The 5 Worst Days in American Economic History

Politics / US Federal Reserve Bank Feb 24, 2016 - 03:41 PM GMTBy: Andy_Sutton

I’ll be upfront going in and say that some of this material is going to double a bit with a fantastic message preached by Chuck Baldwin a few weeks ago. As I listened, some different angles came to mind, and some different events altogether. As we get further and further into the silly season otherwise known as an election year, it is important to remember that sometimes we really do get what we wish for.

I’ll be upfront going in and say that some of this material is going to double a bit with a fantastic message preached by Chuck Baldwin a few weeks ago. As I listened, some different angles came to mind, and some different events altogether. As we get further and further into the silly season otherwise known as an election year, it is important to remember that sometimes we really do get what we wish for.

I guess what hit me the hardest about all of this is the fact that we are watching a circus right now; and that circus has a pre-defined outcome. The winners have already been decided in the major national elections. What is more baffling is that it doesn’t even matter if the winners were already decided, the outcome will be the same regardless of who ‘wins’. There seems to be little doubt among voters that America is on the wrong path – regardless of political affiliation (of which I have none, by the way – I am an American – that’s it) but there is a huge argument about what the ‘right’ path might be and how to get the country on that path. Hence the Laurel and Hardy-esque two bit cheap show we witness every four years.

Getting to my original point, I wonder what horrific events might occur over the next few years and if somewhere down the line someone will add a date from 2017-2020 in some edition of the worst days in American history. By ‘horrific events’, I don’t mean ‘terrorist’ attacks or natural disasters, I am referring to self-inflicted wounds. Agenda-driven policy, illegal usurpations of power, the evisceration of the Constitution and Bill of Rights, further interference in the business cycle or the downright socialization thereof, and so on. So, without further delay and in chronological order:

#1 – December 31, 1781 – The Bank of North America

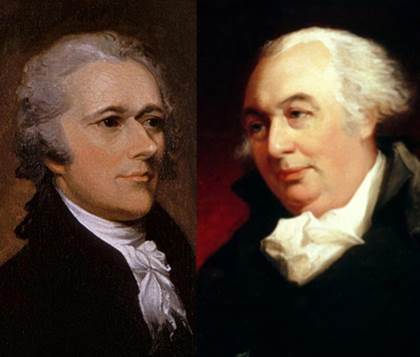

There are two big names in American economic history that observers and analysts often gloss over. These two are not renowned for their contributions, but rather for their conniving. One ended up being a President and his face is on the 10 ‘dollar’ FRN. The other has a college named after him. Both were self-ascribed geniuses and both despised the Jeffersonian model of limited government and sound money. They are Alexander Hamilton and Robert Morris. Both of them were statists and from the first days of the Union, they worked to provide a central bank. Being statists, it is only natural that they aspire to big government. Left to their own devices and given ample time I’m sure the two of them could have conceived most of the draconian measures we find in place today.

It is also very important to note that this battle for control of the country’s money began while the Union was still in its earliest stages of infancy – prior to there even being a ‘United States’ in fact! Just goes to show how important control of the money is to those of a central planning mentality.

Hamilton’s ‘First Bank of the United States’ concept came after Robert Morris and his cronies whiffed on an attempt to centralize the financial system with the ‘North American Bank’. Incidentally, when the plans for the BNA fell through, Morris remanded all the gold loaned by France to the ‘bank’ and placed it in his own bank – invested for the US Government of course. Some things never do change. Just to give you an idea of how bad Morris and his ideas were, this is what he ‘envisioned’ for a central bank:

- Fractional reserve in nature

- Commercial and privately owned

- Headed by Morris himself

- Modeled after the Bank of England

- Grounded on specie, but with inflationary power (yes, I know)

Taking it further, Morris was a complete statist. He believed in a strong and massive central government, complete with the ability to tax and burden the public with its massive debts. Despite signing his name to the Declaration, he was totally against Liberty and its principles in natural law. Beware of the Morris’ of today’s world. But I digress.

The bank was given charter in 1782 and received monopoly power from the federal government: no other banks were permitted in the country, and the notes issued by the BNA were deemed legal tender, at par with specie. Of course as an immediate payback, the BNA agreed to lend the lion’s share of its inflated money to the Congress for the purposes of purchasing public debt and sticking it to the ‘taxpayer’. The BNA was also made the depository for all Congressional funds. The bank, according to data compiled by Murray Rothbard et al indicated that the BNA lent around $1.2 million of its inflated money to Congress, which was headed by Morris.

It is worth noting that in 1782, the Revolution was STILL going on. Independence hadn’t even been gained from the British Crown and already the shenanigans were starting. Morris owned his own bank, was the head of the BNA, and was also pretty much in charge of Congress.

While it would seem that Morris and his little empire had found a way to dominate American finance and monetary policy before there even was an America, the market knew better. Despite the ‘par’ standing of the bank’s notes with specie, market participants began demanding specie over the notes as hints of inflation licked at the foundation of the first great central experiment. The BNA lasted roughly a year and was essentially decommissioned.

One further overriding principle to note here in this, America’s first dabble with a central bank: even when specie and fiat monies are placed at par with each other and declared so with the weight of law, the market will always move towards specie at the first hint of inflation. The only way of preventing this is to convince enough market participants that there is no inflation or that inflation is in fact NECESSARY for growth. This is precisely what we have seen during the last hundred years. Despite the overall retardation of America concerning it’s monetary circumstances, the marketplace is STILL moving to specie.

#2 – December 23, 1913 – Creation of the Not-So-USFed

I’m not going to get into the history of the creation of the standing central bank in the US; authors like G. Edward Griffin and William Greider have done a yeoman’s job explaining how the Not-So USFed was created and how it operates. Thanks to many inspired writers, its activities are closely followed and documented although secrets remain – such to the point that the bank spends untold amounts of money preventing even a simple audit. Instead I’m going to offer some general commentary, irony, and remarks on some selected aspects of the most corrupt institution ever to plague mankind.

No analysis of American economics would be complete without including this massive stinker of robbery, corruption, graft, avarice, usurpation, and pretty much any other negative descriptor one can imagine. The Not-So-USFed is a prime example of order out of chaos, created as a response to a multitude of financial and economic panics over the prior 30 years. The problem is the cure was worse than the disease especially when one considers that most of the panics were caused by the same folks who wanted the central bank in the first place. A bunch of Robert Morris and Alexander Hamilton types basically. Narcissists who believed the world simply couldn’t function without them in full control. That America has managed to survive as long as it has with some semblance of her original Liberty and founding principles intact is proof positive of the hand of God at work.

The Not-So-USFed has all the same characteristics as the Bank of North America with a few additional ‘responsibilities’. Specifically, maximum employment, price stability, and moderate long-term interest rates. The first two of these are often referred to as the bank’s ‘dual mandate’. In 2009, the bank was also tasked with regulating its member banks – a clear conflict of interest – missed by most because they don’t understand (or refuse to acknowledge) the relationship between the central bank and its members.

The member banks – the commercial banks you see on every street corner in America, plus the 12 ‘money center’ banks own the Not-So-USFed. That makes it private, despite its name. Those member banks (owners) receive a statutory (per the federal reserve Act) 6% dividend payment each year on the shares they own in the central bank. When you start looking at things this way, it becomes hilarious that the central bank would have any kind of oversight over commercial banks. Think of a local chamber of commerce that is started by a bunch of local businesses and gets its sustenance from those same businesses. To assert that it has much if any leverage on them is absurd.

After the crisis in 2008 (wait, wasn’t the central bank supposed to prevent these things, not precipitate them??), the Not-So-USFed launched a bevy of ‘Maiden Lane, LLC’ type facilities to absorb bad assets off the books of its member banks. The central bank used money created from nothing to buy junk. So the junk is on the central bank’s balance sheet while the inflated fiat roams the economy. To give credit where credit is due, a great deal of masterful debauchery, deceit, and diversion has gone into keeping that inflation from hitting consumer prices. That aggregate demand is in the toilet has helped the cause tremendously to the point of making one speculate with good cause that the Not-So-USFed is killing the USEconomy on purpose to save its own skin.

#3 – April 5, 1933 - Roosevelt calls in the Gold

When you look at the American circumstance from an economic perspective and study it, some things become very obvious. There are defined steps that take place in a pre-determined progression. I am sure that by this point, there are some people who are downright skeptical about all of this. How could a guy like Robert Morris sign the Declaration then pull a stunt like what is chronicled above? Surely Andy must have lost it. If there is even one lesson anyone learns from this endeavour, it is to question everything. Especially motives. History is absolutely replete with people who have tried to latch on to the moral high ground to commit the most heinous of atrocities. Maybe Morris figured independence from the Crown would give him the chance to become a king in his own right. He certainly behaved that way.

I’ll lead off this section with a bit of a disclaimer. I am no fan of Franklin Roosevelt’s leanings either socially or economically. I don’t claim to know his motives, but can only study the fruits of his efforts and apply them in a historic perspective. Secondly, what happened below would have happened even if Hoover had remained in the White House. Presidents are figureheads. They champion the ideas of those who put them in power. Sometimes they agree with the ideas they champion and sometimes they don’t. I think that as we’ve gone along, most of them are merely political prostitutes – mouthpieces for sale. They care not about anything but the accumulation of money, power, and acumen. This is why so many are worried about their libraries and speaking engagements for pay before they even leave office.

We could easily spend a week or more together discussing the events surrounding the confiscation of gold in 1933 under Executive Order 6102. This is a tricky affair so bear with me. First of all, the federal reserve act of 1913 required 40% gold backing of any federal reserve notes issued. This was seen as a cumbersome constraint on the central bank because it prevented the bank from inflating the money supply. The inability of the central bank to inflate the money supply was seen as the proximate cause of the economy’s inability to escape the Great Depression. This was utter hogwash and still is. In the midst of all this, Americans were hoarding specie – notably Gold. Go figure. Again, the market, sniffing out the desires of a central bank to inflate, runs to specie.

So, on March 6, Roosevelt, using a never-suspended wartime emergency power (Trading with the Enemy Act of 1917), issued Presidential Proclamation 2039, which was a warning to American citizens not to ‘hoard’ gold and furthermore declared a ‘bank holiday’ from March 6-9, 1933, dates inclusive. But it wasn’t a total bank holiday as is often taught in the schools. A quick read of the short text of the proclamation shows that only activities pertaining to the withdrawal of gold or related instruments were ceased. You could have walked into any bank during the holiday with a trainload of gold and deposited it no problem. Other normal and ordinary banking transactions were allowed. History should have called PP2039’s holiday a ‘gold holiday’ rather than a bank holiday. The rationale for calling in the gold follows.

You see, the more gold that went into the federal reserve system, the more notes could be issued under the 40% rule – thereby allowing inflation, albeit still within constraints. You can see now why I said above that it would not have mattered who was in the White House. The powers that be wanted the gold in the hands of the central bank, not the People, hence the progression of events. PP2039 didn’t come without teeth either. The fine for hoarding gold was $10,000 and/or 5-10 years in jail. Just to put it in perspective, the FINE was 500 ounces of gold plus the jail time. Predictably, the American people by and large told the Prez and central bank to go take a long walk off a short pier and a month later Roosevelt was back, pen in hand to issue the EO6102, which required that all but a trivial amount of gold be turned in to any bank. Reimbursement would be $20.67 per troy ounce. The deadline for turning in the gold was April 1, 1933.

Almost immediately thereafter (1934, with the Gold Reserve Act), the Treasury jacked the ‘price’ of an ounce of gold to $35 and the profits reaped from this unabashedly inflationary move provided ‘funds’ (but not capital) for the Exchange Stabilization Fund. The move was a blatant rip-off of the American citizen via devaluation of the currency, which, in addition to giving the central planners more ounces with which to print, was intended to spark inflation.

EO6120 was subsequently superseded by EO6260, which required each American to file a ‘return’ with the Treasury and fully declare the disposition of all the gold in their possession. Can anyone say ‘self incrimination’ and ‘5th Amendment’? This ‘return’ was along the same lines as the yearly ‘income tax’ returns we are required to file. So our own figures, statements, and calculations are used to prosecute us if the IRS deems it necessary. I guess they didn’t read the Constitution either.

Ironically, populist Keynesian economic thinking still asserts that confiscation of gold and devaluation of currency are both positives with good outcomes. From Wikipedia:

The revaluation of gold referenced was an active policy decision made by the Roosevelt administration in order to devalue the dollar.[4] The largest inflow of gold during this period was in direct response to the revaluation of gold.[4] An increase in M1, which is a result of an inflow of gold, would also lower real interest rates, thus stimulating the purchases of durable consumer goods by reducing the opportunity cost of spending.[4] If the Gold Reserve Act had not been enacted, and money supply would have followed its historical trend, then real GNP would have been approximately 25 percent lower in 1937 and 50 percent lower in 1942.[4]

The above tidbit was written by Christina D. Romer, an associate professor of Economics at the University of California at Berkeley. She pops up on the grid every so often with this sort of nonsensical and intellectually dishonest tripe. With this kind of thinking firmly in place in both academia and policy circles is it any wonder there is constant talk of confiscation of everything not bolted down and a continuation in the disturbing global trend of the ‘race to the bottom’ devaluation of currency?

Romer et al can’t be too bright for carrying the water of the Keynesian rip-off con artists. They merely measure economic output in nominal dollars. So if we pump up the money supply and prices follow suit, then that equals growth even if there is not one single additional unit sold. And that, my friends, is precisely what has been going on ever since we de-coupled from the gold standard. I will hastily admit that more units have been sold as a function of population growth, but I’m sure you can see the point. If gas prices double over the next year and not one additional gallon is sold, according to populist economic thinking, there will have been ‘growth’ because the bottom line will have doubled. It is insanity.

As an aside, I hear that Congress recently went into hock to the tune of another $2000 for a decent pair of bolt cutters so they can start confiscating the stuff that is bolted down. (sarcasm mine).

There have been many debates about specie and its role in monetary circles today – if any. Most argue that specie money is merely a barbaric artifact, notably Gold, and that it has no place in the monetary spectrum. While it is true that the monetary system globally has mostly disconnected itself from specie, make no mistake that the powers that be absolutely do care about gold and silver. The private transactions of the establishment are conducted in metal. The avalanche of paper is for the transactions of the foolish masses.

Something to watch in this regard is the China/Russia alliance and the BRICs in general and their accumulation of gold. I have little doubt that there will be a move to go once again to a gold-backed currency. Acceptance of such a measure on a meaningful scale would lead to the near instantaneous destruction of the USEconomy. I would opine there would be an equally instantaneous Executive Order for all Americans to hand in the gold again – as usual because of an ‘emergency’. See a pattern here?

#4 – January 22, 1973 – On-Demand Abortion is Legalized

Many might wonder what abortion on demand has to do with economics. Abortion has been called America’s holocaust and I couldn’t agree more with that statement. It is an ugly stain on the fabric of America both morally and economically. Entire industries have risen up for the sole purpose of killing the most innocent and disposing of their remains (Think Stericycle).

I’ll make the point short and sweet. Everyone always talks about the baby boomers and what a big problem they are causing the social support networks. There aren’t enough workers to support them. Well we’ve killed well north of 50 million potential workers since 1973.

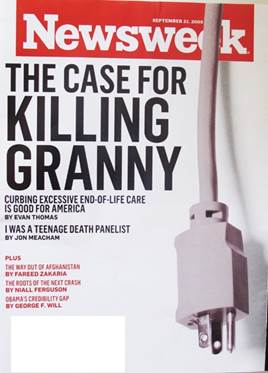

Of course the other side would come right back and say there are no jobs for the people who are here now, so we’d just have 50 million more people on welfare. It has gotten so ludicrous that US News actually put ‘The Case for Killing Granny’ on the front cover of a 2011 issue. Granny, you see, costs too much to take care of. She no longer produces anything, and is simply a cost center. So it isn’t just the unborn these sick mouthpieces are after; they’re after what they call useless eaters. The subtitle of that article, incidentally, was ‘Curbing excessive end of life care is good for America’.

I’ll tell you this much – those 50 million dead could have certainly helped maintain America as the manufacturing superpower it was from WWII through the mid 1980s. Of course the establishment wanted America gutted – literally. In that regard, legalized abortion on demand played right into the hands of the power elite.

I’ll close this section with a thought. It is easy to not give a rip when the crosshairs are on someone else. But in a day of socialized medicine, increased waiting times for medical procedures and services, you’d better hope you don’t get sick. Those crosshairs might fall across your chest if you do. And I am ashamed of the selective libertarianism that runs amok in this country. That one would taut Liberty as a principle and not include the most vulnerable amongst us as being entitled to it is a moral outrage and intellectually disgusting. A society that has no problem killing its children and one that would even contemplate killing senior citizens to save money has no future and no hope. In this regard we may not get what we want, but we will surely get what we deserve.

In my opinion, we’ve killed the future of our country, both literally and figuratively. Many might ask, “What does this have to do with me?” Well, you’re paying taxes for it for starters. More than $5.5 billion has gone to subsidize abortions via Title X for just the largest provider of abortions alone. Here are some other tidbits regarding how the average American is helping to fund the establishment’s war on the unborn:

- Regulations for the national health care plan completed in 2013 require that every participant in an exchange plan pay an additional amount on top of the regular premium amount to fund elective abortions, regardless of age or gender, according to The Heritage Foundation

Insurance companies doing business in 28 states were under set standards that covered abortion services, according to the National Review. Individuals who had coverage from them, whether they self-paid for abortions or the insurance companies covered the cost, were automatically paying a part of their premium to cover abortion services. In those states, there were no health insurance plans that did not cover abortions.

Health insurance exchanges developed through the ‘Affordable’ (sic) Care Act provided participants with coverage at reduced or subsidized rates, but the plans were supposed to prohibit coverage for abortions. Those insured were required to use personal funds to pay for abortions instead of through the insurance plans.

I realize this is a hot button topic and one that both sides will willfully skew to meet their agendas. Data will be massaged, etc. The bottom line – and I don’t think anyone can really argue this – is that we are paying at least something to kill off those who would be producers in a capitalistic economy. If nothing else, January 22, 1973 was another day that marked the fact that a capitalistic economy was no longer in the best interests of the power elite who dominate by brute force – and death when it serves them.

#5 – October 3, 2008 – The Great American Bailout

The Great American Bailout, otherwise known as the Troubled Asset Relief Program or TARP is another great example of problem-reaction-solution / order out of chaos. America was in the throes of a financial crisis, the likes of which hadn’t been seen for at least a decade. I say that tongue in cheek because, thanks to the Keynesian mantra laid bare in previous paragraphs, we are now in a state of near persistent economic crisis. Globally.

The financial crisis was hitting the broader economy as well since the government at the behest of the same banks had allowed them to leverage each other and the broad economy, along with themselves. Put short and sweet, the banks have a socialistic ‘Heads we win, tails you lose’ type of arrangement. The repeal of the Glass-Steagall Act has proven to be one of the largest enablers of the incestuous relationship between the brokerage sides of banks and their savings and loan operations. The very law that held the two distinctly different sides of a commercial bank apart and acted as a firewall between the financial markets and the general economy was pulled out in 1999 and shortly thereafter, the parade of crises began. Ironically Bill Clinton takes much of the blame for the repeal of the law, but to be fair and to further underline that the two party system is a complete joke, the bill that repealed Glass-Steagall, the Graham-Leach-Bliley Act, received near 100% Republican support as well as a majority on the Democratic side.

There are many reasons why the crisis of 2008 took place, but right in the center of it was the Not-So-USFed, micromanaging the economy to the desires and whims of its member-owners. Foolish borrowing was encouraged. Books were written on how one could ‘Retire on the House’ and the notion that one didn’t have to work, but merely do continuous cash-out refinances on their homes for income was a viable career option. The housing market would go up forever, just like the dot-com boom before it. At the end of capitalism lie bubbles. There is massive inflation and the money has to go somewhere. Channeling it has problems. The central bankers knew exactly what they were doing when they helped pump up the dot-com bubble. Alan ‘irrational exuberance’ Greenspan presided over much of it with Ben ‘printing press’ Bernanke taking the reigns just as the housing bubble was starting to come unglued.

My guess would be that the big banks knew they’d get their bailout going in, yet interestingly enough, two of the bigs – Lehman and Bear Stearns – were allowed to fail. Was that just to keep up appearances or was there some other agenda in play? We’ll probably never know and it isn’t worth taking guesses. Taking a close look at the balance sheets of those two pre-failure might be instructive.

Worth noting, TARP was given a ‘no’ vote first in Congress on September 29, 2008. After some serious arm-twisting, the bill passed with some revisions on October 1, 2008 and was signed into law on October 3, 2008. The arm-twisting was pretty severe, with California Rep. Brad Sherman alleging that some members of the House of Representatives were told there would ultimately be martial law in America if the bill wasn’t passed. The passage of the bill was another classic failure of the American political system. Concerned citizens shut down the switchboards at both houses of Congress on multiple occasions during the debate and it is well documented that people calling in were nearly 100:1 against the bailout, yet the ‘representatives’ handed out the money anyway.

Rolling Stone writer Matt Tabbi, who has covered the financial crisis pretty accurately in this writer’s opinion, shared this in a 2013 article looking back on the passage of the Stabilization Act, which gave rise to TARP and other bailout measures:

“At one meeting to discuss the original bailout bill – at 11 a.m. on September 18th, 2008 – Paulson actually told members of Congress that $5.5 trillion in wealth would disappear by 2 p.m. that day unless the government took immediate action, and that the world economy would collapse "within 24 hours."

To be fair, Paulson started out by trying to tell the truth in his own ham-headed, narcissistic way. His first TARP proposal was a three-page absurdity pulled straight from a Beavis and Butt-Head episode – it was basically Paulson saying, "Can you, like, give me some money?" Sen. Sherrod Brown, a Democrat from Ohio, remembers a call with Paulson and Federal Reserve chairman Ben Bernanke. "We need $700 billion," they told Brown, "and we need it in three days." What's more, the plan stipulated, Paulson could spend the money however he pleased, without review "by any court of law or any administrative agency."

This underlines the audacity of Paulson and the rest of his ilk. To throw together such a foolish and undocumented proposal was not from a lack of intelligence or professionalism, but rather a demonstration of hubris. Paulson thought he could actually make a phone call and get a blank check from the taxpayer. As it turned out, that is pretty much what happened.

The White House and leaders of both parties actually agreed to this preposterous document, but it died in the House when 95 Democrats lined up against it. For an all-too-rare moment during the Bush administration, something resembling sanity prevailed in Washington.

So Paulson came up with a more convincing lie. On paper, the Emergency Economic Stabilization Act of 2008 was simple: Treasury would buy $700 billion of troubled mortgages from the banks and then modify them to help struggling homeowners. Section 109 of the act, in fact, specifically empowered the Treasury secretary to "facilitate loan modifications to prevent avoidable foreclosures." With that promise on the table, wary Democrats finally approved the bailout on October 3rd, 2008.

"That provision," says bailout Inspector General Neil Barofsky, "is what got the bill passed."

But within days of passage, the Fed and the Treasury unilaterally decided to abandon the planned purchase of toxic assets in favor of direct injections of billions in cash into companies like Goldman and Citigroup. Overnight, Section 109 was unceremoniously ditched, and what was pitched as a bailout of both banks and homeowners instantly became a bank-only operation – marking the first in a long series of moves in which bailout officials either casually ignored or openly defied their own promises with regard to TARP.”

My high school English teacher would shoot me for using such a long direct quote, but it is about the most important piece of this whole thing – instructive in how things work – or don’t. Paulson knew full well from the beginning that he was going to use the money how he pleased. There really isn’t much doubt about that. He was the former CEO of Goldman. He knew the system. He ginned up the fear, and then took his shot. My only surprise is that he didn’t ask for MORE.

To make the rest of a long story short, the lying continued. The misappropriations of funds continued. The promises of Paulson, resident idiot savant Neel Kashkari, and Larry Summers continued. The mock indignation of Congress continued, but nothing was done beyond tough talking. Not one banking jerk ended up in jail. Not one lost a condo, a yacht or a Mercedes. Not even one country club membership. Tabbi sums it up perfectly:

“Put another way, banks are getting paid about as much every year for not lending money as 1 million Americans received for mortgage modifications and other housing aid in the whole of the past four years.”

Listening to the rest of the lapdog establishment press, however, paints a totally different picture as you can imagine. The TARP, TSLF, etc., were a smashing success and if Americans would only swipe those credit cards more, we could forget about this nasty persistent recession. Or maybe if the government had even more power of the purse. Maybe if the Not-So-USFed had even more control than it already has. Maybe if those nasty writers would just shut up and leave the serious business of running the economy to the experts like Larry Summers, Janet Yellen, and Hank Paulson.

Maybe if Robert Morris and Alexander Hamilton were still around. Just maybe…

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.