall Street and their CNBC mouthpieces. True S&P 500 earnings are the lowest since 2010. Corporate profits only decline at this rate in the midst of recessions.

With approximately $270 billion of "one time" add-backs to income used to deceive the public, the true valuation of the median S&P 500 stock is now the highest in history - higher than 1929, 2000, and 2007. Wall Street's latest con game, with the active participation of corporate CEO co-conspirators, is a last ditch effort to fend off the inevitable stock market crash. It didn't work in 2008 and it won't work now. All economic indicators are flashing red for recession. Stocks are poised for a 40% decline faster than you can say Wall Street criminal banks.

The most infuriating aspect of this shameless ruse by corporate America and the Wall Street cabal is their complete lack of conscience or acknowledgment of misdeeds that destroyed the financial system in 2008. The American people bailed these sociopaths out, have borne the brunt of the QE and ZIRP save a banker programs, and are poised to get screwed again when financial collapse part two hits in the near future.

The establishment is aghast that Donald Trump is storming towards the presidency. They are blind to the fact their unconcealed felonious actions rise to the level of treason in the eyes of average hard working Americans. The fabric of this country is being torn asunder by a contemptible class of corporate fascists, ego maniacal bankers, shadowy billionaires, and media titans. They have reaped billions of profits since 2009 as the Fed and politicians in D.C. rolled out "solutions" designed to enrich them. They are confident their failures will be shifted to the American people again. The American people may have a different opinion this time. Pitchforks and torches are being readied.

"Success was individual achievement; failure was a social problem." - Michael Lewis, The Big Short: Inside the Doomsday Machine

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.