US Dollar Rebound Increases Near-Term Gold and Stocks Risk

Commodities / Gold and Silver Stocks 2016 Feb 28, 2016 - 08:11 AM GMTBy: Jordan_Roy_Byrne

Last week we noted that the odds favored more upside in precious metals before a larger correction would begin. While that view remains on track, we want to note the renewed strength in the US Dollar which could provide immediate resistance to higher levels in Gold and gold stocks.

Last week we noted that the odds favored more upside in precious metals before a larger correction would begin. While that view remains on track, we want to note the renewed strength in the US Dollar which could provide immediate resistance to higher levels in Gold and gold stocks.

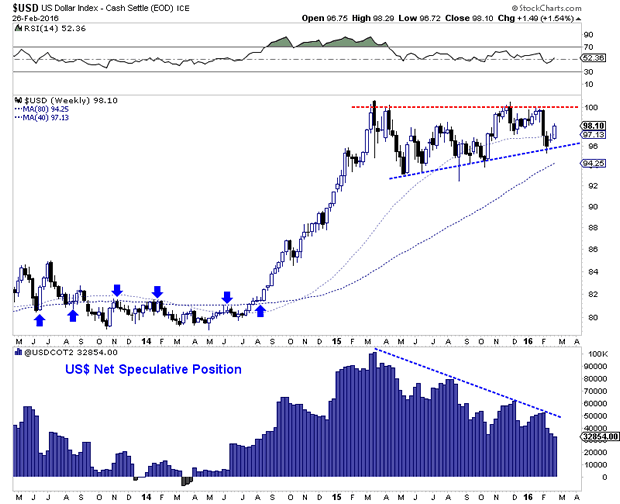

The chart below plots the weekly candles for the US$ index and the net speculative position in the US$ index. The US$ index closed back above its 200-day moving average (97) and remains well above its 400-day (or 80-week moving average).

The larger consolidation appears to be an ascending triangle which is a bullish continuation pattern. Upon breakout through 100, the pattern projects an upside target of 107. Moreover, although the US$ index is only a few points from major breakout territory its net speculative position (as of Tuesday) is the lowest in 18 months!

The improving prognosis for the US$ index could be due to renewed weakness in the Yen. The chart below plots the Yen/US$ pair and Gold. Many other analysts long before me have noted the strong correlation between the two markets. The Yen/US$ pair may have formed a double top at 0.90. If that is the case then it has more downside potential in the short-term. Meanwhile, the question for Gold, which closed the week at $1220/oz is if it can hold support at $1180-$1200/oz.

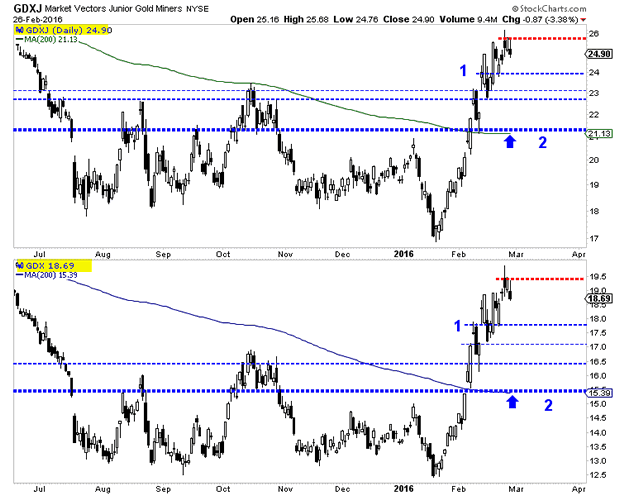

Recent strength in the miners (GDXJ, GDX) has suggested Gold will hold above its key support at $1180-$1200/oz. However, there has been distribution in three of the past four trading days. If the miners can hold above support at point 1, (see the chart below) it would reinforce a bullish short-term outlook. In the case of a very strong US$ breakout and Gold losing $1200/oz then the miners could end up falling to point 2.

The rebound in the US$ index coupled with the failure of Gold and gold miners at resistance over the past three days puts us on guard for the start of a larger retracement in precious metals. The potential double top in the Yen/US$ pair as well as the mini breakdowns in Silver and Platinum are also cause for concern. It is certainly possible that precious metals can rally temporarily with a strong US$ and reach the upside targets mentioned last week. However, a strong breakout in the US$ index above 100 could very well precipitate the next correction in Gold and gold stocks if it has not already started.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.